We closed this position on May 4, 2022. A copy of the associated Position Update report is here.

Puxin, Ltd. (NEW: $18.50/share midpoint of IPO price range), a Chinese K-12 after-school education provider, will IPO on Friday, June 15. At a price range of $17 to $20 per share, the company plans to raise up to $144 million and has an expected market cap of ~$1.7 billion. At the midpoint of its price range, NEW currently earns our Unattractive rating.

Unlike the recent stream of tech IPO’s, NEW is a brick and mortar business. It operates 397 learning centers and served nearly 1.3 million students in 2017. The Chinese after-school education market is large and highly fragmented. The top five companies in the industry account for just 4% of the $75 billion market, according to NEW’s IPO filing.

NEW believes that it can consolidate this industry and achieve superior profitability through efficiencies of scale and implementation of standardized practices. It plans to use 70% of the proceeds from the IPO to fund the acquisition and launch of new learning centers to continue growing its business.

This report aims to help investors sort through Puxin’s financial filings to understand the fundamentals and valuation of this IPO.

Growing Losses

NEW earns revenues by charging tuition fees for its after-school classes, with these fees ranging from $3-$21/hour. The company states in its filing that it hopes in the long run to be able to raise those fees without compromising enrollment.

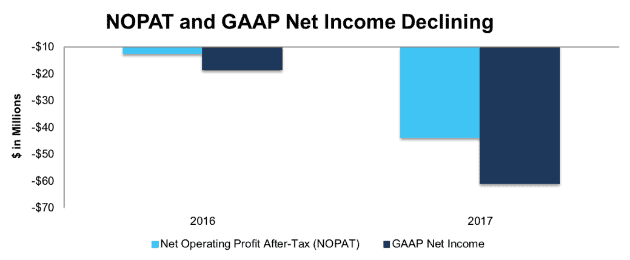

Figure 1 shows that NEW will likely need to raise its fees if it wants to achieve profitability. Both reported GAAP losses and after-tax operating loss (NOPAT) more than tripled in 2017.

Figure 1: NEW GAAP Net Income and NOPAT Since 2016

Sources: New Constructs, LLC and company filings

Even more concerning, gross margin declined from 41% in 2016 to 38% in 2017. Many young companies face mounting losses as they spend heavily on sales & marketing, but NEW appears to be facing declining profitability in the core operations of its business.

One silver lining is that the gross margin for NEW’s existing schools did improve in 2017, from 39% to 42%. The declining overall gross margins were driven by the large number of new schools the company acquired and built last year. If it can improve the economics of these schools the same as it did for its older ones, it may have a path to long-term profitability.

Rapid (And Efficient) Revenue Growth

NEW is still in a growth stage as it attempts to gain scale in the after-school education space, and its growth numbers are impressive. Revenue grew from $63 million in 2016 to $196 million in 2017, a 210% increase. Only 27 companies out of the 2,800+ we cover grew revenue at a faster rate last year.

Even better, NEW achieved this revenue growth in a capital-efficient manner. The company’s average invested capital turns, a measure of balance sheet efficiency, increased from 0.6 to 1.2 in 2017. NEW earned twice as much revenue for every dollar invested in the business in 2017 compared to 2016.

NEW is still a long way from profitability, but its rapid and efficient growth is a good sign for the viability of its consolidation strategy. Other improvements, such as an increase in student retention rate from 65% to 70%, also suggest that the company is successfully improving the performance and value of its newly acquired schools.

Valuation is Similar to Peers

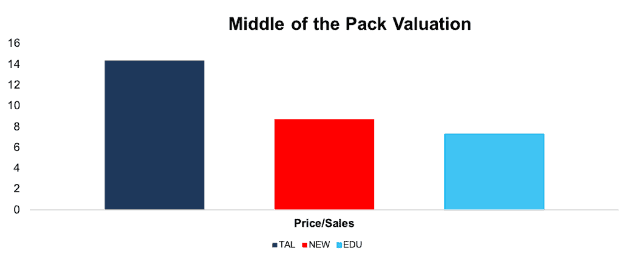

NEW’s strategy of consolidating the fragmented Chinese after-school education market is similar to established companies such as New Oriental Education & Tech Group (EDU) and TAL Education Group (TAL). Figure 2 shows that, at its IPO midpoint, it trades at a price to sales ratio in between these two established peers.

Figure 2: Price to Sales Ratio for Chinese After-School Education Companies

Sources: New Constructs, LLC and company filings

One can make arguments for or against NEW trading at a similar price to sales ratio to these larger companies. On the one hand, TAL and EDU are both profitable, while NEW is not. On the other hand, NEW is growing at a much faster rate.

Ultimately, given their similar business models, it probably makes sense for NEW to trade at a similar price to sales multiple as TAL and EDU. It’s worth watching to see if Muddy Waters’ recent short call on TAL, which accused the company of fraudulently overstating profits, impacts the valuation of NEW’s IPO.

Our Discounted Cash Flow Model Reveals Potential Downside

When we analyze the cash flow expectations baked into the stock price, we find that the market’s expectations for NEW aren’t unreasonable, but they are optimistic. Our dynamic DCF model quantifies exactly what kind of future cash flows the market price of a stock implies a company will generate.

To justify the midpoint IPO price of $18.50/share, NEW must achieve long-term NOPAT margins of 12% (average of TAL and EDU’s margins) double revenue in 2018 before growing at an annual rate of 20% for the next nine years. See the math behind this dynamic DCF scenario here.

Unfortunately for NEW, both TAL and EDU’s margins have declined over the past few years. Increased competition has made it harder for these companies to raise tuition and earn higher profits. If we use the same revenue growth forecast for NEW but assume NOPAT margins of just 8%, the stock is only worth $11/share today, 40% below the midpoint of the IPO range. See the math behind this dynamic DCF scenario here.

To justify buying NEW at the IPO price, investors have to believe that it has some durable competitive advantage that will allow it to overcome the trend of declining industry margins. These optimistic expectations, combined with declining profitability, earn NEW our Unattractive rating.

Limited Disclosure and Fraud Risk

Investors in NEW’s IPO are not investing in the company itself. Instead, they are buying American Depository Shares (ADS) in a shell company in the Cayman Islands that controls the actual business in China. This structure allows NEW to list on the NYSE while avoiding some of the disclosure requirements and regulations that an American company might face.

While the fraud risk in investing in Chinese companies has declined since the days of “The China Hustle,” investors do still face a higher risk of accounting manipulation or outright fraud with these stocks. While there’s no evidence to suggest any fraud at NEW, investors should take this risk factor into account when valuing the stock.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments[1] we make based on Robo-Analyst[2] findings in Puxin’s 2017 F-1:

Income Statement: we made $17 million of adjustments, with a net effect of removing $17 million in non-operating expense (9% of revenue). Our biggest adjustment was removing $11 million in non-operating expense due to changes in the value of convertible notes and derivative liabilities. You can see all the adjustments made to NEW’s income statement here.

Balance Sheet: we made $116 million of adjustments to calculate invested capital with a net increase of $90million. The largest adjustments was $103 million in operating leases. This adjustment represented 91% of reported net assets. You can see all the adjustments made to NEW’s balance sheet here.

Valuation: we made $266 million of adjustments with a net effect of decreasing shareholder value by $266 million. There were no adjustments that increased shareholder value. Outside of the operating leases mentioned above, the largest adjustment to shareholder value was $50 million in outstanding employee stock options. This option adjustment represents 3% of NEW’s proposed market cap.

This article originally published on June 14, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.