Our regular readers know that most dividend stocks are bad investments. They are not the safe-havens that investors think. We recently hosted live training sessions on two dangerous types of dividend stocks:

Last week, we published “Red Alert: Beware False Dividend Stocks” to keep clients away from stocks where dividend cuts could ruin their income portfolio.

In this report, we’re here to warn about a third, less obvious yet dangerous dividend stock:

Dividend-Trap Stocks

Dividend-trap Stocks look good on the outside. They pay a dividend, and the underlying business is solid enough to afford the dividend. The problem is not the cash flows. It’s the nosebleed valuation of the stocks.

No matter how healthy the dividend is, if the stock is priced to perfection, it’s likely to go down and wipe out any gains you hope to get from the dividend payout. Dividend-trap stocks do not offer very high dividend yields (close to the 5-year zero coupon bond) because the stock price is so rich. So, the upside potential from the dividend payout is small compared to the downside risk from the overvalued stock.

In other words, Dividend-trap Stocks are good companies, but bad stocks, and they don’t pay a yield large enough to make them worth the risk.

You don’t want your “income stock” to crater due to a bad earnings report because the stock is priced for perfection, when you could collect the same yield in a far less risky security.

The only way to avoid Dividend-trap Stocks is to do proper due diligence to accurately assess companies’ cash flows and stocks’ valuations. As we’ve proven many times, investors must do their homework to get the truth about any business.

Below, we break down just how prevalent Dividend-trap Stocks are in the current market.

Pinpointing the Dividend-Trap Risk

To find Dividend-trap Stocks, we first screen our entire coverage universe for stocks that pay a dividend.

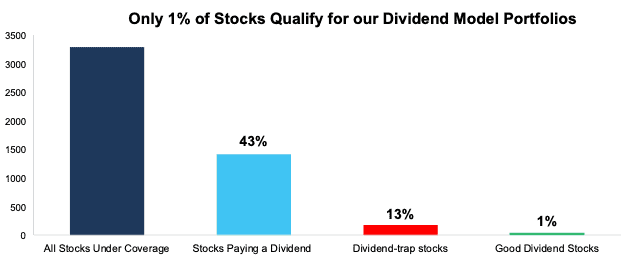

Of the ~3,300 stocks under coverage, 1,416 stocks, or 43%, pay a dividend. Only 44 stocks, or 1% of the universe qualify as Good Dividend Stocks and earn a spot in one of our dividend model portfolios: Safest Dividend Yield Stocks and Dividend Growth Stocks.

Figure 1: Dividend Paying Stocks in Coverage Universe – As of June 10, 2025

Sources: New Constructs, LLC and company filings

After we’ve identified the dividend stock paying universe, we then parse out the Dividend-trap stocks. Specifically, Dividend-trap Stocks have:

- A Neutral stock rating,

- An Unattractive or Very Unattractive rating for market-implied growth appreciation period(GAP), which indicates all good news is priced into stock, and

- A dividend yield equal to or below 4.0% (current risk-free-rate).

Per Figure 2, there are 181 Dividend-trap Stocks as of June 10, 2025.

Figure 2: Dividend Stocks with Low Yields – As of June 10, 2025

Sources: New Constructs, LLC and company filings

The Dividend-Trap Stocks

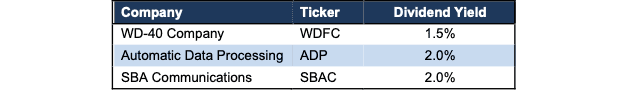

Below, we reveal three of the 181 Dividend-trap Stocks. These stocks earn a Neutral rating and are so expensive that we see far more downside risk than upside potential. From an income perspective, the yield is very low, below the risk-free rate. From the capital appreciation perspective, downside risk dwarfs upside potential.

Figure 3: Three Dividend-Trap Stocks: As of June 10, 2025

Sources: New Constructs, LLC and company filings

WD-40 Company (WDFC: $244/share): 1.5% Dividend Yield

WD-40 earns its spot on the Dividend-trap Stocks list due to its strong earnings but overvalued stock.

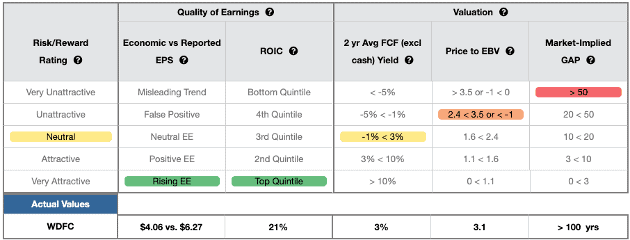

In the trailing twelve months (TTM), WD-40 generated $82 million in net operating profit after-tax (NOPAT) and earns a top-quintile return on invested capital (ROIC) of 21%. Economic earnings, which account for changes to the balance sheet and represent the true profits of the business, are $55 million over the TTM. Additionally, the company generated $60 million in free cash flow (FCF) over the TTM. By all measures, WD-40 meets the criteria of a “good business.”

However, it also meets the criteria of “bad stock”. At its current price of $244/share a WDFC’s price-to-economic book value (PEBV) ratio is 3.1. This ratio implies the company will grow profits over 3 times TTM levels. Furthermore, in the default scenario of our reverse discounted cash flow (DCF) model, WDFC has a market-implied Growth Appreciation Period (GAP) of greater than 100 years.

The company’s current economic book value, or no growth value, is just $80/share, a 67% downside to the current price. In other words, $244/share embeds a rather large amount of future growth in profits. The 1.5% dividend yield does not compensate for the risk of the stock trading sideways or even falling closer to its economic book value. As a result, WDFC finds itself on the Dividend-traps Stocks list.

See Figure 4 for our detailed Stock Rating on WDFC.

Figure 4: WD-40’s Stock Rating Details: Good Company, Bad Stock

Sources: New Constructs, LLC and company filings

Automatic Data Processing (ADP: $312/share): 2.0% Dividend Yield

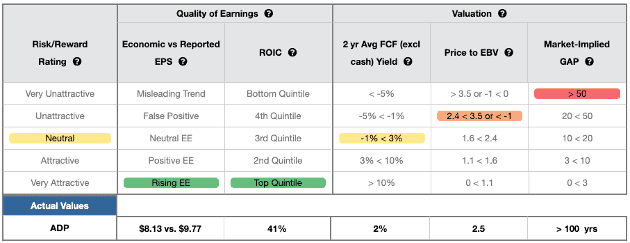

Automatic Data Processing is also a Dividend-trap Stock due to its positive economic earnings and strong ROIC, but overvalued stock price.

In the TTM, Automatic Data Processing generated $4.1 billion in NOPAT and earns a top-quintile ROIC of 41%. Economic earnings are $3.3 billion over the TTM, and the company generated $1.8 billion in FCF over the same time. Automatic Data Processing certainly looks like a “good company” by all fundamental metrics.

The reason for its landing a spot on the Dividend-trap Stocks list is the high future cash flow expectations baked into its stock price. At its current price of $312/share ADP’s PEBV ratio is 2.5. This ratio implies the company will more than double its profits from TTM levels. In the default scenario of our reverse DCF model, ADP has a market-implied GAP of greater than 100 years. In other words, Automatic Data Processing, must achieve the default revenue growth and margins in our DCF for >100 years to justify its current price.

The company’s current economic book value is just $127/share, a 59% downside to the current price. As with WDFC, the expectations for future profit growth in ADP at $312/share are so high that we think all the good news and then some is baked into the current stock price. Downside risk in this stock dwarfs upside potential.

See Figure 5 for our detailed Stock Rating on ADP.

Figure 5: Automatic Data Processing’s Stock Rating Details: Good Company, Bad Stock

Sources: New Constructs, LLC and company filings

SBA Communications Corporation (SBAC: $225/share): 2.0% Dividend Yield

The third stock for today’s report, SBA Communications Corporation, is like the prior two.

In the TTM period, SBA Communications Corporation generated $1.5 billion in NOPAT and earns a second-quintile ROIC of 12%. Economic earnings are $669 million over the TTM, and the company generated $1.3 billion in FCF over the same time. SBA Communications Corporation, just as with WDFC and ADP, could certainly be called a “good company.”

Its valuation is not nearly as “good” though. At its current price of $225/share SBAC’s PEBV ratio is 3.1. This ratio implies the company will more than triple its profits from TTM levels. In the default scenario of our reverse DCF model, SBAC also has a market-implied GAP of greater than 100 years.

The company’s current economic book value is just $73/share, a 68% downside to the current price. The expectations for future profit growth baked into SBAC at $225/share leave no room for cash flow expectations to improve from current levels. As a result, there is little to no upside in the stock, and the 2.0% dividend yield is not enough to offset the downside risk in owning SBAC at this price.

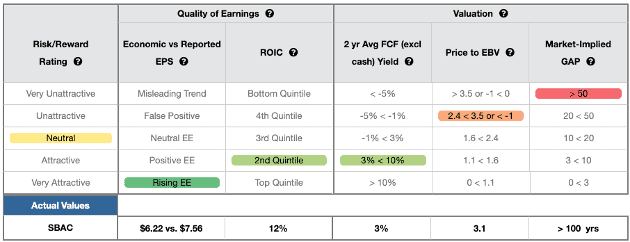

See Figure 6 for our detailed Stock Rating on SBAC.

Figure 6: SBA Communication’s Stock Rating Details: Good Company, Bad Stock

Sources: New Constructs, LLC and company filings

More Dividend Training Sessions

After years of digging into Wall Street’s accounting tricks, we know firsthand that many so-called “dividend plays” are traps for Main Street investors.

To help investors of any kind avoid these pitfalls, we recently hosted a training showing you exactly how to spot a False Dividend Stock. Watch the replay here.

As a follow-up, we hosted another training discussing the exact topic of this report: Dividend-trap Stocks. You can watch the replay here.

No matter how good the dividend, investing in a bad stock can cost you much more than the dividend pays.

Want to know where to get good dividend stocks? We hosted a separate live training on June 17at 1pm ET. In this training, we not only cover the dangers of dividends, but also show you which dividend stocks are worth owning. Watch the replay here.

This article was originally published on June 16, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.