Lear Corp (LEA: $168/share) – Maintaining Long Position – Up 49% vs. S&P +15%

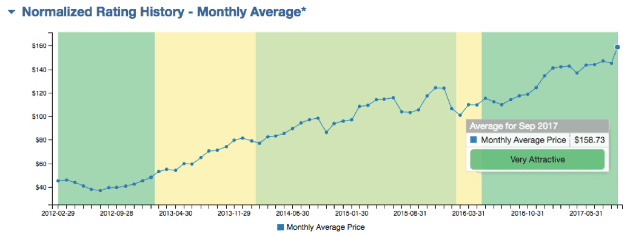

Lear Corp was selected as a Long Idea on 7/22/16. The stock still earns a Very Attractive rating and is up 49% since the original report was published.

Despite the price increase, LEA remains significantly undervalued. The current 0.8 price-to-economic book value ratio (PEBV) means LEA is priced for a permanent 20% decline in after-tax profits (NOPAT). This expectation remains pessimistic as LEA has grown after-tax profit 11% compounded annually since 2010.

The stock’s outperformance centers around a growing global auto industry, which despite reaching historically high levels, still provides opportunity for a parts supplier such as Lear. Lear benefits from trends in the industry besides just overall sales, which some expect to slightly decline in 2018.

The technology being placed in entry level cars (once reserved for luxury vehicles) creates the need for additional electrical wiring. Additionally, increased safety standards lead to increased demand for advanced seating systems. Also, the continued expansion of electric vehicles presents opportunity for Lear Corp. Management noted in its 2Q17 conference call that an average vehicle will have $500-$700 in Lear electronics while an EV contains anywhere from $1,500-$2000 in Lear electronics.

In light of positive industry trends, we believe our original investment thesis remains intact. The thesis highlighted 1) history of consistent profit growth; 2) executive’s incentivized to create shareholder value; 3) buyback and dividend providing a healthy yield; and 4) the company’s undervalued stock price.

Figure 1: LEA Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings

Despite domestic auto weakness, LEA remains positioned to grow profits. Further, the low valuation combined with a favorable fundamental outlook continues to present an attractive risk/reward trade-off for investors. If LEA can maintain TTM NOPAT margins (6%) and grow NOPAT by just 4% compounded annually over the next decade, the stock is worth $234/share today – a 39% upside. This expectation may prove conservative given the growth opportunities outlined above.

This article originally published on September 22, 2017.

Disclosure: David Trainer, Kyle Guske II, and Kenneth James receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.