Tenneco Inc. (TEN: $53/share) – Maintaining Long Position – Down 12% vs. S&P +2%

Tenneco Inc. was selected as a Long Idea on 5/1/17. At the time of the report, the stock received a Very Attractive rating. TEN was downgraded to Neutral by our rating system on 8/10/17 due to lower profitability in its most recent 10-Q. Specifically, NOPAT margin declined to 4% (TTM) from 6% in 2016.

Despite the downgrade, we are maintaining our Long recommendation due to expectations for a 2H17 margin recovery and the stock’s low valuation. The current 0.9 price-to-economic book value ratio (PEBV) means TEN is priced for a permanent 10% decline in after-tax profits (NOPAT).

The stock’s recent underperformance centers around short-term overreaction to negative auto industry news and does not affect our thesis. Our investment thesis highlighted 1) history of consistent profit growth; 2) executive’s incentivized to create shareholder value; 3) regulatory tailwinds in the auto emissions market; and 4) the company’s undervalued stock price.

TEN recently reported 2Q17 earnings, which exceeded expectations and showed revenue growth across all segments. Management raised its full-year outlook and expects full-year margins, which are already high amongst competitors, to remain in line with the previous year.

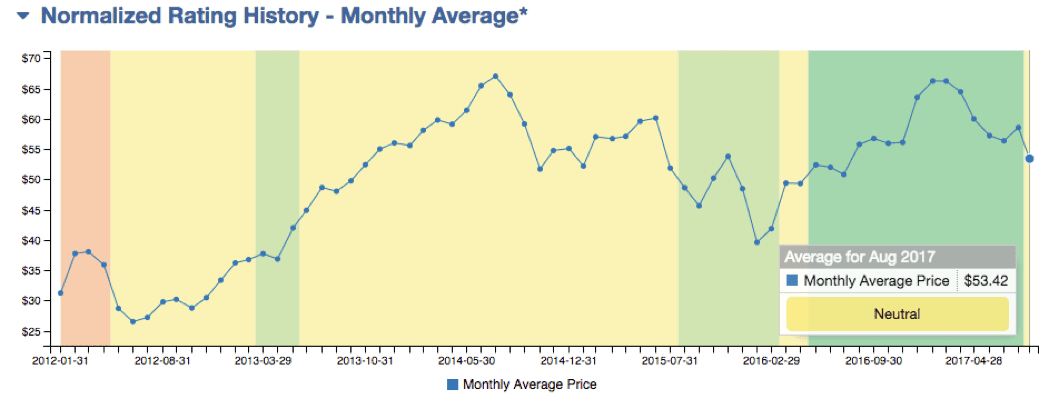

Figure 1: TEN Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings

Despite domestic auto weakness, TEN remains positioned to profit from the expanding global market and stricter emissions standards around the world. Further, the low valuation combined with a favorable fundamental outlook continues to present an attractive risk/reward trade-off for investors. As such, the recent pullback represents an opportunity to buy a quality stock at an undervalued price. If TEN can maintain 2016 NOPAT margins as expected (6%) and grow NOPAT by just 3% compounded annually over the next decade, the stock is worth $110 today – a 107% upside.

This article originally published on August 24, 2017.

Disclosure: David Trainer, Kyle Guske II, and Kenneth James receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.