Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

Intuitive Surgical Inc. (ISRG: $594/share) and GATX Corporation (GATX: $84/share) are in the Danger Zone. These two stocks are likely to miss earnings expectations according to our new Earnings Distortion Scores.

We measure earnings distortion using a proprietary human-assisted ML methodology featured in a recent paper from Harvard Business School (HBS) and MIT Sloan. This paper empirically shows that street earnings estimates are incomplete and less accurate since they do not consistently and accurately adjust for unusual gains/losses buried in footnotes. By adjusting for earnings distortion, we create a measure of core earnings that is more predictive of future earnings.

Starting the week of January 6, 2020, we’ll highlight the Earnings Distortion scores for the important earnings releases for the following week. Our goal is to help investors combat increasingly material levels of earnings distortion. Earnings for the S&P 500 were distorted by an average of 22% in 2018, and we expect that trend to continue.

Stocks Likely to Miss

Earnings season won’t get into full swing until February, but there are still plenty of stocks that report earnings in January. Of those stocks, ISRG and GATX both stand out for their positive earnings distortion – i.e. their earnings are overstated because reported GAAP earnings are above our core earnings.

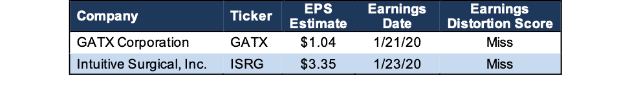

Figure 1: Two Stocks That Should Miss Expectations – ISRG & GATX

Sources: New Constructs, LLC and company filings.

Intuitive Surgical, Inc. (ISRG)

Most of our Danger Zone picks have falling profits and a low return on invested capital (ROIC). ISRG, on the other hand, has rising profits and a top-quintile ROIC of 53%.

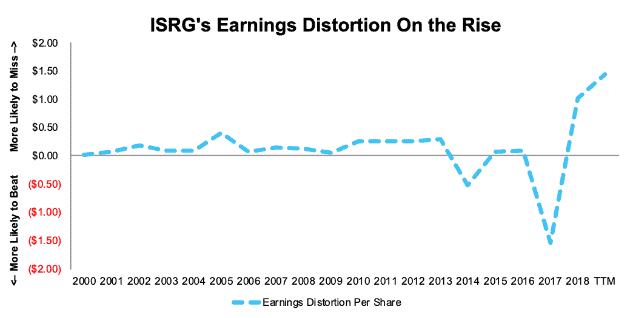

However, ISRG’s earnings distortion is rising, which means earnings are increasingly overstated. As earnings become more overstated, the likelihood that ISRG misses estimates increases because these estimates are artificially propped up by unusual gains. Even with rising core earnings, a company missing estimates can cause a rapid drop in its stock price.

Figure 2 shows ISRG’s earnings distortion is the highest it’s been in the history of the company.

Figure 2: ISRG Earnings Distortion Jumps Significantly Since 2017

Sources: New Constructs, LLC and company filings

In 2018, ISRG had nearly $120 million (2% of assets[1]) in earnings distortion that caused earnings to be overstated. One of the notable unusual gains included $80 million in interest and other income driven by higher interest rates and higher cash and investment balances.

Over the trailing twelve month (TTM) period, ISRG’s earnings distortion has increased to $171 million (2% of assets). Notable unusual gains include:

- $28 million in interest and other income in 1Q19

- $33 million in interest and other income in 2Q19

- $33 million in interest and other income in 3Q19

In other words, through the first three quarters of 2019, ISRG recorded $94 million in gains due to rising interest rates, not the actual operations of the business. In addition, we made a $69 million adjustment for income tax distortion. This adjustment normalizes reported income taxes and removes the impact of unusual or less persistent items on the taxes applied to core earnings.

In total, we identified $1.43/share in earnings distortion in ISRG’s TTM results.After removing this earnings distortion from GAAP net income, ISRG’s TTM core earnings of $9.57/share are significantly lower than $11.00/share in reported earnings.

Worse, we find that TTM GAAP net income grew 17% over 2018. After removing earnings distortion, core earnings grew just 13%. Not only are reported earnings overstated, the pace of growth is also overstated.

Expensive Valuation Adds to Risk of Owning ISRG

With a P/E ratio of 54, it’s clear, even by traditional metrics, that ISRG is overvalued. The Healthcare sector has an average P/E ratio of 30 and the S&P 500 average sits at 23.

We use our reverse discounted cash flow (DCF) model to more rigorously assesses the valuation of this stock by quantifying the expectations for future profit growth baked into the stock price.

In order to justify its price of $594/share, ISRG must achieve a 35% NOPAT margin (compared to 27% TTM and a company high of 29% in 2012) and grow NOPAT by 15% compounded annually for the next 16 years. See the math behind this reverse DCF scenario.

In this scenario, ISRG would be generating over $27 billion in revenue (16 years from now). For reference, Global Market Insights, an industry research provider, expects the entire surgical robots market to be worth $24 billion in 2025. In other words, ISRG must capture huge market share gains in the coming years to justify its current stock price.

Even if ISRG achieves a 29% NOPAT margin (company best in 2012) and grows NOPAT by 14% compounded annually for the next decade, the stock is worth $336/share today, a 43% downside to the current stock price. See the math behind this reverse DCF scenario.

Each of the above scenarios also assume ISRG is able to grow revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, ISRG’s invested capital has increased by an average of $239 million a year, or 23% compounded annually, since 2014.

Overstated earnings mean ISRG is a stock to avoid going into earnings. Its expensive valuation also makes it riskier to own long-term as well, which is why it currently earns our Unattractive rating.

GATX Corporation (GATX)

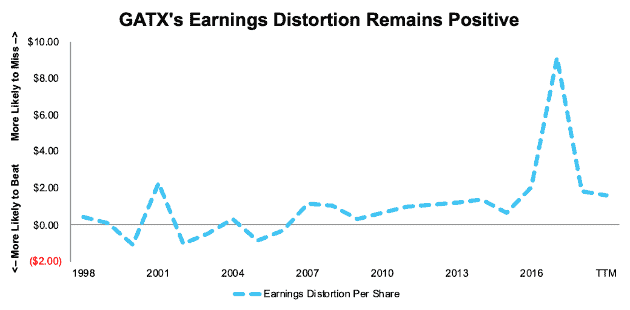

GATX’s earnings distortion has been significant through most of the firms history and is currently higher than most years in the past, per Figure 3.

Figure 3: GATX’s Earnings Distortion Per Share Since 1998

Sources: New Constructs, LLC and company filings.

In 2018, GATX had nearly $70 million (1% of assets) in earnings distortion that caused earnings to be overstated. One of the notable unusual gains included $17 million in tax benefits related to the impact of tax law changes. This income was disclosed on page 74 of GATX’s 10-K.

Over the TTM period, GATX’s earnings distortion is $59 million (1% of assets). Notable unusual gains include:

- $33 million gain on asset dispositions in 2Q19 related to railcar scrapping

- $5 million gain on asset disposition in 3Q19 related to railcar sales

In addition, we made $26 million in adjustments for income tax distortion to normalize reported income taxes and remove the impact of unusual items.

In total, we identified $1.60/share (29% of reported earnings) in earnings distortion in GATX’s TTM results.GATX’s real TTM core earnings are $3.92/share, significantly lower than $5.52/share of reported earnings.

Further, we find that TTM GAAP earnings grew 13% over 2018 while core earnings grew just 2% over the same time.

GATX’s Overvalued Stock

With a P/E ratio of 15, GATX looks cheap by traditional metrics when compared to the overall market, which has a P/E ratio of 23.

Our reverse discounted cash flow (DCF) model shows otherwise. Per below, the expectations baked into the stock price are overly optimistic.

In order to justify its price of $84/share, GATX must maintain TTM margins of 22% (highest since 2006) and grow NOPAT by 7% compounded annually for the next 12 years. See the math behind this reverse DCF scenario. 7% compounded annual growth may not seem like much, but keep in mind that GATX has grown NOPAT by just 1% compounded annually over the past five years and fallen by ~1% compounded annually over the past decade.

Even if GATX maintains a 22% NOPAT margin and grows NOPAT by 5% compounded annually for the next decade, the stock is worth $36/share today, a 57% downside to the current stock price. See the math behind this reverse DCF scenario.

Each of the above scenarios also assume GATX is able to grow revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, GATX’s invested capital has increased by an average of $201 million a year, or 3% compounded annually, since 2009.

Overstated earnings mean GATX is a stock to avoid going into earnings. Its expensive valuation also makes it riskier to own long-term as well, which is why it earns our Unattractive rating.

This article originally published on December 23, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] We weight earnings distortion by total assets to mirror the methods of “Core Earnings: New Data and Evidence”, the recent paper from professors at Harvard Business School and MIT Sloan. That paper found used earnings distortion as a % of assets to create a long/short strategy that delivered abnormal returns of 7-10% annually.