What do Target, Home Depot, J.P. Morgan and Sony have in common? They are all recent victims of a cyber attack. When companies this big are victims, it seems no sector, network, or system is immune to these threats. The result is that companies are investing record amounts to protect themselves from system breaches. Investors can profit from this trend by investing in a global leader in cyber security. This week’s stock pick is Check Point Software Technologies (CHKP).

The Leader In an Expanding Industry

Check Point continues to be the worldwide leader in market share for Firewall Equipment and currently provides security systems for 98% of the Fortune 500 and over 100,000 businesses in total. After reporting its 1Q15 results, despite continued strength in revenue and profit growth, shares are actually down nearly 3%. With a growing user base, rapidly expanding industry, and product improvements on the horizon, Check Point shares don’t get the valuation they deserve.

A SAAS Model That Is Highly Profitable

Check Point has grown revenues by 11% compounded annually over the past ten years in large part due to its combined hardware and software based business model. In addition to traditional hardware sales, Check Point creates recurring revenues through its software as a service (SAAS) business model.

The real determinant of a great company is if management can translate that revenue growth into profit. Over the past decade, Check Point has grown after-tax profit (NOPAT) by 14% compounded annually, even faster than revenue. The consistent profit growth is a testament to Check Point’s efficient operations. Since 2010, Check Point has achieved gross margins above 85% each year, and 88% in 2014. Check Point’s pre-tax (NOPBT) margin has been upwards of 50% over this time period and was 54% in 2014.

Check Point currently earns a return on invested capital (ROIC) of 180%, up from 37% in 2008. The company has generated over $2 billion in free cash flow since 2011. With the large amount of free cash flow, Check Point has ample ability to continue its $1.5 billion share repurchase program that was approved in early 2015 and continue to invest in developing market-leading solutions.

Building for the Future

Investors fear the rapid pace of cyber attacks will make current security providers obsolete. What they fail to realize is that Check Point has faced strong competitive forces since its founding in 1993. Competing against large tech firms to smaller startups, Check Point has maintained its market leading position and has continued to innovate along the way.

The key differentiator for Check Point is its robust and flexible product offerings. As the largest pure play security vendor in the world, the company can offer a higher degree of customization and focus to its clients.

Smaller peers such as Palo Alto networks, although growing rapidly, cannot compete with the multi-layered line of defense from Check Point. In addition, Check Point recently acquired two smaller firms to further their security offerings. Hyperwise is considered to be a direct competitor to Palo Alto’s security prevention platform and will be integrated into Check Point’s existing platforms. Lacoon Mobile on the other hand, provides security for iOS and Android operating systems that can be integrated into a company’s existing security infrastructure.

Check Point is ensuring that it can provide solutions across the entire IT security value chain in addition to providing market leading firewall equipment.

When It Pays to Be First

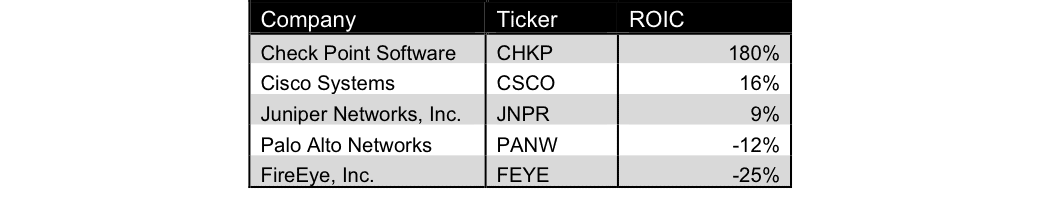

Check Point has strong advantages over its competitors across many key metrics. Many of Check Point’s competitors are either newer entrants into the market, or smaller businesses that must spend large amounts to attract clients and build out system operations. As shown in Figure 1, Check Point derives much greater returns on the capital invested than its competitors. Being more profitable than its competitors gives Checkpoint pricing power and staying power for developing market-leading solutions.

Figure 1: Check Point Operates Above the Rest

Sources: New Constructs, LLC and company filings

Impact of Footnotes Adjustments and Forensic Accounting

To reveal the true economic performance of Check Point, we look deeper into the company’s 10-K reports. By removing nearly $35 million in reported non-operating income, largely in the form of interest income, and $12 million in tax adjustments, we see that Check Point’s NOPAT was lower than GAAP net income in 2013.

2014’s NOPAT was also below GAAP net income but after the removal of non-operating items we see that NOPAT grew 5% year over year while reported net income only grew 1% in 2014. Without an understanding of the accounting adjustments required to derive the true recurring cash flows of a business, investors would have underestimated Checkpoint’s rate of growth.

Invest Now Before Check Point’s True Value is Realized

At its current price of $84/share, Check Point has a price to economic book value (PEBV) ratio of 1.3. This ratio implies the market expects Check Point’s NOPAT to grow by only 30% from the current level over its remaining life. While 30% NOPAT growth is nothing to balk at, after growing NOPAT by 14% compounded annually for the past decade, it seems overly pessimistic to expect Check Point to increase NOPAT by only 30% over the remaining life of the business.

Given Check Point’s market leading position and strong fundamentals the company is undervalued. If we give Check Point credit for 9% compounded annual NOPAT growth for the next decade, well below what it achieved in the preceding decade, the stock is worth $109/share today. This price represents a 31% upside from current levels.

Disclosure: David Trainer owns CHKP.

David Trainer, Allen L. Jackson, and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo credit: Yuri Samoilov (Flickr)