“I’m not an investor. People always tell me, ‘You should have your money working for you.’ I’ve decided I’ll do the work, I’m gonna let the money relax. You know what I mean? Because you send your money out there working for you, a lot of times, it gets fired. You go back there, ‘What happened? I had my money, it was here, it was working for me.’ Yeah, I remember your money. Showing up late, taking time off… We had to let him go.” (Seinfeld, The Stock Tip)

Teamwork

Source: Seinfeld

9 seasons.

Over $3 billion in revenue.

66 girlfriends.

The ‘show about nothing’, one of America’s most successful, was originally pitched as a 90-minute, one-off television special.

No one was more surprised by the show’s success than the cast itself. Jason Alexander, who played the cartoonish urban neurotic George Costanza, said ‘I thought […] that [the show] would not run for even a day…because the audience for this show is me, and I don’t watch TV.’

Yet there was something endearing and familiar about that gang of oddballs and misfits. When viewed in isolation, each member of the cast is strange, to say the least. Jerry couldn’t hold a girlfriend. George couldn’t hold a job. Elaine fumbles through both professional and romantic mishaps. And Kramer…needed no introduction.

But somehow, when they were all together, things just seemed to…click. They acted like they had always known each other. Jerry and Elaine’s tension was never-ending, as was Jerry’s friendship with George, and his banter with Kramer. Jerry’s stand-up routines weren’t even that good – and yet you laughed. Who didn’t want to be a part of the gang?

The cast of Seinfeld made a great team. The whole was greater than the sum of the parts.

Though they’re not as quirky as the Seinfeld cast, our Long Idea picks in the Financials sector enjoy similar synergy. They have different valuations, sizes, areas of operation, and business models, but each has a role to play in rebuilding America as explained in last week’s Rebuild and Renew Thesis.

Let’s dive in.

Laying The Groundwork

Three major pieces of legislation have passed in the last few years which lay the groundwork for a massive overhaul in American infrastructure. They provide incentives for public and private entities to adopt sustainable practices and place the U.S. at the forefront of the clean energy transition. Banks have a critical role to play as lead underwriters of the clean energy transition, as well as conduits and stewards of capital of the most significant public investment program of the last few decades.

The Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the Creating Helpful Incentives to Produce Semiconductors and Science Act (CHIPS Act) are three pivotal pieces of U.S. legislation aimed at infrastructure renewal, economic stability, and technological advancement.

The IIJA commits $1.2 trillion over a decade to rejuvenate the nation’s infrastructure, dividing $550 billion for new spending in the first five years between surface transportation ($284 billion) and core infrastructure ($266 billion). The funding will be directed towards upgrades to roads, bridges, public transit, and significant investment in broadband, energy grids, and sustainability. Moreover, $300 billion in formula grants, primarily benefiting states like Texas and California, will focus on roads and bridges.

The IRA lays out a comprehensive strategy to boost clean energy, manage healthcare costs, and improve tax revenue collection. About $400 billion is channeled towards clean energy, including a new $250 billion loan program. Tax credits constitute the bulk of the funding and account for $216 billion aimed at encouraging private sector investment in clean energy and transportation. An additional $43 billion in tax credits will make green technologies more accessible to consumers. Revenue-generating measures such as increasing the corporate minimum tax to 15% and a 1% excise tax on stock buybacks are designed to offset the new spending.

The CHIPS Act, with a ten-year investment of $280 billion, aims to bolster domestic semiconductor production and innovation in emerging technologies like artificial intelligence (AI) and quantum computing. Of the funding, $200 billion is slated for scientific R&D and commercialization, while $52.7 billion specifically targets semiconductor manufacturing and workforce development. Collectively, these legislations represent significant steps towards modernizing infrastructure, fostering innovation, and aligning federal spending with contemporary challenges and opportunities.

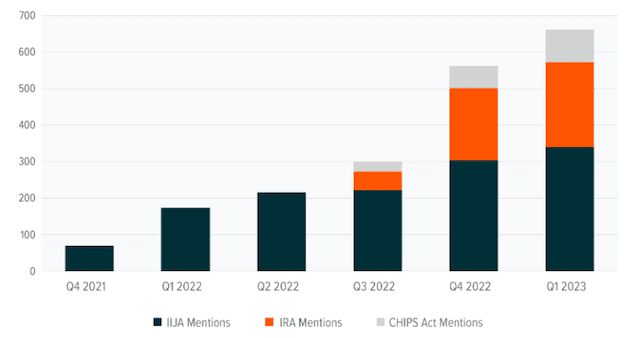

Figure 1: Mentions of Infrastructure Legislation on PAVE ETF Constituents Earnings Calls: 2021 – 2023

Sources: FactSet

A Leading Role

“Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.” (John Maynard Keynes)

Our recent Long Idea picks in the Financials sector are well-positioned to benefit from recent legislation and to help shape the way we build our roads and airports as well as our portfolios.

As the world grapples with the urgent need to transition to a greener economy, banks have emerged as critical players. With the power to unlock a staggering $3.8 trillion in annual investment through 2025 for climate initiatives, their role isn’t just altruistic; it’s good business. By aligning their strategies to promote both environmental and social well-being, banks stand to reduce regulatory risks, tap into lucrative government incentives, and open doors to new business opportunities. Yet, surprisingly, a recent global BCG survey found a gap between intent and action. While 90% of banking executives recognize the importance of considering social impacts in their climate strategies, only a third actually let these considerations guide their decisions.

Why the inertia? Partly, because until recently, there’s been a dearth of guidelines or incentives to motivate change. However, the winds are shifting. The IRA and the IIJA, for example, have set aside nearly $480 billion for climate initiatives that link financial incentives to social benefits. Similarly, the European Union’s Green New Deal and forthcoming Green Deal Industrial Plan are laying down rules and funding, which emphasize workforce retraining as decarbonization accelerates.

Banks will be the primary advisors to help their corporate clients navigate the new legislation to earn credits and grants. As the experts, the banks will guide corporations on how to contribute to the Act’s larger social policy agenda in order to access incentives and tax credits offered under the IRA. For example, clean energy projects in areas with high employment in the fossil fuel industry are eligible for more incentives.

The financial sector’s role extends to capital markets, which shape how businesses finance their transition to greener operations. Banks can impose Key Performance Indicators (KPIs), which influence everything from worker protections to fair income for farmers. In sum, as architects of financial flows, banks are uniquely positioned to steer us toward a future that isn’t just greener, but also fairer for all.

Banks’ ability to leverage underwriting standards to nudge businesses towards sustainable public policy trends would also protect their own bottom line. A recent study by Bain & Company reveals a startling gap in how banks worldwide are tackling climate change risks, particularly in their mortgage lending practices.

For example, if a bank underwrites mortgages on coastal properties in Florida in the same way that it did 20 years ago, it is likely failing to account for flood and hurricane risks accurately. Given that home insurance premia have gone up substantially, the probability that the collateral on those mortgages is mispriced, especially on a 30-year horizon, is relevant.

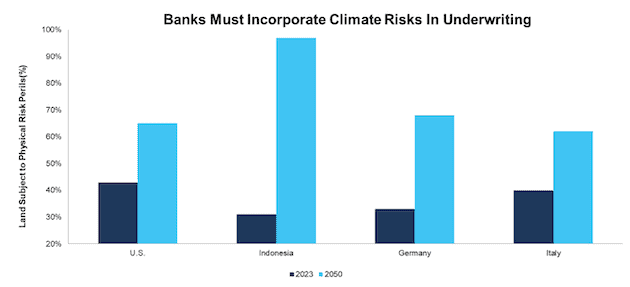

Shockingly, only a small percentage of European banks have begun accounting for such risks in their mortgage portfolios. For instance, without taking mitigating actions in underwriting and valuing loans properly, some banks could see a 10-15% dip in the value of their mortgage collateral by 2050, which could impact profitability by 7-10%. Some of the risks included in the Bain analysis include flood, precipitation, wildfires, hail, and drought. The numbers serve as a wake-up call: banks must urgently incorporate climate risks to secure a stable future. See Figure 2.

Figure 2: Percentage of Land Mass Subject To Climate Risks: 2023 – 2050

Sources: Bain & Company

Capital Stewardship In The Age Of AI

From market giants like Citadel to newcomers like Parallel Strategy, firms are leveraging AI for everything from predictive trading to customer service. AI’s computational prowess is revolutionizing risk assessment, loan approvals, and even financial crime prevention.

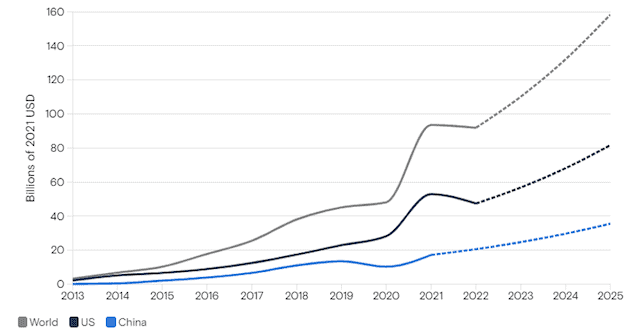

Artificial intelligence (AI) is not just a tech trend; it’s on track to become an economic powerhouse, with Goldman Sachs projecting its potential to outstrip even the massive GDP impact wrought by innovations like electricity and personal computers. Although AI investment starts from a modest base, it is expected to burgeon to around $200 billion globally by 2025. It promises to elevate global labor productivity by over 1% annually in the decade after its mainstream acceptance. A remarkable increase in market interest is palpable: mentions of AI in Russell 3000 company earnings calls leaped from less than 1% in 2016 to over 16%, half of which occurred after the launch of ChatGPT in late 2022.

The U.S. currently spearheads this market, and if Goldman Sachs’ projections hold, AI-related investment could constitute as much as 2.5% to 4% of its GDP. As AI continues to weave itself into the fabric of global business, the challenge remains to scale the technology wisely and efficiently, which ensures its monumental economic promise is fully and safely realized.

As we mentioned in our 2017 prescient report Crossing The Chasm 2.0, financial firms were already bracing for technology to become a larger part of their core business. BlackRock, the case study we chose for our note, has nearly doubled technology services revenue from $785 million in fiscal year 2019 to $1.4 billion in fiscal 2023. It’s not just a shift in strategy; it’s a reimagining of what wealth management can be in the age of artificial intelligence. So, as we stand at this crossroads, one thing is abundantly clear: the future belongs to those who can seamlessly integrate the analytical power of machines with human creativity. See Figure 3.

Figure 3: Private AI Investment: 2013 – 2025

Sources: Stanford, Goldman Sachs Research

In this context, Charles Schwab (SCHW) remains well-positioned to benefit from technological shifts, as the company has successfully ‘crossed the chasm’ from a traditional brick & mortar business to a technology-first firm featuring robo-advisors and self-directed trading. Most importantly, the company is continuing to progress by incorporating AI into Schwab Intelligent Portfolios, the company’s robo-advisor offering, as well as AI assistants for advisors and clients.

Zack Gipson, of Schwab’s Digital Investor Solutions, emphasizes a balanced “people plus technology” approach over a reliance on AI alone. For example, Schwab Assistant, powered by natural language processing (NLP), fields millions of client searches monthly, providing instantaneous, relevant data. The AI’s capabilities extend beyond simple Q&A and help to identify trending customer interests. Casey Royer, Director of Digital Intelligent Interactions, imagines a future where search AIs not only answer your current query but also anticipate and pre-emptively address likely follow-up questions. However, the secret to successfully integrating this powerful technology lies in a balanced equation that incorporates human oversight, thereby ensuring that while the cutting edge is sharp, it doesn’t draw blood.

The Fintech Revolution, Reimagined

Bears have long argued that legacy financial companies were likely going to decline into obsolescence due to complacency and lack of innovation. In the 2010s, the threat of fintech seemed quite real, and terms like ‘embedded finance’ and ‘insurtech’ were commonplace in pitch decks and boardrooms.

So, how does all this affect which stocks we think are the best and the worst?

Get the full report for details.