Can you lie to yourself? Do people do it often? Absolutely. People choose to believe what fits with their desires all the time. And, we are witnessing a world where more people are throwing themselves into confirmation traps than anything I’ve seen since the tech bubble. The lengths to which people will go to find or even fabricate information to confirm what they already believe at the expense of acknowledging anything that conflicts with what they believe are staggering. If you don’t know what I am talking about, spend ten minutes on YouTube watching videos about Tesla, the cars or the stock. You’ll see that people are willing to say and believe just about anything to make them feel good about their beliefs in Tesla – good or bad. We see the same behavior at play in politics, in religion – it’s almost everywhere now.

But, that’s not what really bothers me. The really scary trend I see is aversion to hard work. It feels like too many folks have forgotten the value of hard work. Or, they do not realize it until their portfolio underperforms or one of their holdings blows up. The truth is: bad stock ideas are easy. They require little to no work. Good stock ideas take lots of hard work. Lots. And, I am going to share an example in just a minute. One of our favorite sayings at New Constructs is: “There’s no substitute for hard work.” And, I believe that in my heart. I do not believe in relying on luck, which means the only way to get ahead in this world is to work harder than other people.

One of the quotes on our refrigerator is “Input matters more than output.” I want my kids to know that I care more about how hard they work and how hard they try than I care about the results. I believe that hard work is its own reward. And, I want my kids to know they have control over what matters most: their attitude and effort. The rest is out of their hands. It is important for my boys to know the difference between what’s their responsibility and what is not. They’re responsible for how hard they work, no one else.

The alternative, ie. caring more about output than input, gets people into trouble in many ways. Perhaps, the worst habit that comes from too much focus on results is the desire to cheat or take shortcuts. They are the same thing, in my opinion.

Combine the desire to cheat with lying to oneself, and you have a lethal combination. That’s exactly what I think is happening on Wall Street. I saw it first hand as I detailed in a prior e-letter: Don’t Believe the Hype.

We worked incredibly hard to create the AI that drives our Robo-Analyst technology at New Constructs. Our motivation was clear: if we work really hard to teach machines to analyze financial statements better than humans, then we have a technology that can change the world of investing. We can give everyone access to reliable fundamental research and improve the integrity of the capital markets, which my readers know is the mission of New Constructs.

I’m going to give you an example of a stock pick that clearly distinguishes our research from one of our competitors. Our clients first learned of this stock pick on June 15, 2023, when we published the report: Coal In Green Clothing. Since then, the stock is up over 80% while the S&P 500 is up around 16%. We are still fans of this stock and have it on our Focus List Stocks: Long. In fact, we like it so much that we recently added another stock to our Focus List Stocks: Long that is in a very similar business.

The point is that the work that went into writing our report and determining that this stock should be on our Focus List was huge. To find this stock, we spent

- Twenty years building a technology that enables us to screen the entire U.S. market of actively-traded stocks for the absolute best stocks from a fundamental risk/reward basis.

- 27,000 human analyst hours (far fewer for the Robo-Analyst) every quarter to update our database with the latest 10-Ks and 10-Qs. Details on this work for last quarter are here.

- 3 weeks researching the coal industry, the different types of coal and how demand for coal might look in the future.

- 5 days formatting the data and charts and crafting a compelling story that appropriately represented the value of the idea and the insights that drove it.

- A lifetime of not being afraid to be contrarian and stand up for what is right as opposed to what was easy or popular.

The stock pick we are talking about is Warrior Met Coal (HCC). We believe it is one of the most overlooked stocks in the market and will outperform big time. We have confidence in our research because we put in the work. Even if we are wrong, and we don’t think we are, at least we did our best to ensure we put out the best research possible. At the end of the day, input matters more than output.

To show how confident we are in our work, I want to share a free copy of Coal In Green Clothing, click here to download it. Take a look, let me know if you agree with me about the quality and amount of work we did.

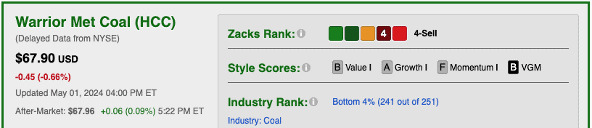

Then, I invite you to compare our research to what one of our competitors shows. Here’s a sample:

Source: https://www.zacks.com/stock/quote/HCC?q=hcc

In case you were wondering, yes, we put the same amount of work into every stock that makes our Focus List: Long and our Focus List: Short. There is no substitute for hard work.

We regularly review our work and research on Long Ideas with clients. We want you to know how much work we do! Here’s how we share our work:

- Free live Podcast every month. The next one is on May 10th at 12pmET. Register here. Send requests for stocks to review in our Society of Intelligent Investors (use this form to sign up for free) and ask questions and make requests anytime!

- Monthly Let’s Talk Long Ideas webinars where we do deep dives into our research, analytics, reverse DCF models and ideas for our Professional and Institutional clients. The next one is on May 8th at 3:30pmET.

- 100% transparency into all models, analytics and data so clients can audit our work anytime with our Marked-up Filings feature.

Diligence matters,

David

This article was originally published on May 3, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.