For most of the past 15-20 years, the market has been flush with cash, and many stocks have traded at astronomical heights without real businesses to support them. In this exuberant market, fundamentals mattered little while momentum and technical rule the day. However, as excess liquidity dries up and global economic concerns weigh on the minds of investors, the reconciliation between cash flows and valuations has arrived. Now, fundamentals matter…a lot. Over the long term, it only makes sense to deploy capital into those businesses that actually generate adequate returns on invested capital (ROIC). Due to change in market mentality, and in light of the recent downturn in the market, we felt it time to revise our price target for Twitter (TWTR: $15/share)

Twitter’s Business Model Remains Broken

We put Twitter in the Danger Zone in June 2015. Since then, TWTR is down 59% while the S&P 500 is down only 12%. Our report was among the first to identify the fatal flaw in Twitter’s business model:

“The best interests of the users (i.e. quick, easy access to the content of their choosing) are not aligned with the best interests of advertisers (i.e. getting more attention of users not necessarily looking for them).”

We also highlighted other issues:

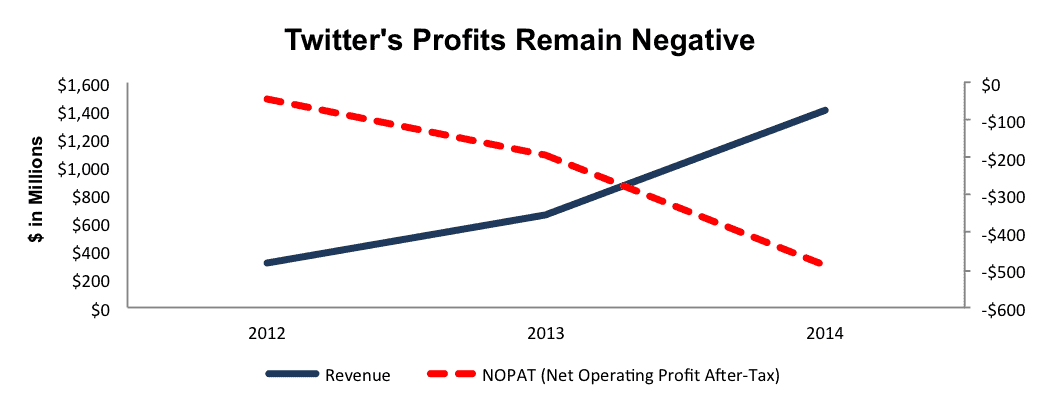

- Negative profits that are getting worse

- Small user base compared to competitors

- Slowing user growth

- Greatly overvalued stock price

The main issues for which we see no answer is that the path to profitability puts the company in a catch 22, to become profitable, Twitter must alienate its users or to grow users, Twitter must alienate its advertisers. With this flaw in mind, it should come as no surprise then that since 2012, Twitter’s after-tax profit (NOPAT) has declined from -$44 million to -$490 million. Figure 1 has the details.

Figure 1: Twitter’s Business Model Lacks Profits

Sources: New Constructs, LLC and company filings

2016 Has Provided No Relief

So far through 2016, Twitter has failed to address any bear concerns surrounding the stock. Twitter has announced that four senior executives will be leaving the company in addition to the head of Vine departing for Google. These executive changes come right on the heels of the CEO change that occurred in 2015. Compounding the issues, when Twitter reported 4Q15 results on February 10, 2016, the most notable number may have been that monthly active users not only stopped growing, but fell to 305 million, down from 307 million in 3Q15.

Given Concerns, TWTR Still Remains Highly Overvalued

It may seem hard to fathom that after falling nearly 60% since June 2015, but TWTR remains significantly overvalued. In order to justify its current price of $15/share, Twitter must immediately achieve 10% pre-tax margins (compared to -36% in last fiscal year) and grow revenue by 21% compounded annually for 12 years. Expecting this scenario to unfold is highly optimistic for any company, much less one with a broken business model.

Looking at a more reasonable scenario shows just how much further TWTR could fall. If Twitter can achieve pre-tax margins of 5% and grow revenue by 20% compounded annually for the next decade, the stock is worth $3/share today – an 80% downside. Without significant changes to Twitter’s business model, this stock exhibits large downside risk and nearly no upside potential.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Garret Heath (Flickr)