Cheap Funds Dupe Investors – 1Q13

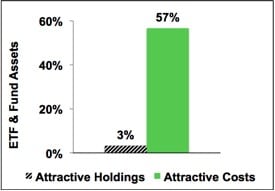

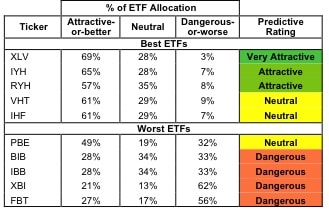

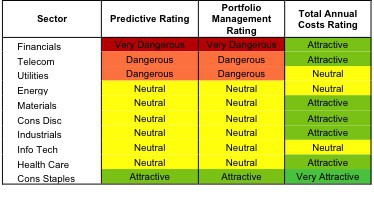

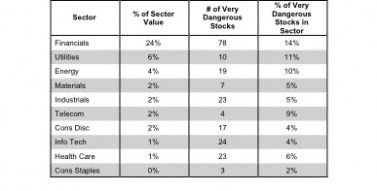

Fund holdings affect fund performance more than fees or past performance. A cheap fund is not necessarily a good fund. Investors are good at picking cheap funds. We want them to be better at picking funds with good stocks. Both are required to maximize success.

David Trainer, Founder & CEO