We closed this position on June 10, 2019. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This company remains committed to a failed business model even in the face of slowing revenue growth and mounting losses. Some investors may be tempted to buy the dip after a 30% decline in 2019, but our research shows that the stock could have much further to fall. TrueCar (TRUE: $6/share) is in the Danger Zone.

Growing Losses Since Original Report

We first put TRUE in the Danger Zone on August 21, 2017. At the time, we warned investors that the company’s business model could not adequately serve the interests of both car dealers and consumers. Since our article, the stock is down 62% while the S&P 500 is up 15%.

We predicted in our article that TRUE’s heavy focus on dealers would alienate consumers and lead to slowing growth and rising losses.

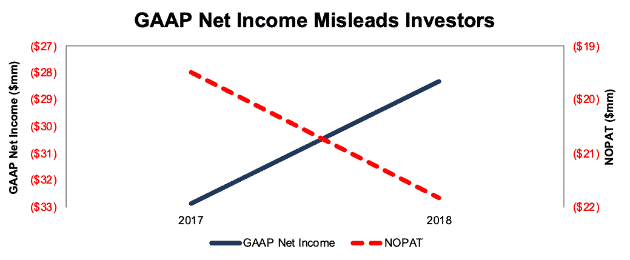

Investors who only look at GAAP net income might think we got that prediction wrong, as TRUE’s GAAP losses decreased from -$33 million in 2017 to -$28 million in 2018. However, our adjustments show that the company’s losses, as measured by after-tax operating profit (NOPAT), did in fact increase.

Figure 1: GAAP vs. NOPAT Year-Over-Year (YoY)

Sources: New Constructs, LLC and company filings

TRUE’s GAAP losses in 2017 were overstated due to $8 million (2% of revenue) in litigation costs. When we adjust for this cost and other non-recurring expenses, we see that operating losses increased from $19 million in 2017 to $22 million in 2018, a 12% increase.

In the past, TRUE could at least claim to be on a path to profitability. Now as losses grow, it’s hard to see exactly how the company breaks even over the long-term.

Diminishing Return on Marketing Weakens Bull Case

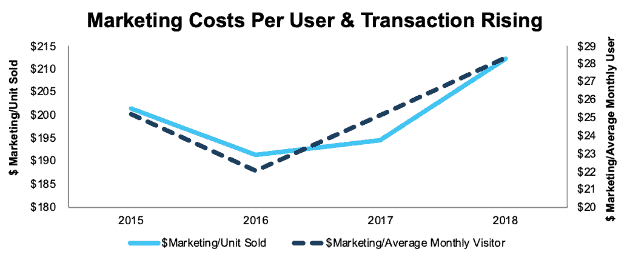

Bulls will argue that TRUE is building its customer base, and, at a certain point, will be able to cut back on marketing costs and achieve profitability. The company spent $213 million (60% of revenue) on sales and marketing in 2018, so cutting back on that spending would go a long way to achieving profitability.

However, TRUE can’t afford to cut back on its marketing spending if it wants to maintain its user base. The company has to spend such a large amount on marketing because its effectiveness is declining.

Figure 2: Rising Marketing Costs Per Visitor and Unit

Sources: New Constructs, LLC and company filings

Marketing cost per average monthly user is up from $22 in 2016 to $28 in 2018, a 29% increase. Marketing cost per unit sold is up from $191 to $212, an 11% increase. In its focus on appealing to dealers, TrueCar offers less value to consumers. There’s a lot of competition in the online automotive space, so if TrueCar isn’t focused on getting consumers the best price, someone else will gladly step in to provide better value.

For the full year 2018, monthly average users increased just 2% while marketing costs increased 15%. In 4Q18, average monthly users actually declined 10% year over year. It’s not just a declining return on marketing anymore, but also TRUE’s business is declining on an absolute basis.

The recent decline in users proves the conflicts apparent in the company’s business model and its declining value to consumers are becoming more widely known. Major publications – such as the New York Times – have recently featured the company’s conflicted business model and its downsides.

Still Focused on Dealers Despite Struggles

Despite the mounting losses, slowing user growth, and increased public scrutiny, TRUE remains committed to its dealer-first model. To understand why, it’s important to know the company’s history.

TRUE started as a consumer-focused website that promised to get car buyers the cheapest price and portrayed dealers as sleazy middlemen. This strategy alienated dealers, who left the platform en masse in 2012. This withdrawal was a huge problem for the company due to the fact that the dealers were, and still are, its primary source of revenue (they pay a fixed fee per car sold through the platform).

TRUE attempted to balance the two competing interests for a time (literally putting a seesaw with the words “dealer” and “consumer” in their headquarters), but eventually the company’s founder was ousted. New CEO Chip Perry came in and introduced a heavily dealer-oriented approach in 2015. See this quote from Perry in 2017:

“We’re doing that (displaying cars on the website) in a way that enables the dealers to price in a way they can still make money,” Perry said at the National Automobile Dealers Association Convention earlier this year. “We want them to know that you don’t have to be the lowest price, and we’re not promoting the lowest price on TrueCar.”

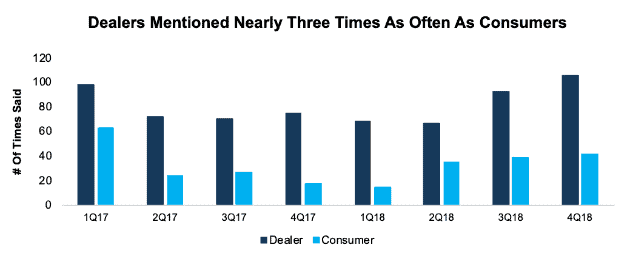

The focus on dealers over consumers can be seen by how often the respective words are said on each earnings call, per Figure 3.

Figure 3: Number of Times the Words “Dealer” And “Consumer” Have Been Said on Each Earnings Call

Sources: Seeking Alpha Earnings Call Transcripts

Over the past year, the focus on dealers has only increased. The word dealer was said 2.6x more often than consumer on earnings calls in 2018 compared to 2.4x as often in 2017.

In addition, TRUE has committed more resources to serving dealers over the past year. The company spent $27 million (8% of invested capital) to acquire DealerScience, a company that provides online tools for dealerships to calculate payment plans. DealerScience promotes itself as “built by a dealer for dealerships”. Doubling down on a dealer-focused approach seems unlikely to stop the growing losses noted above.

Losing Ground to Competition

In the highly competitive world of online automotive retail, TRUE can’t afford to alienate consumers. If buyers don’t believe they can get the best price with TRUE, they can go to CarGurus.com (CARG), Cars.com (CARS), Autotrader.com, Edmunds.com, and a variety of other websites that offer similar services. As Figure 4 shows, TRUE ranks far behind most of these competitors in terms of page views.

Figure 4: Page View Rank: TRUE vs. Peers

Sources: Alexa.com

TRUE is also losing ground in terms of pageviews. When we wrote our original article, the company was the 1,213th most visited site in the US, now it’s at 1,636. Meanwhile, CARG has risen from 375th to 301st, AutoTrader is up from 352nd to 339th, and CARS is up from 446th to 398th.

TRUE is rapidly falling behind in a competitive landscape, and by focusing on dealers, we see no signs of it catching up to its competitors anytime soon.

Significant Downside Remains in Owning TRUE

Some analysts might say that all the bad news discussed in this report has been captured by the 62% decline in the stock price over the past year and a half. However, our dynamic DCF model shows that TRUE has further downside.

In order to justify its valuation of ~$6.50/share, TRUE must immediately achieve NOPAT margins of 11% and grow revenue by 5% compounded annually (both on par with more successful peer Cars.com) for the next 10 years. See the math behind this dynamic DCF scenario.

For a company with widening losses and a declining user base, we don’t see that level of growth and profitability as realistic.

At this point, it’s hard to see any clear path to profitability for the company, so in our analysis TRUE is worth only its tangible book value, which excludes the $97 million in goodwill and other intangible assets on the balance sheet. With TRUE alienating consumers and losing ground to competitors, it’s hard to see intangible assets like brand names and technology having much value.

At its tangible book value, TRUE is worth ~$2.40/share, a 62% downside to the current stock price. Even after the steep decline of the past 18 months, there’s more room for this stock to fall.

Disappointing Earnings Could Send Shares Lower

TRUE fell short of earnings and revenue expectations in 3 out of 4 quarters in 2018, and we expect this trend to continue in 2019. MAU’s tend to be a leading indicator for revenue, so the big decline in MAU’s in 4Q18 set up a disappointing first quarter of 2019.

We also expect the stock to continue its downtrend as long as no positive catalysts materialize to reverse the decline. The two main catalysts bulls are hoping for are:

- Improved results due to the implementation of its new cloud-based “Capsella” tech platform.

- A potential acquisition from a strategic or private equity buyer.

TRUE’s new cloud-based platform, which it spent most of 2018 developing and implementing, is supposed to improve the website’s SEO and the company’s ability to add new features. This might drive some incremental improvements, but it doesn’t fix the core problem of the overall business model. As long as TRUE remains a dealer-oriented company, it will struggle to attract new consumers.

On the acquisition front, competitor CARS has recently been rumored as the subject of private equity interest. However, unlike TRUE, CARS is profitable, and the company has a much larger position in the industry, as Figure 4 shows. We think it’s unlikely that anyone would be interested in acquiring TRUE, a company that is unprofitable, one of the smallest in its industry, and losing ground to competitors when successful firms such as CARS are available instead.

What Noise Traders Miss With TRUE

In general, markets aren’t good at identifying value destroying companies that waste shareholder capital. Instead, due to the proliferation of noise traders, markets are great at amplifying volatility, and therefore risk, in popular momentum stocks, while high-quality unconflicted & comprehensive fundamental research is overlooked. Here’s a quick summary for what noise traders miss when analyzing TRUE:

- Operating losses growing despite improving GAAP results.

- Declining return on marketing as shown by higher marketing spend per MAU and units sold.

- Management that is unwilling to adapt the business model even as the company loses ground to competitors.

Executive Compensation Makes Problems Worse

Part of the reason TRUE’s executives can ignore the ongoing problems is their compensation is tied to adjusted EBITDA, a flawed and easily manipulated metric. Adjusted EBITDA allows TRUE to exclude real costs such as depreciation, amortization, and stock-based compensation.

By excluding these real costs, TRUE maintains the illusion of profitability. In 2018, TRUE earned an adjusted EBITDA of $33 million, a 14% increase from 2017. As long as TRUE continues to use this flawed metric, its executives will be incentivized to boost their growth numbers through overpriced acquisitions or spending heavily on stock-based compensation. These tactics boost adjusted EBITDA in the short run, but they dilute shareholders and destroy value over the long-term.

TrueCar Offers No Shareholder Yield

TrueCar does not currently pay a cash dividend nor have a buyback program in place. As such, the stock offers none of the downside protection that a solid shareholder yield can provide. Given the level of risk we see in the valuation and forward expectations, this downside protection could be sorely missed.

Insider Trading is Minimal While Short Interest Trends Reveal Pessimism

Recent insider trading trends are minimal. Over the past 12 months, 579 thousand shares have been purchased and 355 thousand shares have been sold, for a net purchase of 224 thousand shares. These purchases represent less than 1% of shares outstanding.

Short interest trends are more revealing. There are currently 11 million shares sold short, which equates to 11% of shares outstanding and 6 days to cover. Despite the fact that the stock has dropped 30% so far in 2019, short interest remains near its 52-week high. Many investors seem to agree with us that TRUE has further to fall.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in TrueCar’s fiscal 2018 10-K:

Income Statement: we made $13 million of adjustments, with a net effect of removing $7 million in non-operating expense (2% of revenue). We removed $3 million in non-operating income and $10 million in non-operating expenses. You can see all the adjustments made to TRUE’s income statement here.

Balance Sheet: we made $196 million of adjustments to calculate invested capital with a net decrease of $78 million (21% of reported net assets). Our largest adjustment was removing $108 million (28% of reported net assets) in excess cash. You can see all the adjustments made to TRUE’s balance sheet here.

Valuation: we made $206 million of adjustments with a net effect of increasing shareholder value by $10 million. Despite this increase in valuation, the stock remains overvalued. You can see all the adjustments made to TRUE’s valuation here.

Unattractive Funds That Hold TRUE

There are no funds that allocate >1% of assets to TRUE and receive our Unattractive-or-worse rating.

This article originally published on March 25, 2019.

Disclosure: David Trainer, Sam McBride, and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case study New Constructs: Disrupting Fundamentals Analysis with Robo-Analysts.

1 Response to "Management Doubles Down on a Failed Business Model"

TRUE down ~14% after the company announces CEO Chip Perry’s retirement. Down 13% while the S&P is down 2% since this article. Down over 66% since our original Danger Zone report while the S&P is up 13%.