For most of the past 15-20 years, the market has been flush with cash, and many stocks have traded at astronomical heights without real businesses to support them. In this exuberant market, fundamentals mattered little while momentum and technical rule the day. However, as excess liquidity dries up and global economic concerns weigh on the minds of investors, the reconciliation between cash flows and valuations has arrived. Now, fundamentals matter…a lot. Over the long term, it only makes sense to deploy capital into those businesses that actually generate adequate returns on invested capital (ROIC). Due to change in market mentality, and in light of the recent downturn in the market, we felt it time to revise our price target for Qlik Technologies (QLIK: $19/share)

Qlik Technologies’ Struggles Continue

We put Qlik Technologies in the Danger Zone in December 2015. Since then, QLIK is down 37% while the S&P 500 is down only 8%. In our report, we highlighted multiple problems with Qlik’s stock, which included:

- Deteriorating margins

- More profitable competition

- A flawed bull case propping up shares

- An astronomical valuation

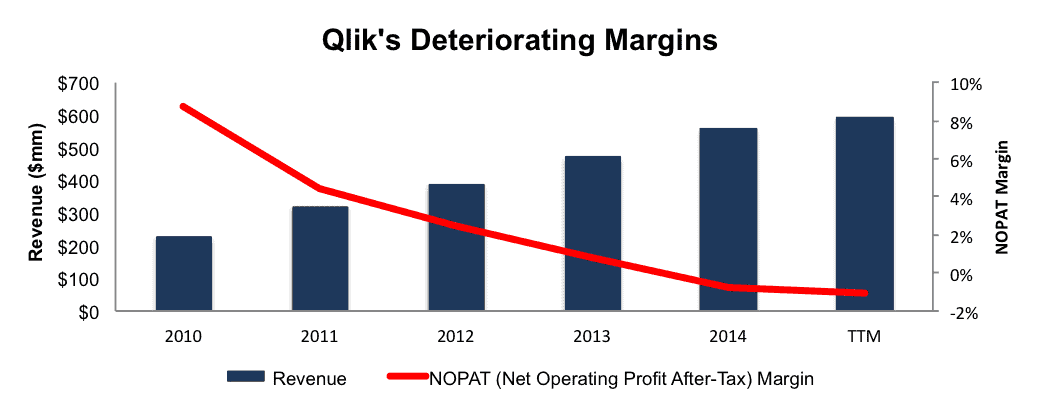

Figure 1 highlights the biggest issue with Qlik. As competition has entered the market, Qlik’s competitive advantages have disappeared. Qlik’s net operating profit after-tax (NOPAT) margins have declined from 9% in 2010 to -1% over the last twelve months. Compounding this issue, Qlik’s return on invested capital (ROIC) has fallen from 48% to -5% over this same time.

Figure 1: Qlik’s Business Model Is Failing

Sources: New Constructs, LLC and company filings

Catalyst Has Yet To Occur

Worst of all for investors in QLIK, shares have fallen so drastically without any particular catalyst, but rather the market’s overall awakening to poor fundamentals. When QLIK reports 4Q15 results, slowing growth in licensing revenue could push shares even lower.

Despite Decline, Shares Still Overvalued

After falling nearly 40%, one might think that QLIK has “gone on sale.” Not even close. Shares still remain significantly overvalued. To justify its current price of $19/share, Qlik must immediately achieve and maintain 5% pre-tax margins (its average since 2010) and grow revenue by 25% compounded annually for the next 13 years. Those are awfully high expectations for any stock. Too high.

Even if we assume something a bit more reasonable (though still pretty darn aggressive), QLIK has large downside risk. If QLIK can achieve pre-tax margins of 5% and grow revenue by 10% compounded annually for the next decade, the stock is worth only $6/share today – a 68% downside. Keep in mind that Gartner expects the entire industry to grow around 9% per year. We think it is clear just how much downside risk is in QLIK.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.