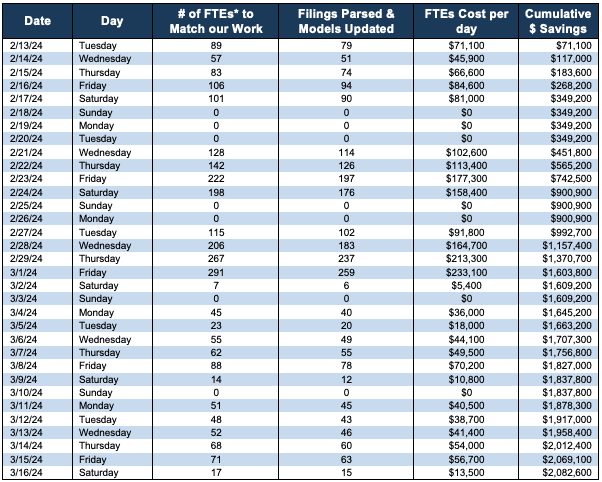

During the 4Q23 filing season, we parsed 2,314 filings and created $2,082,600[1] of value for clients. See Figures 1 and 2 for details.

These filings tend to come in large bunches, which we call Filing Season. The 4Q23 Filing Season is the Real Earnings Season, as it is when companies with 12/31 fiscal year ends file their 10-K’s, the longest and most complex of the financial filings.

Filing Seasons give our Robo-Analyst technology[2] an opportunity to shine as it enables us to produce proven-superior research with unrivaled speed and scale.

Figure 1: Putting a $ Value on Our Parsing Work for Clients: 4Q23 Filing Season

Sources: New Constructs, LLC

* FTEs = Full Time Employees

Indeed, the work we do during filing would cost our clients multiples more time and money than what we charge to replicate what we deliver.

The savings in Figure 1 are likely very conservative estimates because they do not account for the cost of any management or training of analysts. Nor, do they count the cost of building the financial models to house the data or tracking accounting rule changes to make sure those models remain accurate.

There’s Gold in the Footnotes, Lots of It

From the 2,314 10-K and 10-Q filings that arrived during this Filing Season, we collected 263,722 data points. This data led to 39,679 Core Earnings, balance sheet, and valuation adjustments with a combined dollar value of $20.4 trillion. The adjustments were applied as follows:

- 16,434 income statement adjustments with a total value of $1.4 trillion

- 15,252 balance sheet adjustments with a total value of $8.5 trillion

- 7,993 valuation adjustments with a total value of $10.6 trillion

Figure 2: Filing Season 2024 in Numbers

Sources: New Constructs, LLC and company filings.

See the Filing Season Finds section of our site for details on specific companies where we unearthed red flags and gems buried in footnotes that could disrupt the valuations of their stocks.

Even with these conservative assumptions, it is clear that we create tremendous value for all of our clients, from Stock Tracker 50 to Professional and Institutional members.

Want access to our superior fundamental research? Start your membership today.

This article was originally published on April 3, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Cumulative savings is calculated assuming it takes nine hours per filing and a full-time employee making $100/hour to parse each.

[2] Harvard Business School features the powerful impact of our research automation technology in New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.