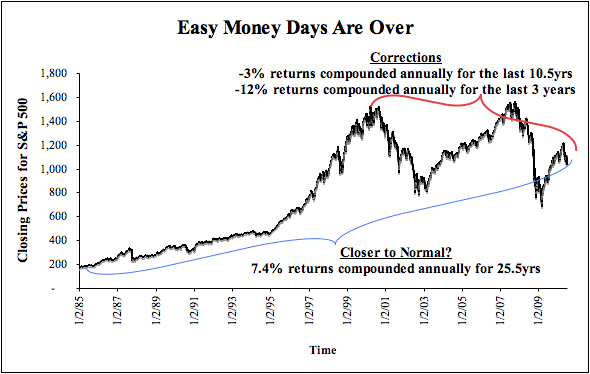

4Q Best & Worst ETFs & Mutual Funds – by Style – Recap

This article provides quick access to all our 4Q reports on Style funds. I also provide a link to all of our 4Q sector reports.

David Trainer, Founder & CEO