We closed this position on May 15, 2018. A copy of the associated Position Update report is here.

Knoll Inc. (KNL: $18/share) – Maintaining Long Position – Down 24% vs. S&P +3%

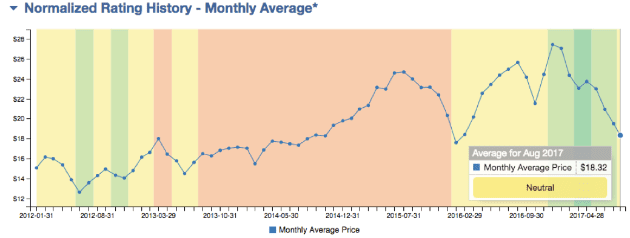

Knoll Inc. was selected as a Long Idea on 4/24/17. At the time of the report, the stock received a Very Attractive rating. KNL was downgraded to Neutral by our rating system on 8/10/17 due to lower profitability in its most recent 10-Q. Specifically, NOPAT margin declined to 7% (TTM) from 8% and return on invested capital (ROIC) fell to 10% TTM from 11% in fiscal year 2016.

Despite the rating change, we are maintaining our long position due to an improved 2H17 outlook, the firm’s profit diversification relative to competitors, and the stock’s low valuation. The current 0.9 price-to-economic book value ratio (PEBV) means KNL is priced for a permanent 10% decline in after-tax profits (NOPAT).

The stock’s recent underperformance can be attributed to disappointing earnings across the industry. Knoll (KNL), Corporation (HNI) and Steelcase (SCS) all fell short of earnings expectations in the most recent quarter and have seen their stocks underperform year-to-date. Both KNL and SCS noted that uncertainty surrounding economic and tax policies were delaying planned corporate investments and building pent up demand.

While our original thesis has proven too optimistic in the short run due to the industry slowdown, we believe KNL remains best positioned to benefit from the expected improvement in 2H17 industry trends.

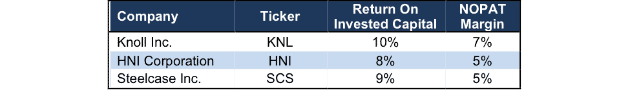

Per Figure 1, KNL’s return on invested capital (ROIC) and NOPAT margins remain above the competition following recent earnings reports. Additionally, KNL’s Studio segment, which has higher operating margins than its Office segment, helps diversify its business across different markets.

Figure 1: KNL’s Top Profitability Among Competition

Sources: New Constructs, LLC and company filings.

KNL management expects efficiency improvement efforts to pay off in 2H17. Clarification on tax policies could also open the flood gates for pent up demand. KNL remains positioned to profit from expanded corporate investments and has a competitive advantage over market participants.

Further, the low valuation combined with industry leading fundamentals continues to present an attractive risk/reward trade-off for investors. As such, the recent pullback represents an opportunity to buy a quality stock in a beaten down industry. If KNL can maintain TTM NOPAT margins (7%) and grow NOPAT by just 2% compounded annually over the next decade, the stock is worth $29/share today – a 61% upside.

Figure 2: KNL Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings

This article originally published on August 31, 2017.

Disclosure: David Trainer, Kyle Guske II, and Kenneth James receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

3 replies to "Position Update: Knoll, Inc. (KNL)"

I don’t think it is good investment policy to recommend a stock that is Neutral. To me, Neutral means Sell (with only a few exceptions like FB where there is a lot of hype involved). I sold KNL as soon as it became Neutral, with a 23% loss. Don’t you think that you should upgrade the KNL to Attractive before presenting such a positive article? Also if KNL deserves a good article why not hype GILD, which has a Very Attractive rating?

cyosh6733@icloud.com – thank you for your comment and excellent questions.

When it comes to our editorial department or the writing of ad-hoc reports on our site, we are applying additional resources to the Ratings system.

Just as fundamental research might not represent 100% of one’s research process, neither should our Ratings. Don;t get me wrong, our Ratings are essential to making informed decisions – and while they may not make up 100% of your decision making, they should not be 0% either. The point is that there needs to be a balance in the analysis and consideration of the different factors that drive stock prices. We admit that not all drivers fo stock prices are fundamentally oriented, esp not in the short term. While fundamentals will always win in the long-term, we acknowledge vagaries in the short-term into which we aim to inject some of our editorial resources to consider non-fundamental forces or even short-term aberations in fundamentals. To summarize, We aim to bring balance in the writing of ad-hoc reports on our site by considering some non-fundamental drivers of stocks. Our Ratings remain at the core of everything we do. At the same time, they are not perfect, they are not a crystal ball for perfectly predicting the future.

Dear cyosh6733,

We appreciate your feedback. We also understand the negative connotation of a “Neutral” rating (or Hold, Equal-Weight, etc.) after decades of misuse by Wall Street Sell-Side research.

Our investment policy frees us from being bound to Wall Street stereotypes and requires us to challenge them when necessary.

The New Constructs rating system is a disciplined assessment of risk/reward that is applied without human bias. In other words, our ratings are not the subjective, malleable marketing tools that Sell-Side ratings represent.

In this context, a Neutral rating is free to enjoy its proper meaning, which in our system means the risk/reward trade-off is balanced. The risk/reward rating system is not meant to infer that every Neutral-rated stock should be sold.