Trailing-twelve-months (TTM) 4Q22 Operating Earnings calculated by S&P Global (SPGI) for the S&P 500 continued to drop from record highs reached in 1Q22 and remain lower than Core Earnings[1] for the third consecutive quarter. We saw a similar trend for GAAP Earnings in 4Q22, as detailed here.

After falling through much of 2022, the S&P 500 price rebounded in the beginning 2023, which drove its price-to-operating earnings ratio higher. However, when viewed through price-to-Core Earnings, the S&P 500 valuation continues to fall. Last quarter’s analysis of Core vs. S&P Global’s Operating Earnings for the S&P 500 is available here.

S&P Global's Operating Earnings Continue Decline in 4Q22

SPGI’s Operating Earnings do not exclude the unusual gains that exaggerated their rebound in 2021 and 2022. On the other hand, SPGI’s Operating Earnings include the unusual losses that drive them lower than Core Earnings in the TTM ended 4Q22.

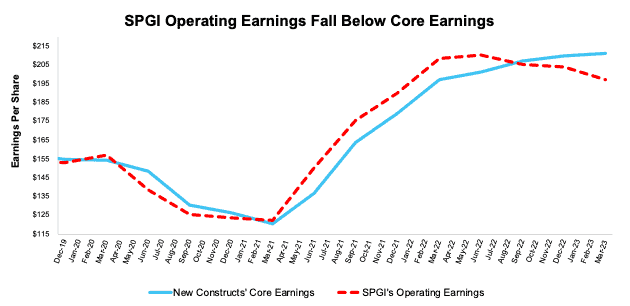

Figure 1 shows TTM Operating Earnings for the S&P 500 are lower than TTM Core Earnings for the third consecutive quarter in 4Q22. Operating Earnings per share fell 3% quarter-over-quarter (QoQ) compared to a <1% rise in Core Earnings per share. Operating Earnings are 7% lower than Core Earnings in the TTM ended 4Q22. For reference, Operating Earnings per share were 3% lower than Core Earnings per share in the TTM ended 3Q22.

On an annual basis, Core Earnings increased 7% year-over-year (YoY) compared to a 5% YoY decline in Operating Earnings.

Figure 1: TTM Earnings: Core Earnings vs. SPGI Operating Earnings: 4Q19 –4Q22

Sources: New Constructs, LLC, company filings, and S&P Global (SPGI). Note: the most recent period’s data for SPGI’s Operating Earnings is based on consensus estimates for companies with a non-standard fiscal year.

More details on the Core Earnings calculation are available in Appendix I.

Core Earnings Are More Reliable than S&P Global's Operating Earnings

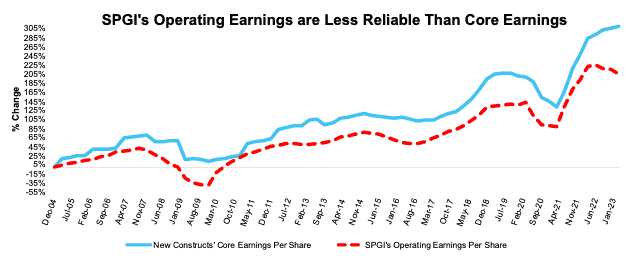

Figure 2 highlights the percentage changes in Core Earnings and SPGI’s Operating Earnings from 2004 through 3/8/23. Flaws in legacy datasets lead to a failure to capture unusual gains/losses buried in footnotes (detailed in The Journal of Financial Economics) and drive the difference between the two measures of earnings.

Figure 2: Core vs. SPGI’s Operating Earnings per Share for the S&P 500 – % Change: 2004 – 3/8/23

Sources: New Constructs, LLC, company filings, and S&P Global (SPGI). Note: the most recent period’s data for SPGI’s Operating Earnings incorporates consensus estimates for companies with a non-standard fiscal year.Our Core Earnings analysis is based on aggregated TTM data through 6/30/13, and aggregated quarterly data thereafter for the S&P 500 constituents in each measurement period.

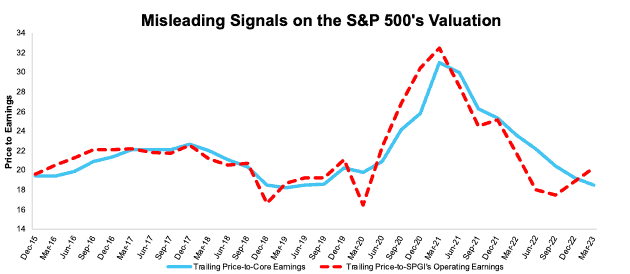

Operating Earnings Misrepresent the Trend in The S&P 500’s Valuation

The drop in Operating Earnings, along with the rebound in the S&P 500 through 3/8/23, caused the S&P 500’s price-to-Operating Earnings ratio to increase from 18.9 as of 12/30/22 to 20.3 as of 3/8/23. Price-to-Core Earnings fell from 19.3 to 18.5 over the same time. By both measures, the market’s valuation is near historical averages, as the average price-to-Operating Earnings ratio dating back to 2004 is 19.0 and the average price-to-Core Earnings ratio is 19.2 over the same time.

Figure 3: Price-to-Core vs. Price-to-SPGI’s Operating Earnings: TTM as of 12/31/15 – 3/8/23

Sources: New Constructs, LLC, company filings, and S&P Global. Note: the most recent period’s data for SPGI’s Operating Earnings incorporates consensus estimates for companies with a non-standard fiscal year.Our Core Earnings P/E ratio is aggregating the TTM results for constituents through 6/30/13 and aggregating four quarters of results for the S&P 500 constituents in each measurement period thereafter. SPGI’s P/E is based on four quarters of aggregated S&P 500 results in each period. More details in Appendix II.

This article was originally published on April 11, 2023.

Disclosure: David Trainer, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

Appendix I: Core Earnings Methodology

In the Figures above, we use the following to calculate Core Earnings:

- aggregated annual data for constituents in the S&P 500 for each measurement period through 6/30/13

- aggregated quarterly data for constituents in the S&P 500 for each measurement period post 6/30/13 to the present

While we prefer aggregated quarterly numbers, we have examined the potential impacts of the two methodologies and have found no material differences.

Appendix II: P/E Ratio Methodology for Core & SPGI’s Operating Earnings

In Figure 3 above, we calculate the price-to-Core Earnings ratio through 6/30/13 as follows:

- Calculate a TTM earnings yield for every S&P 500 constituent

- Weight the earnings yields by each stock’s respective S&P 500 weight

- Sum the weighted earnings yields and take the inverse (1/Earnings Yield)

We calculate the price-to-Core Earnings ratio for periods post 6/30/13 as follows:

- Calculate a trailing four quarters earnings yield for every S&P 500 constituent

- Weight the earnings yield by each stock’s respective S&P 500 weight

- Sum the weighted earnings yields and take the inverse (1/Earnings Yield)

We use the earnings yield methodology because P/E ratios don’t follow a linear trend. A P/E ratio of 1 is “better” than a P/E ratio of 30, but a P/E ratio of 30 is “better” than a P/E ratio of -15. In other words, aggregating P/E ratios can result in a low multiple due the inclusion of just a few stocks with negative P/Es.

Using earnings yields solves this problem because a high earnings yield is always “better” than a low earnings yield. There is no conceptual difference when flipping from positive to negative earnings yields as there is with traditional P/E ratios.

By using quarterly data as soon as its available, we better capture the impact of changes to S&P 500 constituents on a quarterly basis. For example, a company could be a constituent in 2Q18, but not in 3Q18. This method captures the continuously changing nature of the S&P 500 constituency.

For all periods in Figure 3, we calculate the price-to-SPGI’s Operating Earnings ratio by summing the preceding 4 quarters of Operating Earnings per share and, then, dividing by the S&P 500 price at the end of each measurement period.

[1] Our Core Earnings research is based on the latest audited financial data, which is the calendar 2022 10-K in most cases. Price data as of 3/8/23. Operating Earnings from S&P Global is based on the same time frame.