This report identifies the “best” ETFs and mutual funds based on the quality of their holdings and their costs. As detailed in “Low-Cost Funds Dupe Investors”, there are few funds that have both good holdings and low costs. While there are lots of cheap funds, there are very few with high-quality holdings.

Without speculating on the cause for this disconnect, I think it is fair to say that there is a severe lack of quality research into the holdings of mutual funds and ETFs. There should not be such a large gap between the quality of research on stocks and funds, which are simply groups of stocks.

After all, investors should care more about the quality of a fund’s holdings than its costs because the quality of a fund’s holdings is the single most important factor in determining its future performance.

My Predictive Rating system rates 7400+ mutual funds and ETFs according to the quality of their holdings (portfolio management rating) and their costs (total annual costs rating).

The following is a summary of my top picks and pans for all style ETFs and mutual funds. I will follow this summary with a detailed report on each style, just as I did for each sector. My rankings for all 12 styles is here.

Figure 1 shows the best ETF or mutual fund in each investment style as of April 25, 2013. Note that only five styles have any Attractive-or-better rated funds.

For a full list of all ETFs and mutual funds for each investment style ranked from best to worst, see our free ETF and mutual fund screener.

Figure 1: Best ETFs and Mutual Funds In Each Style

Fidelity Large Cap Growth Enhanced Index Fund (FLGEX) is my top rated Large Cap Growth fund. It earns this rating by allocating over 47% percent of its value to Attractive-or-better rated stocks and allocating less than 6% to Dangerous-or-worse rated ones. It also has low total annual costs of just 0.68%.

International Business Machines Corp (IBM) is one of my favorite stocks held by FLGEX and earns my Very Attractive rating. IBM has grown after tax profit (NOPAT) by 7.5% compounded annually over the past 14 years. Its ability to produce consistent growth over a long period of time in the highly competitive tech sector should give investors confidence in its ability to adapt and succeed. IBM’s 16% ROIC demonstrates its ability to turn growth into value for investors and is a sign of highly capable management. One would expect a highly profitable, big name stock like IBM to be expensive, but currently the market has surprisingly low expectations for it. IBM’s current valuation of ~$191.71/share gives it a price to economic book value ratio of 0.9, implying that its NOPAT will permanently decline by 10%. High profitability plus low expectations equals low risk and high reward for investors.

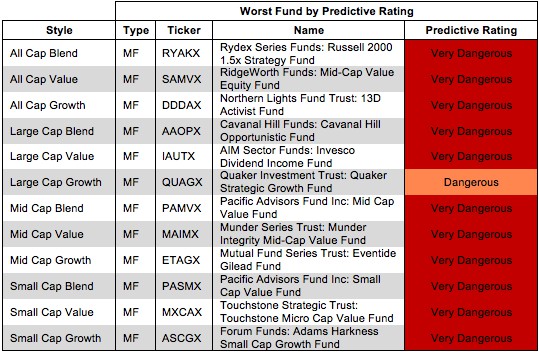

Figure 2 shows the worst ETF or mutual fund for each investment style as of April 25, 2013. Note the diversity among the worst funds. Twelve different fund providers supply the twelve different worst style funds.

Dangerous-or-worse-rated funds have a combination of low-quality portfolios (i.e. they hold too many Dangerous-or-worse rated stocks) and high costs (they charge investors too much for the [lack of] management they provide).

Figure 2: Worst ETFs and Mutual Funds In Each Style

Touchstone Micro Cap Value Fund (MXCAX) is the worst rated Small Cap Value Fund and earns my Very Dangerous rating. It earns this rating by allocating over 55% of its assets to Dangerous-or-worse rated stocks and charging investors total annual costs of 4.48%.

PowerSecure International (POWR) is one of my least favorite stocks held by MXCAX and earns my Dangerous rating. POWR has a bottom quintile ROIC of 3%. It has earned negative economic earnings for the past four years. Its NOPAT has been historically volatile and is currently at about one third of its 2006 peak. Despite these facts, the market apparently sees significant profit growth in POWR’s future. To justify its current share price of ~$13.93, POWR would have to grow NOPAT by 7% compounded annually for 16 years. With that level of growth priced in, very little upside remains. At best POWR can justify its current valuation, at worst it could regress and see significant decline in profitability. In either care, I see no upside and lots of downside for investors.

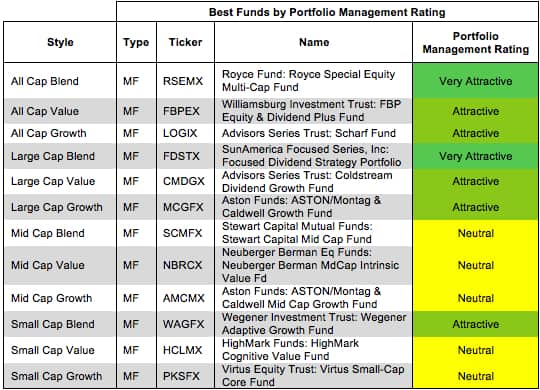

Traditional mutual fund research has focused on past performance and low management costs. The quality of a fund’s holdings has been ignored. Our portfolio management rating examines the fund’s holdings in detail and takes into account the fund’s allocation to cash. Our models are created with data from over 40,000 annual reports. This kind of diligence is necessary for understanding just what you are buying when you invest in a mutual fund or an ETF.

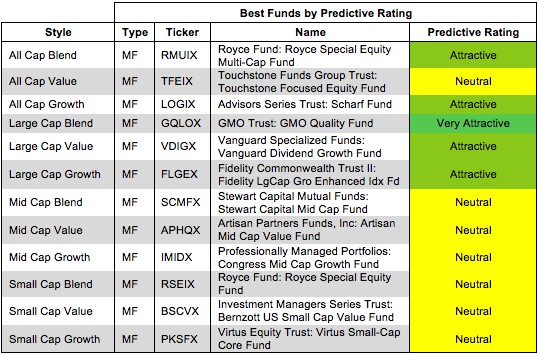

Figure 3 shows the best fund based on our Portfolio Management Rating for each investment style as of April 25, 2013. Only seven styles offer funds with Attractive holdings.

Attractive-or-better-rated funds own high-quality stocks and hold very little of the fund’s assets in cash – investors looking to hold cash can do so themselves without paying management fees. Only 3% of funds receive our Attractive or Very Attractive ratings, so investors need to be cautious when selecting a mutual fund or ETF – there are thousands of Neutral-or-worse-rated funds.

Figure 3: Style Funds With Highest Quality Holdings

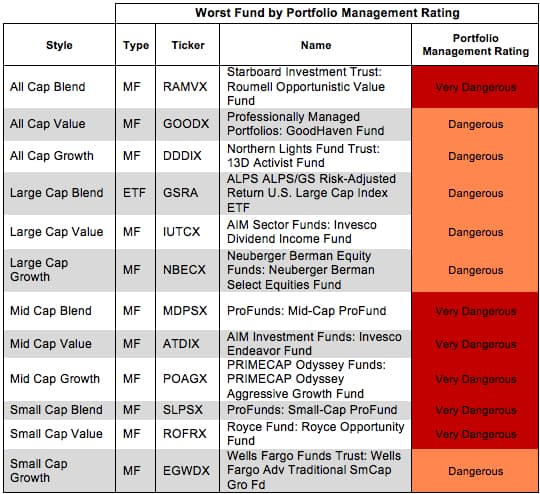

Figure 4 shows the worst fund based on our Portfolio Management Rating for each investment style as of April 25, 2013.

Figure 4: Style Funds With Lowest Quality Holdings

Investors should care about all of the fees associated with a fund in addition to the quality of the fund’s holdings. The best funds have both low costs and quality holdings – and there are plenty of low cost funds available to investors.

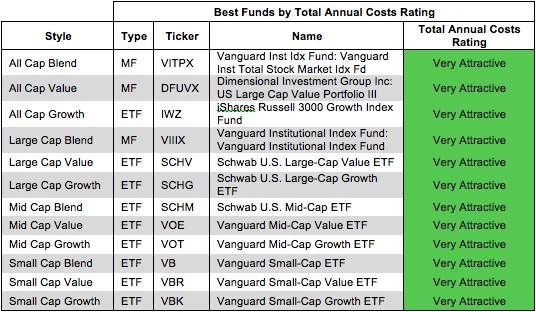

Figure 5 shows the best fund in each investment style according to our total annual costs rating. An ETF ranks as the lowest cost for nine of the twelve style categories.

Total Annual Costs incorporates all expenses, loads, fees, and transaction costs into a single value that is comparable across all funds. Passively managed ETFs and index mutual funds are generally the cheapest funds.

Figure 5: Style Funds With Lowest Costs

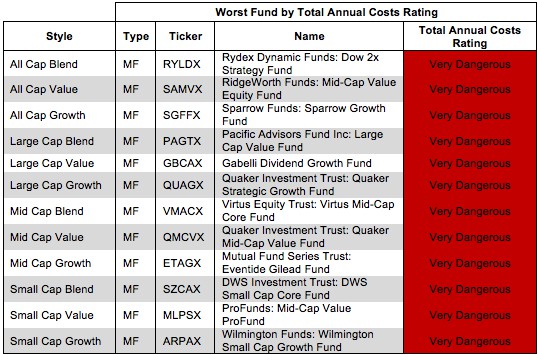

The most expensive fund for each investment style has a Very Dangerous Total Annual Costs Rating. Investors should avoid these funds and other funds with a Very Dangerous Total Annual Costs Ratings because they charge investors too much. For every fund with a Very Dangerous Total Annual Costs Rating there is an alternative fund that offers similar exposure and holdings at a lower cost. We cover over 7000 mutual funds and over 400 ETFs. Investors have plenty of alternatives to these overpriced funds.

Figure 6 shows the worst fund in each investment style according to our total annual costs rating. No ETFs ranks as the most expensive for any style category.

Figure 6: Style Funds With Highest Costs

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector or theme.