This week’s Filing Season Finds report highlights some of the most interesting footnote disclosures in the 176 10-Ks and 10-Qs our Robo-Analyst[1] analyzed last week.

- GlaxoSmithKline’s (GSK) materially understated profits and

- alarming and material disclosures in the 10-Ks of Squarespace (SQSP), VBI Vaccines (VBIV), and Research Frontiers (REFR).

Since 2005, we’ve reported how traditional earnings measures are unreliable due to accounting loopholes that allow companies to manage earnings. Our Economic Earnings and Core Earnings research closes those loopholes and provides more reliable[2] analysis of profits that also deliver a new source of alpha.

Growing Profits + Cheap Valuation = Very Attractive Rating

In GlaxoSmithKline’s 2021 20-F, our analyst Hunter Anderson highlighted how our Robo-Analyst found $2.1 billion in non-operating charges on page 15, which consisted of:

- $1.2 billion in transaction related items

- $626 million in major restructuring costs

- $314 million in separation costs

These non-operating charges are not on the income statement. They can only be found with careful analysis of footnotes, which legacy firms tend not to do. After removing these non-operating items and other Earnings Distortions (net -$2.5 billion, or 56% of GAAP earnings), we reveal that GlaxoSmithKline’s 2021 Core Earnings of $6.9 billion, or $2.71/share, are much higher than GAAP earnings of $4.4 billion, or $1.73/share.

With higher profits than GAAP earnings indicate, an 11% return on invested capital (ROIC), and a valuation that implies the company’s profits will decline permanently, GlaxoSmithKline earns a Very Attractive Stock Rating, which was upgraded from Attractive after we analyzed its 2021 20-F.

Profits are an indication of a good business, but a good business is only worth buying at a good price. At its current price, GSK’s price-to-economic book value (PEBV) ratio is 0.6. This ratio means the market expects GlaxoSmithKline’s profit to permanently decline 40% from 2021 levels. GSK experienced a profit surge in 2020 that reversed in 2021, but the market is pricing in further declines. We view that assessment as overly pessimistic. GlaxoSmithKline has grown net operating profit after-tax (NOPAT) by 5% compounded annually over the past five years while also increasing its NOPAT margin by five percentage points during that time.

Other Material Earnings Distortions & Insights We Found

From disclosures in the footnotes and MD&A:

Squarespace (SQSP) – Still Unprofitable After Removing Unusual Expense

- In Squarespace’s 2021 10-K, analyst Sam Moorhead noted that on page 44 our Robo-Analyst found that the company bundled a one-time stock-based compensation expense of $229 million related to its direct listing in general and administrative expenses. We remove this non-operating charge from our measure of NOPAT and Core Earnings to calculate the true recurring profits of the business. However, even after removing all Earnings Distortion (-$230 million, or 92% of GAAP earnings), we reveal that Squarespace’s 2021 Core Earnings are still negative, at -$20 million, or -$0.20/share, compared to GAAP earnings of -$250 million, or -$2.60/share. Squarespace’s negative profits and expensive valuation earn it an Unattractive rating, and a place in the Danger Zone, as we pointed out in our recent report Square Peg Meets Round Hole.

VBI Vaccines (VBIV) & Research Frontiers (REFR) – Look Beyond the Fundamentals

- While most of the items we highlight pertain specifically to a company’s fundamentals, we also leverage our Robo-Analyst to identify specific disclosures that can better inform investors about a company’s business condition.

- In VBI Vaccines’ 2021 10-K, analyst Garrett O’Grady noted that our Robo-Analyst identified the company’s independent auditor EisnerAmper LLP raised doubts about the company’s ability to continue as a going concern. Specifically, it was noted that the company will require significant additional funds to continue as a going concern.

- In Research Frontiers’ 2021 10-K, analyst Robin Ortega noted that our Robo-Analyst found the company’s independent auditor CohnReznick LLP identified a material weakness in internal control over financial reporting. Weaknesses in internal controls increase the risk that the company’s financials are fraudulent and/or misleading.

The Power of the Robo-Analyst

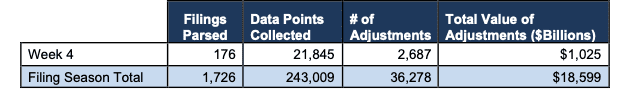

From the 176 10-K and 10-Q filings analyzed by our Robo-Analyst last week, we collected21,845 data points. This data led to 2,687 Core Earnings, balance sheet, and valuation adjustments with a combined dollar value of $1.0 trillion. The adjustments were applied as follows:

- 1,121 income statement adjustments with a total value of $61 billion

- 1,058 balance sheet adjustments with a total value of $442 billion

- 508 valuation adjustments with a total value of $522 billion

Figure 1: Filing Season Diligence for Filing Season 2022

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks and 10-Qs to update our models for companies with 12/31 and 1/31 fiscal year ends. This combination of technology and human expertise enables investors to overcome the flaws in legacy fundamental research and make more informed investment decisions.

This article originally published on March 15, 2022.

Disclosure: David Trainer, Hunter Anderson, Sam Moorhead, Garrett O’Grady, Robin Ortega, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.