The S&P 500 hit its first record close of President Trump’s second term, as a flurry of executive orders looks to shape the new administration’s agenda. Many analysts agree that the incoming administration could create a business landscape that is less regulated and more conducive to mergers & acquisition activity. As we noted last week, banks easily surpassed earnings estimates when they kicked off earnings season, and if such a landscape does materialize, such beats could be the beginning of a banking boom.

On the other hand, there’s Fartcoin, the combination of crypto and meme stocks – known as a “meme coin”. And, in this new administration, there are new meme coins every day. Are you kidding me?

Do you ever wonder what other junk Wall Street insiders might be willing to sell you when they’re openly hocking a security that clearly has no intrinsic value?

In such an environment, its critical to find stock picks and research you can trust. How else can you make sense out of the madness of the current market?

You need something to help you discern between signal and noise.

This report does exactly that.

We first made Royal Bank of Canada (RY: $122/share) a Long Idea in April 2018 and most recently reiterated our bullish thesis on the stock in September 2023. Since this update, the stock has underperformed the S&P 500 by ~5%, which indicates that the market isn’t fully appreciating the strength of this business. And, its stock remains undervalued.

Our thesis highlighted Royal Bank of Canada’s diversified business, position as an industry leader, growing net interest margins, and attractive valuation. Today, the company continues to grow its deposits and loans, as well as net interest income and net interest margins. Meanwhile, we think the valuation of the stock is cheap and offers attractive risk/reward.

RY offers favorable Risk/Reward based on the company’s:

- continued loan and deposit growth,

- improving net interest margin,

- consistent and strong free cash flow generation, and

- cheap stock valuation.

What’s Working for the Business

Maintaining Its Leading Position

Royal Bank of Canada has maintained its position as the market share leader in all “key personal and business banking product categories across Canada”. It is also the #1 ranked investment bank in Canada, the #1 ranked Canadian investment bank in the U.S., and the 10th largest global investment bank based on global investment banking fees according to the company’s fiscal 2024 annual report.

As a full-service wealth advisory firm, Royal Bank of Canada is the 6th largest firm in the U.S. when measured by assets under administration (AUA).

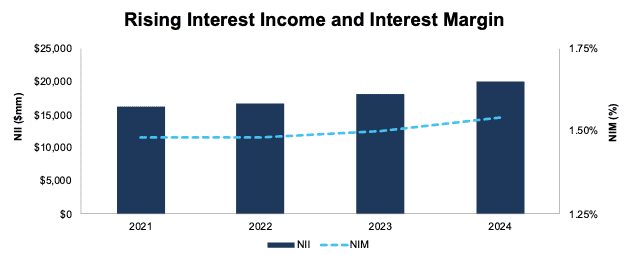

Rising Net Interest Income and Margins

Last time we wrote about Royal Bank of Canada, the U.S. treasury yield curve was inverted, showing signs of a recession, yet we believed Royal Bank of Canada would be able to maintain its strong net interest margins anyway. Royal Bank of Canada managed to do just that. Now, with inflation decreasing and the U.S. treasury yield reverting to a normal curve, the bank’s net interest margins have increased.

At a basic level, a bank makes money when it generates more interest than it pays out. This standard function of a bank grew more difficult in recent years, as interest rates in both the United States and Canada increased. However, Royal Bank of Canada was able to effectively manage its asset base and the rising cost of deposits.

In 2024, Royal Bank of Canada’s net interest income (NII) rose to 11% year-over-year (YoY) in fiscal 2024. The bank’s net interest margin followed suit, rising 4 basis points YoY to 1.54%. See Figure 1.

As the Bank of Canada and The Federal Reserve consider further rate cuts, any decrease in the cost of deposits could bode well for future increases to the company’s NIM.

Figure 1: Royal Bank of Canada’s Net Interest Margin and Net Interest Income: Fiscal 2021 – Fiscal 2024

Sources: New Constructs, LLC and company filings

The success of the business doesn’t come from just one segment. For instance, Royal Bank of Canada grew reported 2024 net income YoY in its Personal Banking, Commercial Banking, Wealth Management, Insurance, and Capital Markets segments.

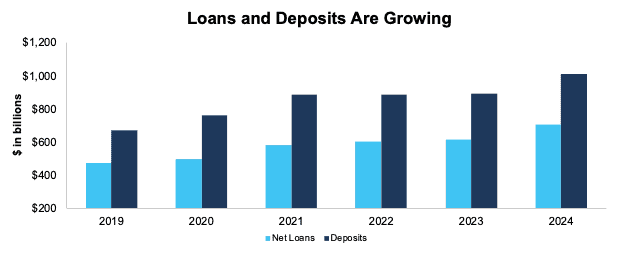

Loans and Deposits Are Growing at a Fast Pace

Not only has Royal Bank of Canada improved its net interest margins over the last few years, but the bank is also growing its loans and deposits. In other words, Royal Bank of Canada isn’t just improving its net interest margin on a stagnant balance sheet, it is doing so while growing its book of business.

Royal Bank of Canada’s net loans increased from $470 billion in fiscal 2019 to $704 billion in fiscal 2024, or 8.4% compounded annually. Over the same time, the bank’s total deposits grew from $673.3 billion to $1.0 trillion, or 8.5% compounded annually.

Figure 2: Royal Bank of Canada’s Net Loans and Deposits: Fiscal 2019 – Fiscal 2024

Sources: New Constructs, LLC and company filings

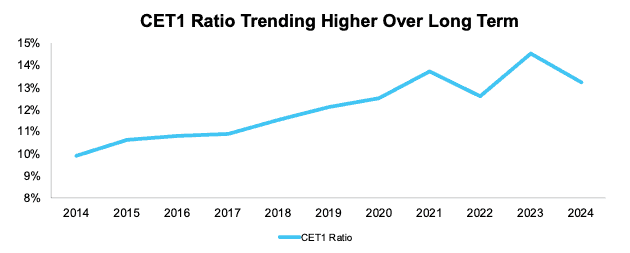

Quality Capital Ratio

The strength of Royal Bank of Canada’s business also manifest in the bank’s strong capital ratios. Over the past three years, the bank has averaged a tier 1 common equity (CET1) ratio of 13.4% and averaged a 13.3% CET1 ratio over the past five years.

Royal Bank of Canada’s CET1 ratio did fall from 14.5% in fiscal 2023 to 13.2% in fiscal 2024. However, the decrease in the bank’s CET1 ratio is a direct result of the company’s acquisition of HSBC Canada in March 2024, which resulted in a 240-basis point decline in the overall company’s CET1 ratio. This decline was partially offset by an increase in internal capital generation and shares issuances under the company’s dividend reinvestment plan.

Longer-term, Royal Bank of Canada’s CET1 ratio has improved from 9.9% in fiscal 2014 to 13.2% in fiscal 2024, per Figure 3.

Figure 3: Royal Bank of Canada’s CET1 Ratio: Fiscal 2014 – Fiscal 2024

Sources: New Constructs, LLC and company filings

Attractive Dividend Yield

Since fiscal 2019, Royal Bank of Canada has paid $28.7 billion (17% of market cap) in cumulative dividends and has increased its quarterly dividends from $0.73/share in January 2019 to $1.05/share in January 2025. The company’s current dividend, when annualized, provides a 3.4% yield.

The bank also announced a new share buyback program that authorizes the repurchase of 30 million shares June 2024 to June 2025, though repurchases up to this point have been minimal. In fiscal 2024, Royal Bank of Canada repurchased $140 million worth of shares. A similar sized repurchase in 2025 would equate to just 0.1% of the current market cap.

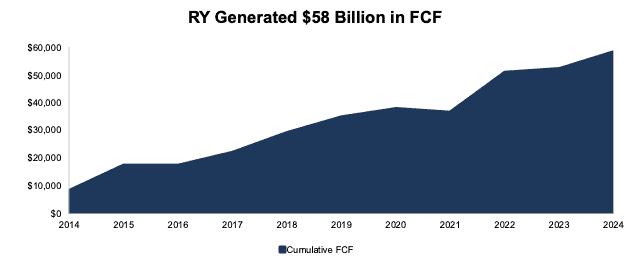

Generating Free Cash Flow

Not only does Royal Bank of Canada provide an attractive dividend yield, but its free cash flow (FCF) easily exceeds its dividend payments. Since fiscal 2019 Royal Bank of Canada has generated $29.4 billion in FCF.

Longer-term, Royal Bank of Canada has generated a cumulative $58 billion in FCF since fiscal 2014, which represents 32% of its enterprise value.

Figure 4: RY Free Cash Flow: Fiscal 2014 – Fiscal 2024

Sources: New Constructs, LLC and company filings

What’s Not Working for the Business

Economic Headwinds Haven’t Died Down Yet

Although inflation has fallen from recent highs, inflationary pressures haven’t disappeared completely. The Fed is taking a slower approach to cutting interest rates. High rates for longer could translate to less financial activity in the economy, which creates a headwind across the entire banking industry.

However, at least in the U.S., experts are predicting a much more favorable environment for mergers & acquisitions under the new presidential administration. Such deals could offset any persistent inflation and reduced loan activity in other segments of Royal Bank of Canada’s business.

The good news remains that Royal Bank of Canada has proven its ability to generate profits amidst all economic cycles. Even when inflation was higher and economic activity was slower than it is today, Royal Bank of Canada was still growing its loan portfolio while maintaining its margins.

Shares Have Upside at Current Levels

Below, we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations for different stock price scenarios for Royal Bank of Canada. At its current price, RY’s price-to-economic book value (PEBV) ratio is 1.0, which means the market expects its NOPAT to never grow from current levels. For reference, Royal Bank of Canada has grown NOPAT 4% compounded annually over both the past five and ten years.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin immediately falls to 11% (compared to a three-year average NOPAT margin of 16% and 13% in the TTM) from fiscal 2025 through fiscal 2034, and

- revenue grows at 3% a year through fiscal 2034 (compared to 13% compounded annually in the last five years), then

the stock would be worth $123/share today – nearly equal to the current stock price. In this scenario, Royal Bank of Canada’s NOPAT grows just 1% compounded annually from fiscal 2025 – fiscal 2034. For reference, Royal Bank of Canada has grown NOPAT by 4% compounded annually over the last decade.

Shares Could Go At Least 24% Higher

If we instead assume:

- NOPAT margin falls to 12% from fiscal 2025 – 2034 and

- revenue grows by 4.5% compounded annually from fiscal 2025 – 2034 (compared to 10% compounded annually over the last decade), then

the stock would be worth $151/share today – a 24% upside to the current price. In this scenario, Royal Bank of Canada’s NOPAT would grow just 3% compounded annually from fiscal 2025 to 2034.

Should the company’s NOPAT grow more in line with historical levels, the stock has even more upside. See Figure 5.

Figure 5: RY Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article was originally published on January 23, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.