Tesla’s (TSLA) 4Q21 earnings report only underscores our thesis that the stock is wildly overvalued and will fall as low $136/share.

Musk’s promises of riches from non-EV businesses are only getting more and more outlandish. Remember the Roadster, CyberTruck, FSD, paradigm-shifting battery technology, solar panels, and now robots. To date, none of these have produced any meaningful profits. Musk’s claims to the contrary point to an increasingly unstable house of cards.

We disagree that Tesla is like Amazon and will reap profits from multiple businesses. Unlike Elon Musk, Jeff Bezos never tipped his hand about new businesses into which Amazon might move. Amazon Web Services (AWS) had a huge first-mover advantage before most investors knew it existed. And once AWS was well-known, Amazon made the most of its first-mover advantage to become an industry leader.

Tesla has earned its first-mover advantage in electric vehicles, for sure, but it is different from Amazon’s AWS success in two ways:

- Unlike cloud services, automobile manufacturing is not a new industry, and it is rife with multiple deep-pocketed incumbents with more experience building cars than Tesla.

- AWS maintains industry-leading market share and capitalized on its first-mover advantage, while Tesla’s manufacturing woes have allowed its competition to catch up and take over the lead in market share in Europe.

Mr. Musk focused on robots instead of Tesla’s record profits because he knows those profits are illusory and unsustainable given the rise of competition in the electric vehicle market from both incumbent car makers and other start-up EV makers.

Nevertheless,Tesla bulls continue to pile into the stock on the hopes that Tesla will revolutionize not just the auto industry, but energy, software, transportation, insurance, and more, despite ample evidence to the contrary as we detail in our report here. The optimistic hopes for these businesses seem to compel investors to buy shares at valuations more suited to science-fiction than investing.

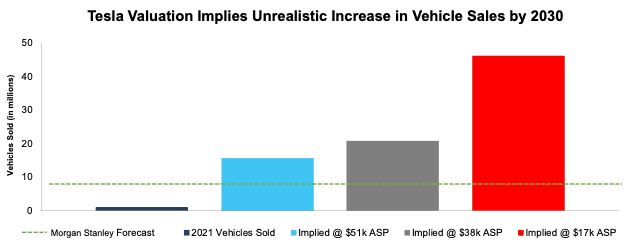

Tesla’s record vehicle deliveries were a major factor in stock performance in 2021. Selling just under 1 million cars in 2021 sounds great and was no small feat. However, that number is minuscule compared to the number of vehicles Tesla must sell to justify its stock price – anywhere from 16 million to upwards of 46 million depending on average selling price (ASP) assumptions. For reference, Adam Jonas, a Morgan Stanley analyst, projects Tesla will sell 8.1 million vehicles in 2030.

Why We Remain Bearish on Tesla: Valuation Ignores Weakening Competitive Position: The headwinds Tesla faces are numerous (such as the recent recall of half a million vehicles) and outlined in more detail in our report here. The biggest challenge to any Tesla bull case is the rising competition from incumbents and startups alike across the global EV market.

Incumbent automakers have spent billions of dollars building out their EV offerings. Indeed, automakers other than Tesla already account for 85% of global EV sales through the first half of 2021. The global EV market is simply not big enough for Tesla to achieve the sales expectations in its valuation unless everyone else exits the market.

The bottom line is that it is hard to make a straight-faced argument that in a competitive market, Tesla can achieve the sales its valuation implies.

Reverse DCF Math: Valuation Implies Tesla Will Own 60%+ of the Global Passenger EV Market

At its current average selling price (ASP) per vehicle of ~$51k, Tesla’s stock price at ~$1,200/share implies the firm will sell 16 million vehicles in 2030 versus ~930k in 2021. That represents 60% of the projected base case global EV passenger vehicle market in 2030 and the implied vehicle sales based on lower ASPs look even more unrealistic.

To provide inarguably best-case scenarios for assessing the expectations reflected in Tesla’s stock price, we assume Tesla achieves profit margins twice as high as Toyota Motor Corp (TM) and quadruples its current auto manufacturing efficiency.

Per Figure 1, a $1,200/share price implies that, in 2030, Tesla will sell the following number of vehicles based on these ASP benchmarks:

- 16 million vehicles – current ASP of $51k

- 21 million vehicles – ASP of $38k (average new car price in the U.S. in 2020)

- 46 million vehicles – ASP of $17k (equal to General Motors over the TTM)

If Tesla achieves those EV sales, the implied market share for the company would be the following (assuming global passenger EV sales reach 26 million in 2030, the base case projection from the IEA):

- 60% for 16 million vehicles

- 80% for 21 million vehicles

- 179% for 46 million vehicles

If we assume the IEA’s best case for global passenger EV sales in 2030, 47 million vehicles, the above vehicle sales represent:

- 33% for 16 million vehicles

- 44% for 21 million vehicles

- 98% for 46 million vehicles

Figure 1: Tesla’s Implied Vehicle Sales in 2030 to Justify $1,200/Share

Sources: New Constructs, LLC and company filings

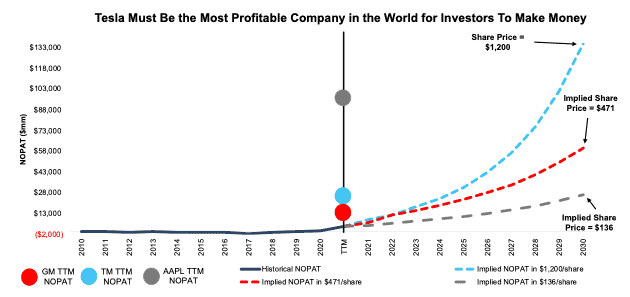

Tesla Must be More Profitable Than Apple For Investors to Make Money

Here are the assumptions we use in our reverse discounted cash flow (DCF) model to calculate the implied production levels above.

Bulls should understand what Tesla needs to accomplish to justify ~$1,200/share:

- immediately achieve a 17.2% NOPAT margin (double Toyota’s margin, which is the highest of the large-scale automakers we cover), compared to Tesla’s TTM margin of 7.7%) and

- grow revenue by 38% compounded annually for the next decade.

In this scenario, Tesla generates $789 billion in revenue in 2030, which is 103% of the combined revenues of Toyota, General Motors, Ford (F), Honda Motor Corp (HMC), and Stellantis (STLA) over the TTM.

This scenario also implies Tesla generates $136 billion in net operating profit after-tax (NOPAT) in 2030, or 46% higher than Apple’s (AAPL) fiscal 2021 NOPAT, which, at $93 billion, is the highest of all companies we cover.

TSLA Has 44% Downside If Morgan Stanley Is Right About Sales

If we assume Tesla reaches Morgan Stanley’s estimate of selling 8.1 million cars in 2030 (which implies a 31% share of the global passenger EV market in 2030), at an ASP of $38k, the stock is worth just $471/share. Details:

- NOPAT margin improves to 17.2% and

- revenue grows 27% compounded annually over the next decade, then

the stock is worth just $471/share today – 44% downside to the current price. See the math behind this reverse DCF scenario. In this scenario, Tesla grows NOPAT to $60 billion, or nearly 17x its TTM NOPAT, and just 3% below Alphabet’s (GOOGL) TTM NOPAT.

TSLA Has 84%+ Downside Even with 28% Market Share and Realistic Margins

If we estimate more reasonable (but still very optimistic) margins and market share achievements for Tesla, the stock is worth just $136/share. Here’s the math:

- NOPAT margin improves to 8.5% (equal to General Motors’ TTM margin, compared to Tesla’s TTM margin of 7.7%) and

- revenue grows by consensus estimates from 2021-2023 and

- revenue grows 20% a year from 2024-2030, then

the stock is worth just $136/share today – an 84% downside to the current price.

In this scenario, Tesla sells 7.3 million cars (28% of the global passenger EV market in 2030) at an ASP of $38k. We also assume a more realistic NOPAT margin of 8.5% in this scenario. Given the required expansion of plant/manufacturing capabilities and formidable competition, we think Tesla will be lucky to achieve and sustain a margin as high as 8.5% from 2021-2030. If Tesla fails to meet these expectations, then the stock is worth less than $136/share.

Figure 2 compares the firm’s historical NOPAT to the NOPAT implied in the above scenarios to illustrate just how high the expectations baked into Tesla’s stock price remain. For additional context, we show Toyota’s, General Motors’, and Apple’s TTM NOPAT.

Figure 2: Tesla’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Each of the above scenarios assumes Tesla’s invested capital grows 14% compounded annually through 2030. For reference, Tesla’s invested capital grew 53% compounded annually from 2010-2020 and 29% compounded annually from 2015-2020. Invested capital at the end of 3Q21 grew 21% year-over-year (YoY). Tesla’s property, plant, and equipment has grown even faster, at 58% compounded annually, since 2010.

A 14% CAGR represents 1/4th the CAGR of Tesla’s property, plant, and equipment since 2010 and assumes the company can build future plants and produce cars 4x more efficiently than it has so far.

In other words, we aim to provide inarguably best-case scenarios for assessing the expectations for future market share and profits reflected in Tesla’s stock market valuation.

This article originally published on January 27, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

1 Response to "Nothing New To See Here"

100% accurate and nailed it ! wish I read this early