As major market indices approach correction territory, many investors are wondering where they can find safe places for their money. We’ll be honest with you – there are no easy answers. In fact, picking stocks is only getting tougher now that strategies like MOMO and FOMO aren’t working.

Ever wonder, if, maybe, picking stocks was supposed to be hard? Maybe, having efficient markets means that piling into popular stocks is not a viable strategy. Given the choice, we would take having an efficient market over easy-money investing strategies all day long and twice on Sundays.

Efficient markets are not only better for society, but they are also the only type of market that can survive long term. Inefficient markets, inevitably, devolve into big losses for everyone except those that can bully or cheat the best.

So, do we see a silver lining in the volatility in the market today? Yes, we do, and our research is perfectly suited to helping investors outperform in this environment. You know the saying…when the going gets tough, the tough get going. New Constructs is the toughest research company in the world.

This week’s new Long Idea is a great example of a good, tough stock. This company boasts industry leading market share, is growing its profits, and its stock has gotten much cheaper over the last few months.

We previously made The Hershey Company (HSY: $180/share) a Long Idea in August 2020 and closed the position in April 2023 after the stock outperformed the S&P 500 by 59%. At the time we closed the position, the company was still a great business with strong fundamentals, but its stock valuation was too expensive.

Since closing the position, the stock has fallen over 34% and looks undervalued again. In 2024, the company had its most profitable year to date (since 1998) and, at its current price, shareholders could see upwards of 4% yield. The Hershey Company presents high quality Risk/Reward once again and is this week’s Long Idea.

HSY offers favorable Risk/Reward based on the company’s:

- diverse and innovative product offering,

- sales growth in all segments,

- falling operating costs despite rising cocoa prices,

- highest profitability among peers, and

- cheap stock valuation.

Snacking Poised for Growth

Put plainly, Americans love snacks. In fact, according to data from Circana, 46% of Americans eat three or more snacks a day. And, consumers know what they like and seek it out. Circana notes that “despite economic constraints, consumers remain loyal to familiar products…”

Consumers’ love for snacks bodes well for specific snacking submarkets as well.

Statista estimates that the North America confectionery market will grow 5.2% compounded annually from 2025 to 2030. On the other side of snacking, salty not sweet, Grand View Research estimates the North America savory market will grow 6.5% compounded annually over the same time.

Strong growth forecasts create profit growth opportunities for The Hershey Company, which sells both leading confectionery and savory snack brands.

Adaptive Marketing Is an Edge

While snacking may always be in vogue, the way in which consumers find products and decide to purchase is always changing.

To keep up with changing habits and preferences, The Hershey Company has made impactful changes to its marketing mix to ensure its products stay in front of customers’ eyes.

In 2017, the live TV advertising segment made up 68% of The Hershey Company’s total marketing spending, while only 24% of advertising was done in new media (digital, social, streaming) segments. However, the company realized that new media use is booming while live TV is slowing and adapted its marketing & advertising efforts accordingly.

In 2024, 64% of total marketing was done through new media channels (26% in digital media, 20% in social media, and 18% in streaming), and the live TV segment only made up 23%. Such a shift meets consumers where they’re viewing and helps The Hershey Company maintain its brand position.

Additionally, The Hershey Company is promoting its brands by collaborating with celebrities and influencers. To name a few, the company entered an official partnership with WNBA star Angel Reese to promote its Reese’s brand. The Reese’s brand is now a sponsor of the New Heights Podcast hosted by former and current NFL players Jason and Travis Kelce. And, on the candy front, it launched a new brand called Shaq-A-Licious, with gummies shaped as Shaquille O’Neal’s face.

Turns out, at the Hershey Company, smarter marketing is also more efficient. The company’s selling, marketing, and administrative expense as a percentage of revenue fell from 25% in 2017 to 21% in 2024.

The Hershey Company’s brands have been among the top choices of customers for decades. We see no reason that will change anytime over the decades to come.

Still the King of Chocolate

The Hershey Company’s marketing efforts aren’t just about building awareness of new products. The company needs to maintain its leading market share for existing brands.

And it has done just that.

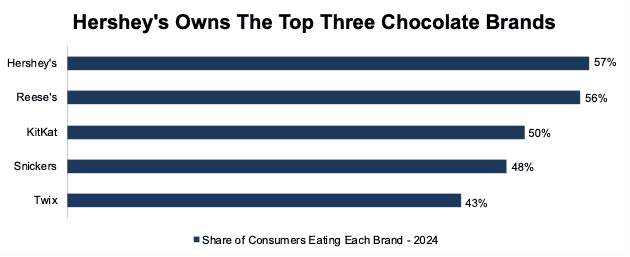

In 2024, the Hershey’s brand was the most consumed chocolate brand in the U.S. In fact, the top three most consumed chocolate brands in 2024, Hershey’s, Reese’s, and KitKat, are all owned and operated by The Hershey Company. See Figure 1.

Across all confectionery, The Hershey Company holds the highest market share in the U.S. as well, beating out Mars, Inc to claim the top spot.

Figure 1: Share of Consumers Eating Each Brand of Chocolate – 2024

Sources: Statista

Becoming a One Stop Snack Shop

The Hershey Company is on the path to becoming a one stop shop for all snacks.

The Hershey Company has grown its North America salty snacks sales 22% compounded annually from 2019-2024. This rapid growth also means salty snacks now make up 10% of sales in 2024, up from just 5% of sales in 2019.

Two acquisitions played a big role in the growth of the salty snacks segment. First, The Hershey Company acquired Amplify Snack Brands in 2017. Amplify was the parent company of SkinnyPop, which is a ready-to-eat (RTE) popcorn brand. At the time of the acquisition, SkinnyPop was the #2-brand in the RTE popcorn subcategory in terms of retail sales. Post acquisition, The Hershey Company grew the SkinnyPop brand into the #1-brand in the RTE popcorn subcategory in 2024, by doubling the brand’s retail sales.

Second, The Hershey Company acquired Dot’s Pretzels and Pretzels Inc. at the end of 2021. Dot’s Pretzels sales more than tripled retail sales from the acquisition date, through 2024. The brand also grew from the #3-brand to #2-ranked brand by retail sales over the same time.

Cementing Leadership Position with Strong Distribution

The Hershey Company excels at making sure its products are available to purchase wherever consumers purchase items. It may seem simple, but quality distribution and logistics can create lasting competitive advantages.

Per Figure 2, The Hershey Company grew its U.S. Retail takeaway and its U.S. Candy, Mint, Gum takeaway YoY in each of the last six years. Its products are not just being shipped to stores and sitting stagnant on shelves, but they’re also being purchased at those stores.

Takeaway represents the rate at which The Hershey Company’s products are purchased compared to overall sales growth in the multi-outlet combined plus convenience stores channels.

Figure 2: The Hershey Company’s Year-over-Year Takeaway: 2019 – 2024

Sources: New Constructs, LLC and company filings

*U.S. Retail takeaway is measured in the expanded multi-outlet combined plus convenience store channels, which includes candy, mint, gum, salty snacks, meat snacks, and grocery items.

Strong Fundamentals Across Decades

The Hershey Company is unique, in that despite not being a flashy tech company, it has consistently grown its top- and bottom-line for more than two decades straight.

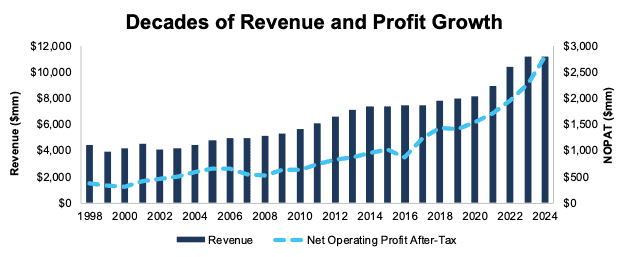

The company has grown revenue by 4% and net operating profit after-tax (NOPAT) by 8% compounded annually since 1998. See Figure 3.

The company improved its NOPAT margin from 9% in 1998 to 25% in 2024 while invested capital turns fell from 1.4 to 0.9 over the same time. Rising NOPAT margins are enough to offset falling invested capital turns though, and, drive return on invested capital (ROIC) from 12% in 1998 to 22% in 2024.

Additionally, the company’s Core Earnings grew 8% compounded annually from $322 million in 1998 to $2.5 billion in 2024.

Figure 3: The Hershey Company’s Revenue and NOPAT Since 1998

Sources: New Constructs, LLC and company filings

Industry Leading Profitability as Well

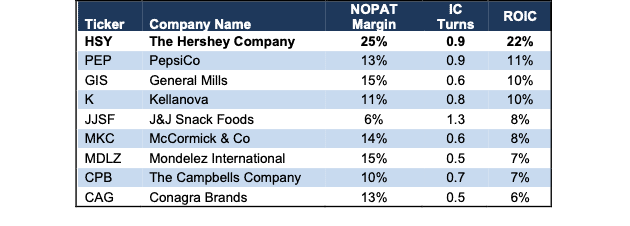

Not only is The Hershey Company the leading confectionery company, but it is also the most profitable company amongst its peers in the snacking industry. The company leverages its large distribution network, brand name, product placement, and efficient operations to drive competitive advantages.

The Hershey Company’s NOPAT margin and ROIC are higher than all peers, while the company’s invested capital turns surpass all but one of its publicly traded competitors. In fact, The Hershey Company’s ROIC is double the next closest competitor, PepsiCo (PEP). Competitors in this analysis also include Mondelez International (MDLZ), Kellanova (K), Conagra Brands (CAG), and more, per Figure 4.

Figure 4: The Hershey Company’s Profitability Vs. Peers: Trailing Twelve Months (TTM)

Sources: New Constructs, LLC and company filings

Building a More Efficient Operation

The Hershey Company is not just the most profitable amongst its competitors, but it is consistently building a more efficient operation too. Since 2017, the company has decreased operating expenses across the board.

From 2017 to 2024, as a percent of revenue, The Hershey Company’s cost of sales fell from 54% to 53%, its selling, marketing, & administrative expense fell from 25% to 21%, and its business realignment costs fell from 3% to 0%.

The company’s total operating costs fell from 82% of revenue to 74% of revenue over the same time.

Figure 5: The Hershey Company’s Expenses as a Percentage of Revenue From 2017 to 2024

Sources: New Constructs, LLC and company filings

Potential for 4.4%+ Yield

Since 2019, The Hershey Company has paid $4.7 billion (13% of market cap) in cumulative dividends and has increased its quarterly dividends from $0.72/share in 1Q19 to $1.37/share in 1Q25. The company’s current dividend, when annualized, provides a 3.1% yield.

The Hershey Company also returns capital to shareholders through share repurchases. From 2019 through 2024, the company repurchased $2.3 billion (7% of market cap) of shares.

As of December 2024, the company is authorized to repurchase up to an additional $470 million of shares. Should the company repurchase shares at its 2024 rate, it would use up the entirety of its remaining authorization and repurchase $470 million of shares in 2025, which equals 1.3% of the current market cap. When combined, the dividend and share repurchase yield could reach 4.4%.

Quality Cash Flow Generation

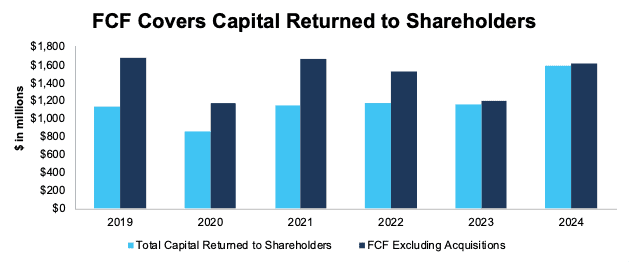

The Hershey Company generates enough free cash flow (FCF) to cover both its share repurchases and regular dividend payments.

From 2019 to 2024, The Hershey Company generated $8.8 billion in FCF excluding acquisitions while paying $4.7 billion in dividends and $2.3 billion in repurchases, for total capital return of $7.0 billion.

We like companies that choose to return capital to shareholders instead of spending it on costly executive bonuses that rarely drive shareholder value creation. See Figure 6.

Figure 6: Hershey’s FCF Excl Acquisitions and Total Capital Returned to Shareholders: 2019 – 2024

Sources: New Constructs, LLC and company filings

Strong Balance Sheet and Credit Rating to Weather Uncertainty

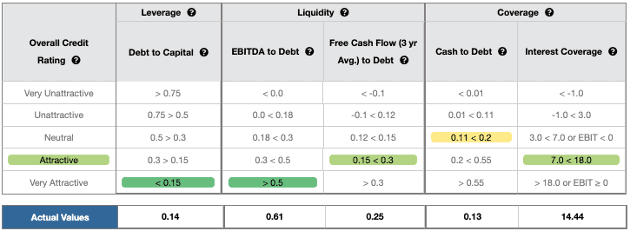

Per Figure 7, The Hershey Company earns an Attractive overall Credit Rating and scores an Attractive-or-better rating in four of the five credit rating metrics.

Even if economic conditions deteriorate or cocoa prices rise again, the company’s strong financial footing secures its operations for the foreseeable future.

Figure 7: The Hershey Company’s Credit Rating Details

Sources: New Constructs, LLC and company filings

Rising Cocoa Prices Remain a Challenge

As a chocolate producer, the price of cocoa has a big impact on The Hershey Company’s costs.

Cocoa prices started rising in mid-2023 and soared in 2024. From January 2024 to the peak in April 2024, cocoa future contract prices nearly tripled. The surge in cocoa prices was largely due to poor weather conditions and disease outbreaks in West Africa, which is the biggest cocoa producing region in the world.

While the price of cocoa has fallen since the beginning of the year, the future contract prices remain well above 2022 or end of 2023 levels. The Hershey Company notes that the production forecast for the 2024 – 2025 season is up over 30% combined in Ghana and Ivory Coast, due to better weather and significantly improved farmer prices. Additionally, a return to a surplus production environment is expected in the 2024-2025 growing season.

Despite the recent positive developments, the impact on The Hershey Company’s reported results will be drastic. After benefiting from derivative mark-to-market gains in 2024, The Hershey Company projects reported earnings will be down “in the high-40%” range YoY in 2025.

The market started pricing in the fact that The Hershey Company won’t be able to replicate 2024 results in 2025. However, the stock price has fallen to the point where it now implies the company’s profits will never recover at all. In the meantime, investors get a potential 4% yield as management looks to implement new pricing strategies, supply chain savings, and diversify its raw materials procurement to improve results in 2025. Long-term, should cocoa prices stabilize, the company will be best positioned to once again grow profits for years to come.

Furthermore, should cocoa prices stay too high for too long, we believe Hershey can pivot to selling other more profitable products so that their profit growth streak will not be broken for long, if at all.

Current Price Implies Profits Will Fall

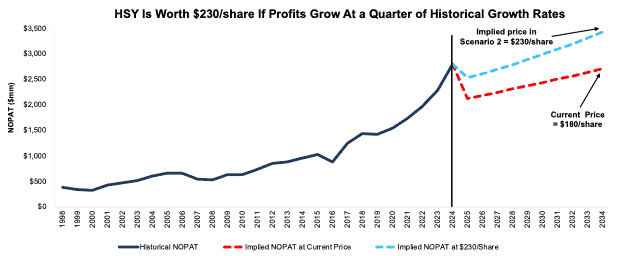

At its current price, The Hershey Company’s price-to-economic book value (PEBV) ratio is 0.9. This ratio means the market expects the company’s NOPAT to permanently decline 10% from 2024 levels. This expectation seems overly pessimistic considering The Hershey Company has grown NOPAT by 11% compounded annually in the last decade and 8% compounded annually over the last two decades.

Below, we use our reverse discounted cash flow (DCF) model to analyze expectations for different stock price scenarios for HSY.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin immediately falls to 19% (below five-year average margin of 20% and 2024 margin of 25%) through 2034, and

- revenue grows at 2.7% a year through 2034 (compared to 4.2% compounded annually in the last ten years and 4.7% compounded annually in the last twenty years) then

the stock would be worth $180/share today – equal to the current stock price. In this scenario, HSY’s NOPAT would fall <1% compounded annually from 2025 – 2034.

Shares Could Go 28%+ Higher at Consensus Growth Rates

If we instead assume:

- NOPAT margin immediately falls to 22% through 2034,

- revenue grows at consensus rates in 2025 (+2.9%) and 2026 (+2.5%), and

- revenue grows at 3.5% (compared to the forecasted global snacks market CAGR growth of 5.3%) each year thereafter through 2034, then

the stock would be worth $230/share today – a 28% upside to the current price. In this scenario, HSY’s NOPAT would grow just 2% compounded annually from 2025 to 2034.

Should the company’s NOPAT grow more in line with historical levels, the stock has even more upside. Furthermore, we think companies with long track records of strong profit growth deserve premium stock valuations, especially in a market filled with so many underperforming companies.

Figure 8: The Hershey Company’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Hershey’s business will enable it to continue to generate higher NOPAT than the current market valuation implies:

- large distribution network to sell and promote new and existing products,

- smarter marketing

- superior profitability compared to peers, both margins and ROIC,

- strong balance sheet.

What Noise Traders Miss with The Hershey Company

These days, fewer investors focus on finding quality capital allocators with shareholder-aligned corporate governance. Due to the proliferation of noise traders, the focus is on short-term technical trading trends while more reliable fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- growing demand for snack foods, across all sub-industries,

- consistent Core Earnings growth for more than two decades,

- valuation implies profits will permanently decline by 10%.

Earnings Beats Could Send Shares Higher

The Hershey Company has beaten earnings estimates in 14 of the past 16 quarters, including the latest quarter ended 4Q24. Beating estimates and achieving consistent top- and bottom-line growth could help explain HSY outperforming the overall Consumer Staples sector since the beginning of this year. Year-to-date, HSY is up 6% while the Consumer Staples Select Sector SPDR Fund (XLP) is up just 4%. Additional earnings beats, especially after management guided for such a decline in EPS in 2025, could send shares even higher and further extend the stock’s outperformance.

Exec Comp Could Be Improved

The Hershey Company’s executives receive both annual incentives and long-term equity awards. The annual incentives are tied to net sales, adjusted earnings per share, and EBIT margin goals.

Long-term equity awards, and specifically the performance share portion (65% of equity awards), are tied to relative total shareholder return, three-year CAGR in adjusted earnings per diluted share, and three-year cumulative free cash flow.

We would prefer the company tie executive compensation to ROIC. Doing so ensures that executives’ interests are more aligned with shareholders’ interests as there is a strong correlation between improving ROIC and increasing shareholder value. Improving ROIC requires attention to all areas of the business, so including it in an executive compensation plan would incentivize executives to improve the entire business, not just one sales goal or earnings number.

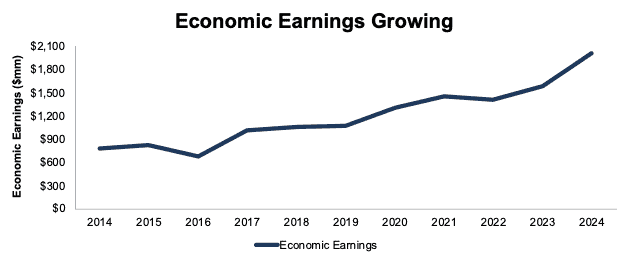

Despite using total shareholder return and adjusted earnings goals in its executive pay, Hershey’s management has grown economic earnings, the true cash flows of the business, 10% compounded annually over the last decade, from $778 million in 2014 to $2.0 billion in 2024.

Figure 9: The Hershey Company’s Economic Earnings: 2014 – 2024

Sources: New Constructs, LLC and company filings

Insider Trading and Short Interest Trends

Over the past 12 months, insiders have purchased 91,353 shares and have sold 95,220 shares for a net effect of 3,867 shares sold. These sales represent <1% of shares outstanding.

There are currently 7.7 million shares sold short, which equates to 4% of shares outstanding and just over three days to cover.

Attractive Funds That Hold HSY

The following funds receive an Attractive-or-better rating and allocate significantly to HSY:

- BTS Enhanced Equity Income Fund (EEQIX) – 4.0% allocation and Attractive rating.

- Bright Rock Mid Cap Growth Fund (BQMGX) – 3.6% allocation and Very Attractive rating.

- Sterling Capital Equity Income Fund (BEGIX, BCEGX, STREX) – 3.6% allocation and Very Attractive rating.

- First Trust Nasdaq Food & Beverage ETF (FTXG) – 3.6% allocation and Very Attractive rating.

This article was originally published on March 12, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.