Our Focus List Stocks: Long Model Portfolio outperformed the S&P 500 by 35% in 2021. This report looks at a Focus List Long stock that outperformed in 2021 and is positioned to outperform again in 2022. Recently we highlighted three underperformers from 2021 that remain undervalued, which you can read here.

General Motors Co (GM: $61/share) outperformed in 2021 and still presents quality risk/reward. We also feature two other Focus List stocks that outperformed in 2021, HCA Healthcare (HCA) here and AutoZone (AZO) here.Focus List Stocks Outperformed in 2021

The Focus List Stocks: Long Model Portfolio contains the “best of the best” of our Long Ideas, and leverages superior fundamental data[1], which provides a new source of alpha. The current Model Portfolio is available here while real-time updates are available to Pro-and-higher members.

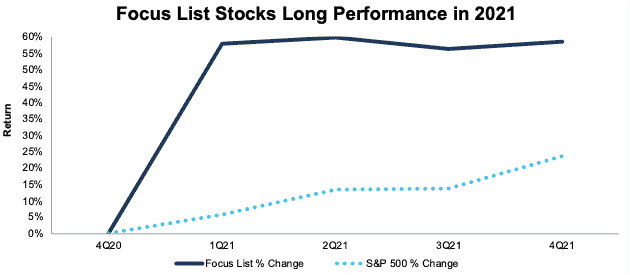

The Focus List Stocks: Long Model Portfolio returned[2],[3], on average, 58% in 2021 compared to 23% for the S&P 500, per Figure 1.

Figure 1: Focus List Stocks: Long Model Portfolio Performance from Period Ending 4Q20 to 4Q21

Sources: New Constructs, LLC

Because our Focus List Stocks: Long Model Portfolio represents the best of the best picks, not all Long Ideas make the Model Portfolio. We published 66 Long Ideas in 2021 but added just six of them to the Focus List Stocks: Long Model Portfolio during the year. Currently, the Focus List Stocks: Long Model Portfolio has 39 stocks.

Figure 2 shows a more detailed breakdown of the Model Portfolio’s performance, which encompasses all the stocks that were in the Model Portfolio at any time in 2021.

Figure 2: Performance of Stocks in the Focus List Stocks: Long Model Portfolio in 2021

Sources: New Constructs, LLC

Performance includes the performance of stocks currently in the Focus List Stocks: Long Model Portfolio, as well as those removed during the year, which is why the number of stocks in Figure 2 (45) is higher than the number of stocks currently in the Model Portfolio (39).

Outperforming Focus List Stock: General Motors (GM): Up 41% vs. S&P 500 Up 27% in 2021

We added General Motors to our Focus List Stocks: Long Model Portfolio in June 2018, and the stock outperformed the market by 14% in 2021. General Motors was also one of our outperforming picks in 2020. The significant progress in the firm’s electric vehicle (EV) development, along with an established manufacturing footprint, positions the company well for a changing market. See our most recent report on General Motors here.

Main Reason for Outperformance: EV Progress & Improved Profitability: General Motors is using its large-scale manufacturing capabilities to close the gap on Tesla’s first-mover advantage. The firm is now delivering the Hummer EV Edition 1 Pickup and the BrightDrop EV600 delivery van, which are based on its Ultium EV platform. The company has its sights set on delivering the Cadillac LYRIQ next and aims to have more than 30 EVs in its portfolio by 2025.

Though the company is investing heavily in EV and technology for future growth opportunities, it remains focused on increasing shareholder value. General Motors’ return on invested capital (ROIC) has improved from 7% in 2020 to 9% over the TTM.

Why General Motors Has More Upside: Established Manufacturing & Distribution: General Motors’ established manufacturing capabilities and expertise, distribution and customer service networks, and proven technological capabilities position the firm to grow in a changing market. General Motors’ Ultium Platform is designed to leverage the firm’s scale and gives the company the capability to make EV versions of nearly every type of vehicle in its portfolio.

While developing transformative technology and new cars, upstart EV manufacturers such as Tesla (TSLA) and Rivian (RIVN) have struggled mightily to increase vehicle-production capacity while meeting and maintaining high quality standards. As a large, experienced manufacturer, General Motors can more easily scale its EV production by converting existing facilities to EV manufacturing and continuing to invest in the following areas:

- self-driving technology: Consumer Reports found General Motors’ Super Cruise is superior to Tesla’s Full Self Driving in detecting distracted driver behavior.

- battery capabilities: the firm will build two new battery plants to accelerate battery production capacity.

- software services: Ultifi, the firm’s newly announced software platform, will more fully integrate the driving experience with peoples’ digital lives and add an array of upgradeable enhancements.

Furthermore, General Motors’ future growth opportunities extend beyond EV as the firm seeks to create ecosystems for its customers. For example, BrightDrop, a last-mile commercial delivery logistics solution provides a portfolio of EVs, smart containers, and software to help its customers efficiently manage their fleets. FedEx (FDX) and Walmart (WMT) are early customers of this new offering, with GM delivering its first vehicles to FedEx in December 2021.

Current Price Implies General Motors’ Profits Fall 30%: General Motors’ price-to-economic book value (PEBV) ratio is 0.7. This ratio implies that the market expects General Motors’ profits will permanently decline by 30%.

We use our reverse discounted cash flow (DCF) model to highlight the disconnect in the future profit growth expectations baked into General Motors’ current stock price.

To justify General Motors’ current price of $61/share, the market is assuming:

- net operating profit after-tax (NOPAT) margin falls to 6% (equal to its five-year average and compared to 7% TTM) and

- revenue falls <1% compounded annually over the next decade. For reference, average consensus estimates expect General Motors’ revenue to grow 9% compounded annually from 2021 to 2023.

In this scenario, General Motors’ NOPAT ten years from now is just $6.8 billion, or 18% below its five-year average NOPAT and 29% below its TTM NOPAT. See the math behind this reverse DCF scenario.

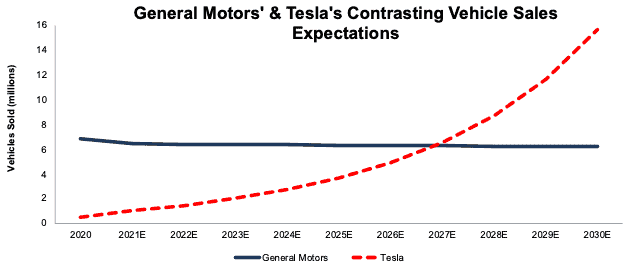

In this scenario, General Motors’ revenue falls <1% compounded annually from 2020 to 2030. Assuming an average sales price of $17k[4], General Motors’ vehicle sales fall from 6.8 million in 2020 to 6.2 million in 2030. To provide reference, with an average sales price of $51k[5], Tesla’s current valuation implies vehicle sales grow from ~500,000 in 2020 to ~16 million in 2030. See the math behind Tesla’s expectations in our most recent update here. Figure 3 compares the expected vehicle sales embedded in General Motors’ and Tesla’s stock prices. GM has a very low hurdle to clear before stockholders start seeing upside at the current price.

Figure 3: Implied Vehicle Sales: General Motors Vs. Tesla

Sources: New Constructs, LLC and company filings

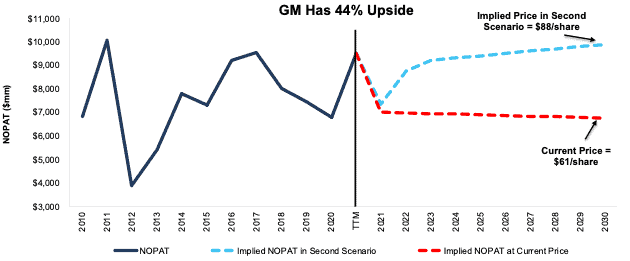

44% Upside if Consensus is Right: General Motors’ stock has significant upside If we assume its:

- NOPAT margin falls to 6% (equal to its five-year average margin and compared to 7% TTM),

- revenue grows at a 9% CAGR (equal to consensus CAGR from 2021-2023) from 2021-2023, and

- revenue grows by just 1% compounded annually from 2024-2030, then

The stock is worth $88/share today – a 44% upside to the current stock price. See the math behind this reverse DCF scenario. Figure 4 compares General Motors’ historical NOPAT with the implied NOPAT in each of these scenarios.

Figure 4: General Motors’ Historical and Implied NOPAT

Sources: New Constructs, LLC and company filings

This article originally published on January 12, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] Performance represents the price performance of each stock during the time in which it was on the Focus List Stocks: Long Model Portfolio in 2021. For stocks removed from the Focus List in 2021, performance is measured from the beginning of 2021 through the date the ticker was removed from the Focus List. For stocks added to the Focus List in 2021, performance is measured from the date the ticker was added to the Focus List through December 31, 2021.

[3] Performance includes the 1745% increase in GME stock price during its time on the focus list in 2021.

[4] Over the TTM ended calendar 3Q21, General Motors sold ~6.9 million vehicles and generated $117.6 billion in automotive revenue, or ~$17 thousand per vehicle sold.

[5] Over the TTM ended calendar 3Q21, Tesla sold ~800,000 vehicles and generated $41 billion in automotive revenue, or ~$51 thousand per vehicle sold.