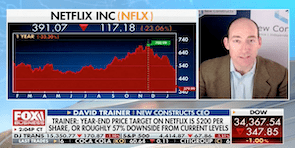

ICYMI: Live by the Musk, Die by the Musk, #1-Ranked Stock Picker Again, 2Q22 Sector Ratings & Model Portfolio Updates

Here's what happened at New Constructs this past week.

Matt Shuler, Investment Analyst II