We think Tesla’s (TSLA: $640/share) inclusion in the S&P 500 marks a new peak in the recklessness of today’s investment environment and will be the catalyst for the long-awaited reconciliation of Tesla’s valuation with the firm’s poor fundamentals.

Given the rise of passive investing over the past decade, the inclusion of Tesla in the S&P 500 adds unnecessary risk to the many investors who have exposure to index funds that track the S&P 500.

While Tesla’s addition to the S&P 500 will likely push the stock even higher over the next week, given the rebalancing of the index, this boost is just a sugar high. After the rebalancing, we expect profit taking, especially from fund managers who may end up with a larger-than-expected weighting of Tesla in their client’s portfolios because of the S&P 500 inclusion.

Up 716% over the past year and 57% since S&P decided in mid-November to add the stock to the S&P 500, we think Tesla may have finally exhausted the technical and sentiment support that has driven the stock to dizzying heights.

Tesla’s recent surge is unjustified, given the many competitors that have recently entered the electric vehicle market, high cash burn and its falling market share in the electric vehicle market globally.

Based on our models, the stock should be trading at $172 a share – that’s 73% lower than where the stock is trading now.

After S&P 500 Indexers, Who’s Left to Buy the Stock?

There is an estimated $5.4 trillion in index funds that track the S&P 500, all of which have to buy shares of Tesla and sell other firms to rebalance their portfolio upon inclusion into the index.

After the initial purchase to rebalance, are there any more marginal buyers of Tesla? Put another way, are there enough buyers willing to overpay for one of the least profitable firms in the index once so many investors already own the stock through index funds?

Tesla’s inclusion and subsequent purchase by so many passive and active funds further compound the hidden dangers of passive investing. Instead of efficiently allocating capital to the most deserving companies, passive index investing allocates money to companies with the largest market caps.

Forced Selling Creates Bad Technical Trend

Given the huge runup in the stock, many portfolios hold outsized allocations to Tesla. For instance, there are 365 mutual funds and ETFs in our coverage universe that already allocate greater than 1.8% of assets to Tesla which is the estimated weight Tesla will have in the S&P 500. The increased risk of overweighting Tesla is undeniable for fiduciaries.

As a result, many funds need to trim, at a minimum, positions in Tesla in order to re-balance their portfolios.

Investors may not complain about an outsized position when things are going well, but managers must also manage downside risk. Holding too much of any one stock creates concentration risk that could quickly become a drag on a fund’s performance should that stock price fall. From a fiduciary perspective, there is no denying that this risk is amplified in a stock with as much downside risk as Tesla.

Market Share Declines Are Underway

While Tesla delivered an all-time high of 139,300 vehicles in 3Q20, the firm is rapidly losing EV market share in Europe. Tesla’s Western European market share (which includes the EU plus the United Kingdom, Iceland, Norway, and Switzerland) has fallen from 34% in 3Q19 to just 14% in 3Q20. With competition selling lower-priced vehicles at higher volume, Tesla will have a difficult time regaining its Western European market share, even after its German factory comes online.

The precipitous drop in Western European market share portends market share losses for Tesla in the rest of the world as incumbent automakers’ EV production comes online. Tesla’s first-mover advantage is gone.

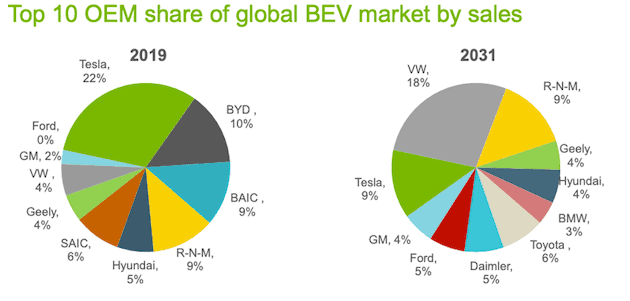

McKinsey estimates that automakers will introduce ~450 additional EV models through 2022. As more competition enters the market, Tesla’s market share will fall further. LMC Automotive estimates Tesla’s share of the global EV market will fall from 22% in 2019 to 9% by 2031 while Volkswagen’s will improve from 4% to 18% over the same time. See Figure 1.

Figure 1: Global EV Market Share Undergoing Drastic Change

Sources: New Constructs, LLC and LMC Automotive.

While 2031 is still a long ways out, market share decline is already taking place beyond Western Europe. GM’s Hongguang Mini, which sells for ~11% of the price of the Model 3, just surpassed Tesla to become the bestselling EV in China. Over the three-months-ended October 31, 2020, GM sold 55,781 Hongguang Minis compared to just 35,283 Model 3s over the same time.

It may not be long before we see a similar pattern in the U.S. Since March 2019, General Motors (GM) has committed to spend upwards of $4.5 billion at three U.S. manufacturing sites to accelerate the production of GM EVs, with an additional $2 billion planned across six more facilities. The firm will also invest $2.3 billion to build a battery cell manufacturing plant in Lordstown, Ohio.

Ford recently announced $3.2 billion in investments for EV vehicles and plans to invest $11.2 billion in EVs through 2022.

Meanwhile, Tesla has been unable to match its competition’s EV investments as the firm has reduced its capital investments, presumably in its pursuit of short-term profitability. In 2019, the firm’s capex was just 62% of its depreciation, amortization, and impairment. Tesla’s TTM capex of $2.4 billion is much smaller than the combined $82 billion Volkswagen, GM, Daimler, and Ford plan to invest in EV between 2022 to 2025.

Quality Issues Persist as Production Scales Up

While incumbent automakers are simply converting existing factories to produce their EVs, Tesla needs to scale up by building new gigafactories to meet its production targets. Scaling up also increases the likelihood that Tesla will have quality issues with its vehicles. Just a few examples of existing issues include:

- Consumer Reports is no longer recommending the Model S and notes the Model Y has “well below average reliability.” Overall, Tesla ranked second to last in Consumer Reports’ reliability study.

- The Motley Fool reported that Tesla “is recalling over 9,100 Model X cars and 400 Model Y SUVs just six days after Consumer Reports questioned the reliability of several models.”

- BIOS-Groep, a taxi-company in Amsterdam is suing Tesla for losses due to car defects ranging from suspension problems to power steering issues

- Tesla recalled Model S and X vehicles in China due to suspension issues. The firm claims the recall wasn’t necessary but was better than dealing with the Chinese government’s consequences of not doing so.

- The U.S. National Highway Traffic Safety Administration has opened a formal investigation into 115,000 vehicles regrading a separate suspension issue.

Such issues, especially if covered by warranty or under recall, only stand to increase the costs of Tesla’s ever growing vehicle fleet.

Tesla’s Battery Is Not that Good

Another sign that Tesla’s first mover advantage is wanning is the erosion of the firm’s once sizable advantage in the quality and size of its battery factories. While cost used to be an inhibiting factor for competition, costs have fallen significantly and are projected to fall further moving forward.

For instance, General Motors’ Ultium battery pack is expected to cost as little as $120/kilowatt-hour (kWh), and the firm believes the cost will soon fall below $100/kWh. BloombergNEF projects the average battery price will fall below $100/kWh by 2024, so should GM achieve cost efficiencies even before then it can provide even more attractive (i.e. cheaper) EV offerings.

Volkswagen expects the costs for its ID series will reach $152/kWh by 2020. Across the industry, the average battery pack cost was $161/kWh, which is down from $236/kWh in 2017.

General Motors also recently announced its new battery offers up to 400 miles of range (a feat Tesla only recently achieved in June 2020, despite a multi-year head-start) and will be used in several of its new fully electric models, including the Cruise Origin and Cadillac luxury SUV. Additionally, the firm plans to offer its Ultium battery in capacities up to 200 kWh, compared to Tesla’s biggest battery at 100 kWh.

Tesla’s competition on this front grows larger and more advanced every day. All the EV makers are focused on increasing range of their vehicles, and they are succeeding.

Full-Self Driving Lags the Competition – If It Ever Works

Elon Musk has a long history of making aggressive projections and deadlines for products and features that often miss the mark. “Full Self Driving” (FSD) is just another in a long list, as Elon has made claims about its functionality as far back as 2016 that simply don’t match reality.

In reality, Tesla’s advanced driver systems don’t stack up against competition and are nowhere near the “full autonomy” Elon boasts about.

- In October 2020, Consumer Reports released their latest test of assisted-driving technology and General Motors’ Super Cruise system topped the list, with Tesla “a distant second.”

- Earlier this year, MES Insights, an industry research provider, ranked Waymo, GM Cruise, and Ford’s Argo AI startup ahead of Tesla in terms of expertise and capabilities for self driving.

- Guidehouse Insights ranked Waymo, Ford and General Motors first, second, and third respectively in their Automated Driving Vehicles leaderboard. Tesla ranked last out of the 18 firms included in the analysis.

Furthermore, the roll-out of a beta version of its FSD has revealed several issues, such as the vehicle driving off the road or into a median, that highlight the system is not as advanced as Tesla would have you believe. Such claims have also gotten Tesla in trouble with regulators in the past. A German court banned the use of “full potential for autonomous driving” and “Autopilot inclusive” from German marketing materials. In the United States, the National Transportation Safety Board (NTSB) criticized Tesla for not taking adequate steps to prevent “foreseeable abuse” of its Autopilot technology.

As with other aggressive claims, Tesla’s boasts about its technology successfully drive a narrative that it leads in driving technology. This narrative further drives the stock price higher when in reality the situation is much different.

Insurance Isn’t a Magic Savior

As we noted in Bad Idea in September, Even Worse Now, Tesla’s insurance business is unlikely to generate enough profit to put a dent in the future cash flows required to justify its current valuation.

Here’s the math. On sales of ~27 million vehicles, General Motors’ auto insurance business generated $1.9 billion in GAAP net income, about $70 per car, from 2004-2006. If we assume Tesla can generate the same level of profit for its insurance business, we’re looking at an additional:

- ~$30 million in net income based on TTM vehicle sales or

- ~$230 million in net income based on optimistically growing its vehicle sales to 50% of the amount of GM’s TTM vehicle sales.

In either scenario, the profits are nowhere near the incremental profit growth needed to justify the expectations baked into its stock price.

Equity Raise Highlights Cash Burn

Bulls also argue that Tesla’s recent equity issuance will provide the firm necessary capital to increase investment in production to maintain competitiveness with growing competition. While true that capital aids Tesla’s investment requirements, such an argument also ignores the fact that the raising of capital has become a routine event for what bulls continue to argue is a sustainable and profitable business.

Instead, the business is a cash burning machine, to the tune of -$20.1 billion in free cash flow over the past five years, and the capital raises are needed to continue operating the business. Elon previously stated as far back as 2012 that the firm would not need to raise additional capital and has since raised nearly $24 billion through equity and debt offerings.

In 2020 alone, Tesla has raised $12 billion in capital despite Elon stating earlier this year that “it doesn’t make sense to raise money because we expect to generate cash despite this growth level”.

Equity Raise Also Throws Doubt on Wall Street Ratings

Given the overvalued stock, it’s no surprise Tesla recently announced another dilutive equity issuance, led by Goldman Sachs. Just days prior, Goldman Sachs upgraded Tesla from Neutral to Buy, which raises long held questions about conflicts in Wall Street ratings.

Meanwhile, firms not involved in the capital raise, namely JPMorgan Chase and Jefferies recently downgraded Tesla. JPMorgan analyst Ryan Brinkman noted specifically, “Tesla shares are in our view and by virtually every conventional metric not only overvalued, but dramatically so.” Any shift in Wall Street sentiment could provide another challenge to attract more stock buyers after the S&P 500 inclusion.

Tesla Keeps Getting More Expensive – Who Will Buy Next?

Despite losing its first mover advantage, competition ramping up production, and continued questions about the quality of its products, Tesla’s stock price continues to rise.

Now the expectations baked into its stock price of ~$640/share are not only overly optimistic, but nearly impossible in some cases. To justify its current valuation Tesla must:

- Immediately achieve a 7% NOPAT margin, which is above Toyota’s 2020 NOPAT margin of 5%. For reference, Tesla’s TTM NOPAT margin is 2%, which is the highest in the firm’s history.

- Grow revenue by 37% compounded annually for the next 11 years

- Grow revenue, NOPAT, and FCF without increasing working capital or fixed assets – a highly unlikely assumption that creates a truly best-case scenario. For reference, Tesla’s invested capital has grown 56% compounded annually since 2010 and 36% compounded annually over the past five years.

See the math behind this reverse DCF scenario. In this scenario, Tesla would earn $788 billion in revenue 11 years from now and the firm’s NOPAT in 2030 would equal $55 billion (vs. $538 million TTM). For comparison, the combined TTM revenue of Toyota (TM), Honda Motor Co. (HMC), Ford Motor Company (F), General Motors (GM), and Fiat Chrysler Automobiles (FCAU) is $726 billion. Toyota, the world’s second largest (by revenue) automobile manufacturer, generated TTM NOPAT of $12.8 billion, or just 23% of Tesla’s implied NOPAT in this scenario.

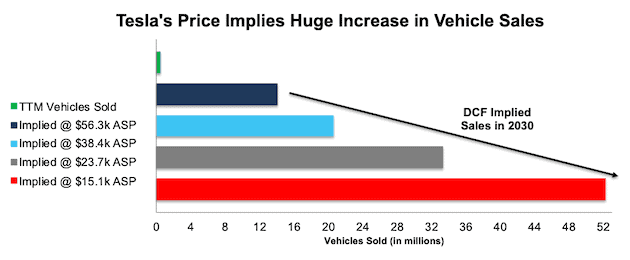

Tesla’s Valuation Also Implies It Will Sell Majority of Global EVs

At its current average selling price (ASP) of ~$56k, Tesla’s current stock price implies the firm will sell 14 million vehicles in 2030 (up from ~431k TTM), or 54% of the expected global EV sales. If Tesla’s ASP falls to ~$38k, or the average car price in the U.S. in July 2020, its implied sales volume in 2030 increases to 20.5 million vehicles in 2030, or 79% of projected global EV sales in 2030.

We think it highly unlikely that Tesla will ever sell such a high volume of cars at its current ASP because the luxury car market is not very large relative to the overall automobile market. Instead, investors should consider the implied vehicle sales by 2030 based on lower ASPs that are required to justify TSLA’s valuation at ~$640/share.

Figure 2: Implied Vehicle Sales in 2030 to Justify Current Price

Sources: New Constructs, LLC and company filings.

Per Figure 2, Tesla’s valuation implies that, in 2030, the firm will sell:

- 20.5 million vehicles – ASP of $38k (average car price in U.S. in July 2020)

- 33.3 million vehicles – ASP of $24k (equal to Toyota)

- 52.3 million vehicles – ASP of $15k (equal to General Motors)

Below are the percentages of expected global EV sales in 2030 that those numbers of vehicles represent:

- 79% for 20.5 million vehicles

- 128% for 33.3 million vehicles

- 201% for 52.3 million vehicles

In other words, even if you believe Tesla can maximize production, effectively cut costs, and introduce mass-market vehicles at an ASP equal to the U.S average, the firm must take 79% of the expected EV market to justify its current stock price. Anything less means the stock is overvalued and it must do even more to have any upside.

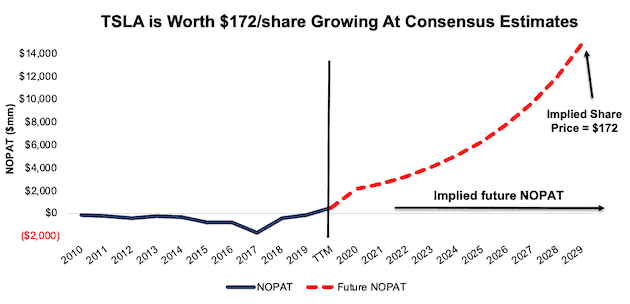

Significant Downside Even Growing at Consensus

Even if we assume Tesla can achieve a 7% NOPAT margin and grow revenue by 24% compounded annually (in line with consensus estimates through 2025) for the next decade, the stock is worth only $172/share today – a 73% downside to the current stock price. See the math behind this reverse DCF scenario.

Figure 3 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT. This scenario implies Tesla’s NOPAT 10 years from now will be nearly $15 billion, or 16% higher than Toyota’s TTM NOPAT.

Figure 3: Tesla Has Large Downside Risk: DCF Valuation Scenario

Sources: New Constructs, LLC and company filings.

Given the above, it’s clear to see just how much risk investors take by owning Tesla at current prices. The overvalued stock price, along with its weakening competitive position, led us to name it one of the Most Dangerous Stocks for Fiduciaries Heading Into 2021.

This article originally published on December 16, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.