We published an update on this Danger Zone pick on October 14, 2022. A copy of the associated report is here.

For years, Elon Musk has used hype to prop up Tesla’s stock. It’s worked so well that other companies have followed his lead. But now, we think the world has seen that the emperor has no clothes. The attempted Twitter (TWTR) takeover is yet another example of Musk bullying his way into what he wants and underscores how his super-star status cannot always convince people to overlook his irreverent, reckless, and potentially illegal behavior. As the recent lawsuit against Musk shows, he is not completely immune from the consequences of his actions. Despite recent gains, investors should consider selling Tesla (TSLA: $1,000/share) and other meme stocks now, before institutional money bails.

End of the Road for Musk

Most investors are keenly aware of Musk’s long history of making grand promises that don’t come true – the Roadster, the Semi, the Cybertruck, full-self driving (FSD) etc. – and at times are blatantly unethical, such as tweeting “funding secured” to go private, and pumping Doge coin. But now, we have evidence that he may have acted illegally in the way he reported his purchases of Twitter stock. Given the clear rules about how investors should report large stakes in public companies – like what Musk has in Twitter – this case seems straightforward: Musk broke the rules.

The next question is how severely he will be punished. If the past is any guide, regulators will not muster more than a slap on the wrist. The real question is how institutional investors will react to signs Musk has pushed the envelope too far.

Institutional investors own Tesla stock more often because they must, given its influence on their performance, than because they see it as a good investment. Any investor with a rigorous process can see the stock is ridiculously overvalued; so, you own it for the “Musk effect”. Accordingly, the institutional investors’ decision to sell Tesla stock will be based on when Musk’s outsized influence begins to wane.

We think that moment has come.

Figure 1: Elon Musk

Sources: Daniel Oberhaus (2018)

Musk Meets His Maker: Twitter

In our view, Musk’s repeated rule-breaking behavior has finally gone too far. Details of the case are still emerging, but Musk’s failure to disclose his more than 5% stake in Twitter arguably hurt investors who sold shares after he crossed that ownership threshold. Instead, Musk kept purchasing shares until reaching a 9% stake in Twitter before disclosing his position. The initial class-action lawsuit and the potential for more have finally gotten the attention of investors, if not regulators.

The poor reception Twitter’s employees gave the news of Musk’s stake is a very public rejection of his super-star influencer status and provide the first tangible evidence that maybe his star power has limitations. If a hostile takeover prompts a mass exodus of talent, then Musk might end up destroying the company in the process of buying it. That being said, the loudest voices in the company are not necessarily the most valuable.

As more people join lawsuits against Musk, and Twitter employees continue to express their mistrust of the company’s largest shareholder, institutional investors may seize this moment to quietly unload their shares of overvalued Tesla stock. Now is the time to sell because the price of the stock to this point has been more a reflection of Musk’s ability to draw an audience than any underlying fundamental value in the company.

Live by the Stunt, Die by the Stunt

Ultimately, it appears that as much as Twitter was the launch pad for Musk’s super influence powers, his failure thus far to win the publicity battle could mark the beginning-of-the-end of his super-star status.

Musk’s Twitter play, which started as another in a long series of attempted distractions, could end poorly for Musk. Instead of addressing Tesla’s issues, Musk is attempting to position himself as a defender of free speech. The risk he faces is that instead of looking like a hero he looks more like a bully running an ego-driven hostile takeover with little regard for the rules. While regulators may still be too frightened to hold Musk accountable (more on this below), a change in public opinion would be far more consequential to Musk and his empire.

Tesla’s investors have not been impressed with Musk’s Twitter antics either, as the stock is down 11% since he announced his ownership in the social media giant. Likewise, the “Musk bump” in Twitter shares is likely to fade as investors realize the only value Musk brought was publicity, and not good publicity either. Although Twitter remains a popular platform, it has its own problems and suggestions such as removing a letter from its name can do more harm than good.

Why Haven’t Regulators Done Anything Before Now?

Tesla’s high stock price has, thus far, kept its CEO well beyond an arm’s length of regulators. Other executives in other times likely would have faced consequences for many of the things Musk has said and done. Today, Tesla’s high stock price indicates investors’ collective belief in Musk’s promises and protects Musk. Regulators don’t want to be accused of causing the company’s stock price to fall, thereby destroying the wealth of many investors and, as a result, footing the cost of defending against numerous shareholder lawsuits.

Furthermore, Musk can claim Tesla’s elevated stock price and the wealth it endows is what he needs to fulfill his outlandish promises over time. However, should Tesla’s stock price ever reflect realistic expectations for the company, authorities may feel emboldened to pursue legal or regulatory action against Musk and/or Tesla. Credible claims can be made for several offenses, including:

- stock and cryptocurrency manipulation

- false advertising of Full Self Driving (FSD)

- ignoring safety authorities

- neglecting to file documentation on time related to his purchase of Twitter’s shares

- and other claims of dubious veracity

What Will Regulators Do When the Bubble Pops?

Musk has positioned himself as a pop-culture icon. Though society loves to build up celebrities, so too does it love tearing them down even more. Once Tesla’s stock price falls from its overly inflated levels, Musk will lose his cover that has protected him from all his unethical and arguably illegal behavior. Regulators are likely to come after Musk with knives out after all the humiliation they had to suffer at his hand.

Trouble on the Horizon

All the hype around Musk’s large stake in Twitter and the speculation around his plans for the social media platform takes focus away from the troubles, which are many, ahead for Tesla. Of course, that is likely his goal. Below we discuss the fundamentals of Tesla’s business, which cannot be wished away or made irrelevant with hype.

Incumbents Are Catching Up: Tesla’s first-mover advantage has long been cited as reason enough for investors to pile their money into the company. However, that advantage is gone, and in some cases turning into a lag. Ford (F), Rivian (RIVN), and General Motors (GM) aim to produce EV trucks in 2022, but Tesla will be on the sidelines until at least 2023 before launching its Cybertruck.

The rising competition from incumbents means the days of Tesla’s rising profitability could be numbered. For starters, 26% of the company’s GAAP earnings in 2021 were from the sale of regulatory credits, not from the underlying economics of making and selling vehicles and other ancillary services.

Once incumbents increase production of EVs they will need to purchase fewer credits from Elon. That means Tesla needs to actually start selling cars to make money. The catch-22 is that for the company to sell more cars, it first needs to increase its production capacity. If Tesla’s succeeds in selling more cars capital expenditure and working capital are primed to grow along with sales. Tesla needs to build economies of scale before it can benefit from them.

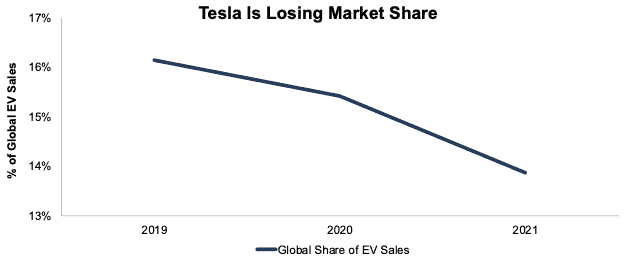

Market Share Losses Continue: Incumbent automakers have entered the EV market with scale and are already taking market share from Tesla. Per Figure 2, Tesla’s share of global EV sales fell from 16% in 2019 to 14% in 2021.

Tesla’s share of the U.S. EV market fell from 79% in 2020 to 70% in 2021. With light truck sales comprising more than three out of every four vehicles sold in the U.S. in January 2022, Tesla falling behind in truck EVs means its share of the U.S. market could fall further.

Figure 2: Tesla’s Share of the Global EV Sales

Sources: New Constructs, LLC, EV-volumes.com and Statista

Slow Start to 2022: Though Tesla forecasted an at least 50% YoY rise in deliveries in 2022, the company is feeling the effects of supply chain problems – just like every other automaker. The company delivered 310,000 vehicles in the quarter, while consensus estimates were for 313,000.

Reverse DCF Math: Valuation Implies Tesla Will Own at Least 57% of the Global Passenger EV Market

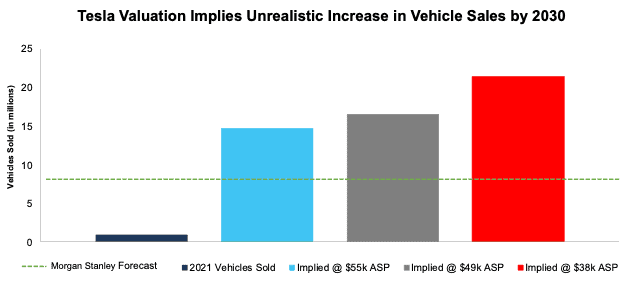

Despite the increased competition, failure to meet delivery expectations, and diminutive share of the global EV market in 2021, Tesla’s valuation implies the company will own 57% of the global passenger EV market in 2030.

Even if Tesla increases the average selling price (ASP) per vehicle to $55K vs. ($49K in 2021), Tesla’s stock price at ~$1,100/share implies the firm will sell 15 million vehicles in 2030 versus ~936k in 2021. That figure represents 57% of the projected base case global EV passenger vehicle market in 2030 and the implied vehicle sales based on a lower ASP looks even more unrealistic.

To provide inarguably best-case scenarios for assessing the expectations reflected in Tesla’s stock price, we assume Tesla achieves profit margins 1.5x Toyota Motor Corp (TM) and triples its current auto manufacturing efficiency.

Per Figure 3, an $1,100/share price implies that, in 2030, Tesla will sell the following number of vehicles based on these ASP benchmarks:

- 15 million vehicles – ASP of $55K (above average U.S. new car price of $47K in 2021)

- 17 million vehicles – ASP of $49K (equal to Tesla’s 2021 ASP[1])

- 21 million vehicles – ASP of $38K (equal to General Motors’ ASP[2] of $38K in 2021)

If Tesla achieves those EV sales, the implied market share for the company would be the following (assuming global passenger EV sales reach 26 million in 2030, the base case projection from the IEA):

- 57% for 15 million vehicles

- 64% for 17 million vehicles

- 83% for 21 million vehicles

If we assume the IEA’s best case for global passenger EV sales in 2030, 47 million vehicles, the above vehicle sales represent:

- 31% for 15 million vehicles

- 35% for 17 million vehicles

- 45% for 21 million vehicles

Figure 3: Tesla’s Implied Vehicle Sales in 2030 to Justify $1,100/Share

Sources: New Constructs, LLC and company filings

Tesla Must Generate More Profits Than Apple For Investors to Make Money

Below are the assumptions we use in our reverse discounted cash flow (DCF) model to calculate the implied production levels above.

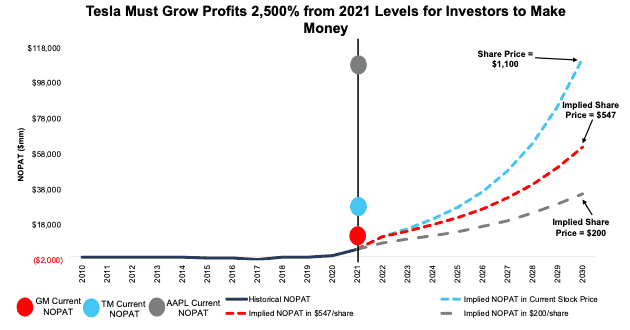

Bulls should understand what Tesla needs to accomplish to justify ~$1,100/share:

- immediately achieve a 14% NOPAT margin (1.5x Toyota’s margin, which is the highest of the large-scale automakers we cover), compared to Tesla’s TTM margin of 8%) and

- grow revenue by 32% compounded annually from 2022 to 2030.

In this scenario, Tesla generates $811 billion in revenue in 2030, which is 116% of the combined revenues of Toyota, Stellantis (STLA), Ford (F), General Motors, and Honda (HMC) over the past twelve months. Tesla must replace the U.S. auto industry before 2030 to justify current valuations.

This scenario also implies Tesla grows net operating profit after-tax (NOPAT) by 2,458% from 2021 to 2030. In this scenario, Tesla generates $112 billion in NOPAT in 2030, or 12% higher than Apple’s (AAPL) TTM NOPAT, which, at $100 billion, is the highest of all companies we cover, and 65% higher than Microsoft (MSFT), the second-highest. Those companies have intertwined themselves in the lives of consumers and businesses around the world, which seems an unlikely feat for Tesla at this point.

TSLA Has 46% Downside If Morgan Stanley Is Right About Sales

If we assume Tesla reaches Morgan Stanley’s estimate of selling 8.1 million cars in 2030 (which implies a 31% share of the global passenger EV market in 2030), at an ASP of $55k, the stock is worth just $542/share. Details:

- NOPAT margin improves to 14% and

- revenue grows 27% compounded annually over the next decade, then

the stock is worth just $547/share today – a 46% downside to the current price. See the math behind this reverse DCF scenario. In this scenario, Tesla grows NOPAT to $62 billion, or nearly 14x its 2021 NOPAT, and just 7% below Alphabet’s (GOOGL) 2021 NOPAT.

TSLA Has 80%+ Downside Even with 27% Market Share and Realistic Margins

If we estimate more reasonable (but still very optimistic) margins and market share achievements for Tesla, the stock is worth just $200/share. Here’s the math:

- NOPAT margin improves to 9% (equal to Toyota’s TTM margin) and

- revenue grows by consensus estimates from 2022 to 2024 and

- revenue grows 17% a year from 2025 to 2030, then

the stock is worth just $200/share today – an 80% downside to the current price.

In this scenario, Tesla sells 7 million cars (27% of the global passenger EV market in 2030) at an ASP of $47K (average new car price in U.S. in 2021) and grows NOPAT by 24% compounded annually from 2022 to 2030.

We also assume a more realistic NOPAT margin of 9% in this scenario, which is 1.3x higher than Toyota’s industry-leading five-year average NOPAT margin of 7%. Given the required capital requirements to fund manufacturing and match increased competition in the EV market, Tesla is unlikely to achieve and sustain a margin as high as 9% from 2022 to 2030. If Tesla fails to meet these expectations, then the stock is worth less than $200/share.

Figure 4 compares the firm’s historical NOPAT to the NOPAT implied in the above scenarios to illustrate just how high the expectations baked into Tesla’s stock price remain. For additional context, we show Toyota’s, General Motors’, and Apple’s TTM NOPAT.

Figure 4: Tesla’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Each of the above scenarios assumes Tesla’s invested capital grows 14% compounded annually through 2030. For reference, Tesla’s invested capital grew 49% compounded annually from 2011 to 2021 and 30% compounded annually since 2015.

An invested capital CAGR of 14% represents 1/3rd the CAGR of Tesla’s property, plant, and equipment since 2011 and assumes the company can build future plants and produce cars 3x more efficiently than it has so far.

In other words, we aim to provide inarguably best-case scenarios for assessing the expectations for future market share and profits reflected in Tesla’s stock market valuation.

Tesla Won’t Be the Only One to Fall

Other meme stocks have taken pages from the Musk playbook and will likely suffer the same fate we expect Tesla to suffer once the game is up. GameStop (GME) promised to transform itself into an ecommerce powerhouse, yet the company continues to head in the opposite direction and earnings continue to disappoint. GameStop’s Core Earnings fell from -$200 million in fiscal 2021 to -$321 million in fiscal 2022.

Despite the company’s inability to quickly execute operational change, GameStop’s stock has remained well above a reasonable valuation thanks in part to announcing the launch of a marketplace for nonfungible tokens (NFTs) and partnerships with blockchain firms.

AMC Entertainment Holdings (AMC) has also run several Tesla-esque plays to prop up its stock. Indeed, the company’s CEO recently tweeted that the company is “playing on offense again” with its investment in a microcap gold mine. Before gold mines, the company got on the crypto bandwagon in 2021 by accepting Bitcoin, Ethereum, Bitcoin Cash, and Litecoin.

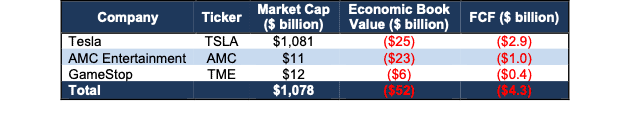

Beyond the repeated attempts at propping up their stocks, the fundamentally weak business models of Tesla, GameStop, and AMC Entertainment in highly competitive industries burn cash and continue to dilute shareholders whenever possible. Per Figure 5, despite combining for more than $1.1 trillion of market cap, Tesla, AMC Entertainment, and GameStop have a combined economic book value, our measure of the no growth value of a stock, of -$52 billion and -$4.3 billion of free cash flow (FCF) over the past twelve months.

Figure 5: Meme Stock’s Market Cap, Economic Book Value & FCF: TTM

Sources: New Constructs, LLC and company filings

This article originally published on April 14, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Tesla’s ASP = (total automotive revenues – regulatory credits) / deliveries

[2] General Motors’ ASP = Vehicle, parts and accessories / wholesale vehicle sales

4 replies to "Is the End Near for Tesla and Other Meme-Stocks?"

I’m not a Tesla fanboy, but even I understand that market share is a flawed metric when one party has a nine month backlog and the other a 90 day inventory during a year when microchips cannot be made quickly enough, and the country supplying nickel has been busy invading the country that provides wiring harnesses. Nor is your comparison of margin based upon actuality. Tesla’s new factories are going to change that metric and neither you or I have a clue what the impact on margins will be-good or bad.

All of this to say, I might not be holding TSLA until 2035, but dumping it now is bad advice.

Well written article. However, financial markets have said goodbye to fundamentals a long while back. We’re now a nation, where billionaires grow like weeds while national debt keep rising exponentially – and ordinary people can’t live a decent life working full time. Middle class wage earners are forced to pay lion’s share of taxes and those who “makes” money while sleeping or doing whatever pays next-to-nothing. FED created an illusion by flooding markets with money and everybody is chasing that illusion. Hard working people have nothing while someone who bould $100 worth of crypto few years back became multi millionaires. And there is no end in sight.

All the logic you provided hear has no value simply because logic itself doesn’t belong anymore.

and i thought i disliked Musk!

Going into the fall, as energy costs rise, inflation goes to the moon, and interest rates follow inflation; expect Elon and TSLA to fall from grace and watch it’s price drill to China!