Trailing-twelve-months (TTM) Economic Earnings for the S&P 500 have been falling quarter-over-quarter (QoQ) since 1Q22. 1Q23 was no different. TTM Economic Earnings in 1Q23 were lower than 4Q22 TTM levels for all but one sector: Financials.

This report is an abridged and free version of S&P 500 Economic Earnings: Downward Trend Continues In 1Q23, one of our quarterly series on fundamental market and sector trends. The full reports are available to our Professional and Institutional members or can be purchased below.

The full version of this report analyzes the economic earnings[1] (which adjust for unusual items on both the income statements and balance sheets) and GAAP earnings for the S&P 500 and its sectors (last quarter’s analysis is here).

Economic Earnings provide a more accurate measure of the true underlying cash flows of businesses than GAAP earnings. Reports on the drivers of Economic Earnings are here.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[2] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

Economic Earnings Fall in 1Q23

TTM Economic Earnings for the S&P 500 fell from $625.0 billion in 4Q22 to $548.6 billion in 1Q23, while TTM GAAP Earnings rose from $1.55 trillion to $1.57 trillion over the same time. TTM Economic Earnings have fallen QoQ in the last five quarters and are nearing levels last seen in 1Q21.

The S&P 500’s falling Economic Earnings are the continuation of a trend we foresaw in our 1Q22 report S&P 500 Economic Earnings Set Records, but WACC Is a Drag. Indeed, a major headwind facing Economic Earnings is a rising WACC. WACC for the S&P 500 sits at 7.1% in 1Q23, which is up from 6.8% in 4Q22 and 4.7% in 1Q21. Investors can protect themselves by paying closer attention to Economic Earnings, which account for the effects of rising WACC.

See Figure 1 in the full version of our report for the chart of Economic Earnings vs. GAAP earnings for the S&P 500 from December 2004 through 1Q23.

Key Details on Select S&P 500 Sectors

The Financials sector saw the largest QoQ improvement in TTM Economic Earnings, which rose from -$5.9 billion in 4Q22 to -$2.6 billion in 1Q23.

The Technology sector’s TTM Economic Earnings fell by 8% QoQ in 1Q23, though it generates the highest TTM Economic Earnings of any sector. On the flip side, the Utilities sector has the lowest TTM Economic Earnings of any sector and was one of ten sectors that destroyed shareholder value in 1Q23.

Below, we highlight the Financials sector, the only sector which saw a QoQ improvement in TTM Economic Earnings in 1Q23.

Sample Sector Analysis[3]: Financials

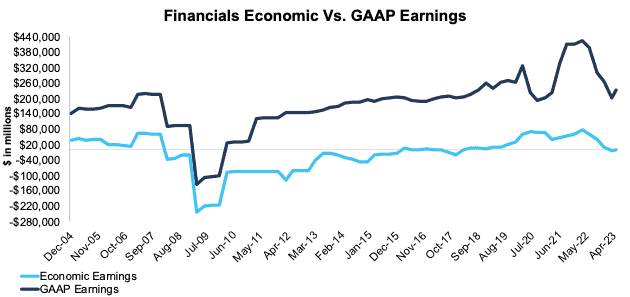

Figure 1 shows Economic Earnings for the Financials sector rose from -$5.9 billion in 4Q22 to -$2.6 billion in 1Q23, while GAAP earnings rose from $202.9 billion to $232.8 billion over the same time.

Figure 1: Financials Economic Earnings Vs. GAAP: 2004 – 1Q23

Sources: New Constructs, LLC and company filings.

Our Economic Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The May 15, 2023 measurement period incorporates the financial data from calendar 1Q23 10-Qs, as this is the earliest date for which all the calendar 1Q23 10-Qs for the S&P 500 constituents were available.

This article was originally published on June 2, 2023.

Disclosure: David Trainer, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

Appendix: Calculation Methodology

We derive the economic earnings and GAAP Earnings metrics above by summing the Trailing Twelve Month individual S&P 500 constituent values for economic earnings and GAAP Earnings in each sector for each measurement period. We call this approach the “Aggregate” methodology.

The Aggregate methodology provides a straightforward look at the entire sector, regardless of market cap or index weighting and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

[1] This report is based on the latest audited financial data available, which is the 1Q23 10-Q in most cases. Price data as of 5/15/23.

[2] Our research utilizes our more of reliable fundamental data, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[3] The full version of this report provides analysis for every sector like what we show for this sector.