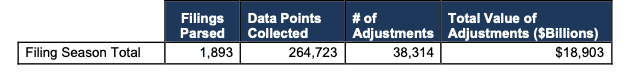

During the Real Earnings Season (February 14 – March 18), our Robo-Analyst[1] analyzed 1,893 10-K and 10-Q filings, from which we collected 264,723 data points. This data led to 38,314 Core Earnings, balance sheet, and valuation adjustments with a combined dollar value of $18.9 trillion. The adjustments were applied as follows:

- 15,752 income statement adjustments with a total value of $1.2 trillion

- 14,942 balance sheet adjustments with a total value of $8.4 trillion

- 7,620 valuation adjustments with a total value of $9.4 trillion

Figure 1: Filing Season 2022 Productivity

Sources: New Constructs, LLC and company filings.

This Filing Season Finds report highlights some of the most interesting footnote disclosures and largest Earnings Distortions we haven’t already featured from the 1,893 10-Ks and 10-Qs we analyzed during filing season.

- International Flavors & Fragrances’ (IFF) understated profits don’t make a good stock and

- material disclosures in the 10-Ks of American Airlines (AAL), EnPro Industries (NPO), and more.

Since 2005, we’ve reported how traditional earnings measures are unreliable due to accounting loopholes that allow companies to manage earnings. Our Economic Earnings and Core Earnings research closes those loopholes and provides more reliable[2] analysis of profits that also deliver a new source of alpha.

Understated Profits Aren’t Always a Good Investment

In International Flavors & Fragrances’ (IFF) 2021 10-K, our analyst Hunter Anderson highlighted how our Robo-Analyst found $631 million in net non-operating items on page 44, which consisted of:

- $368 million in Nutrition and Biosciences (N&B) inventory step-up costs

- $101 million in N&B integration related costs

- $91 million in N&B transaction related costs

- $42 million in business divestiture costs

- $29 million in employee separation costs

- $13 million in gains on business disposal

- $7 million in shareholder activism related costs

- $4 million in Frutarom integration related costs

- $2 million in acquisition related costs

These non-operating charges are not on the income statement. They can only be found with careful analysis of footnotes, which many analysts and investors tend not to do. After removing these non-operating items and other Earnings Distortions (net -$530 million, or 198% of GAAP earnings), we reveal that International Flavors & Fragrances’ 2021 Core Earnings of $798 million, or $3.28/share, are much higher than GAAP earnings of $268 million, or $1.10/share.

Despite higher profits than GAAP earnings indicate, International Flavors & Fragrances earns an Unattractive Stock Rating. Profits are an indication of a good business, but a good business is not worth buying at a bad price. At its current price, IFF’s price-to-economic book value (PEBV) ratio is 4.4. This ratio means the market expects International Flavors & Fragrances profits to grow over 4x from current levels. Buying stocks with such lofty expectations already baked into their price leaves little room for upside potential and greater risk for downside.

Other Material Earnings Distortions & Insights

From disclosures in the footnotes and MD&A:

American Airlines (AAL) – Losses Still Bigger Than You May Realize

- In American Airlines’ 2021 10-K, analyst Sam Moorhead noted that on page 114 our Robo-Analyst found that the company bundled $539 million in PSP Financial Assistance in the “Special Items, net” line on its income statement. We remove this non-operating income from our measure of NOPAT and Core Earnings to calculate the true recurring profits of the business. After removing all Earnings Distortions ($3.5 billion, or 173% of GAAP earnings), we reveal that American Airlines’ 2021 Core Earnings of -$5.4 billion, or -$8.46/share, are even worse than GAAP earnings of -$2.0 billion, or -$3.09/share.

EnPro Industries (NPO) – Hidden Gains Boost Reported Profits

- In EnPro Industries’ 2021 10-K, analyst Robbie Woodward noted that our Robo-Analyst found a $135 million gain on the sale of businesses reported as an operating gain in EnPro’s cash flow statement. After removing all Earnings Distortions (net $197 million, or 111% of GAAP earnings), including $132 million in “other income” reported on the income statement, we reveal that EnPro’s 2021 Core Earnings of -$20 million, or -$0.97/share, are much worse than GAAP earnings of $177 million, or $8.52/share.

These Companies Need to Clean Up Reporting Processes

- Last week, we highlighted our Robo-Analyst finding that Research Frontier’s (REFR) independent auditor identified a material weakness in internal control over financial reporting, but it wasn’t the only company. In fact, our Robo-Analyst found 18 other companies that disclosed material weaknesses in their internal controls in their 2021 10-Ks. These companies include:

- 3D Systems (DDD)

- Advaxis (ADXS)

- Cardlytics (CDLX)

- CBRE Group (CBRE)

- Coupang (CPNG)

- Encore Capital Group (ECPG)

- Garrett Motion (GTX)

- Gold Resource Corp (GORO)

- Gray Television (GTN)

- IHS Holding Limited (IHS)

- Myriad Genetics (MYGN)

- Par Technology Corp (PAR)

- Pennsylvania Real Estate Investment Trust (PEI)

- Peoples Bancorp (PEBO)

- SeaWorld Entertainment (SEAS)

- Shenandoah Telecommunications (SHEN)

- SPX Corporation (SPXC)

- MDC Partners (STGW)

Weaknesses in internal controls increase the risk that the company’s financials are fraudulent and misleading. Identifying this risk is necessary due diligence for every investment decision-making process.

This article originally published on March 21, 2022.

Disclosure: David Trainer, Hunter Anderson, Sam Moorhead, Robbie Woodward, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] See Harvard Business School case: New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.