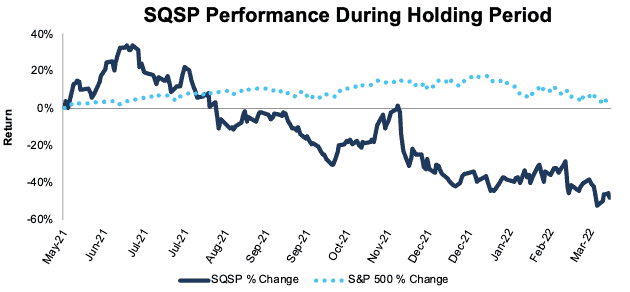

We first put Squarespace (SQSP: $25/share) in the Danger Zone in May 2021 prior to its IPO. Since then, the stock is down 48% compared to a 3% gain for the S&P 500. Despite record revenue and subscriptions, this company’s growth story is crumbling, and lasting profits look increasingly unlikely. The fundamentals of this business simply don’t justify the expectations baked into its stock price. It’s like trying to put a square peg in a round hole.

We leverage more reliable fundamental data[1], shown to provide a new source of alpha, with qualitative research to pick this Danger Zone idea.

Squarespace’s Stock Could Fall Further Based On:

- expectations for slowing growth in 2022

- its business competes against larger companies and free offerings

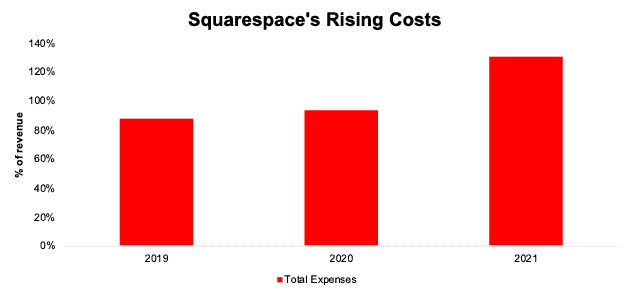

- lack of scale efficiency with expenses rising faster than revenue

- current valuation of the stock implies Squarespace will be larger and generate more profits than Shopify (SHOP) and GoDaddy (GDDY) – anything less, and the stock could have 68%+ downside

Figure 1: Danger Zone Outperformance of 51%: From 5/19/21 Through 3/11/22

Sources: New Constructs, LLC

What’s Working

Benefiting from COVID-driven shift to ecommerce: Squarespace’s platform enables online ecommerce, making the company a direct beneficiary of the accelerated shift to ecommerce brought on by the COVID-19 pandemic.

In 2021, Squarespace achieve record revenue, gross merchandise value (GMV), and subscribers. Each of these metrics grew by the following year-over-year (YoY):

- revenue grew 26%

- GMV grew 48%

- Subscriptions grew 12%

Global ecommerce sales are expected to grow at 11% compounded annually through 2025, which bodes well for continued top-line growth at ecommerce focused companies such as Squarespace.

What’s Not Working

Growth story ending: Despite operating in the booming ecommerce market, Squarespace’s growth story is seemingly coming to a screeching halt. Growth rates across many key metrics, while positive, have declined from 2020, and 2022 looks even worse. For instance:

- Revenue grew 28% YoY in 2020 and 26% YoY in 2021

- GMV grew 95% YoY in 2020 and “only” 48% YoY in 2021

- Subscribers grew 23% YoY in 2020 and 11% YoY in 2021

Looking ahead to 2022, the midpoint of management’s guidance implies just 11% YoY revenue growth.

Total Expenses Continue to Rise: Beyond slowing growth, Squarespace is moving further from profitability. Per Figure 2, Squarespace’s total expenses[2] have risen from 87% of revenue in 2019 to 131% in 2021. Even when we remove the one-time, stock-based compensation expense of $229 million resulting from Squarespace’s direct listing (as we do in our calculation of NOPAT), Squarespace’s total expenses were 101% of revenue, up from 94% in 2020.

Despite a record year of top-line growth, Squarespace remains unprofitable. It’s net operating profit after-tax (NOPAT) margin is -1% in 2021 while its invested capital turns, a measure of balance sheet efficiency fell from 4.8 in 2020 to 1.6 in 2021. Return on invested capital (ROIC) sits at -1% in 2021. Free cash flow (FCF) fell from -$200 million in 2020 to -$507 million in 2021, for a cumulative cash burn of -$707 million over the past two years.

Figure 2: Squarespace’s Total Expenses: 2019 through 2021

Sources: New Constructs, LLC and company filings

Competition growing market share faster: As we noted in our original report, Squarespace’s biggest competition comes from free website builders such as WordPress. Against this backdrop, taking meaningful market share is a daunting task, especially while trying to improve profitability.

Not surprisingly, Squarespace’s share of content management systems used across the internet is growing slower than its competition. Content management systems used across the web have increased as follows (time frame starts in January 2020 and ends in March 2022):

- WordPress: from 35.4% of sites to 43.2% of sites

- Shopify (SHOP): from 1.9% of sites to 4.4% of sites

- Wix (WIX): from 1.3% of sites to 2.0% of sites

- Squarespace: from 1.5% of sites to 1.8% of sites

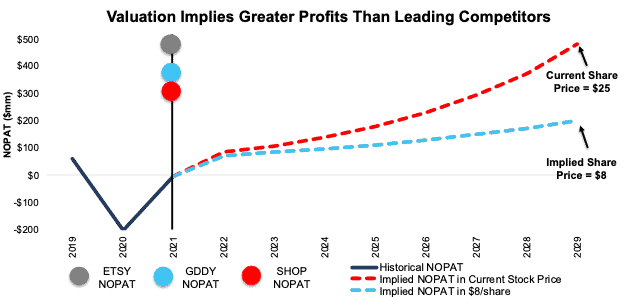

Priced to Be As Profitable As Etsy & Nearly 2x Shopify

Despite SQSP falling 40% since its 52-week high, the stock is still significantly overvalued. Below, we use our reverse discounted cash flow (DCF) model to illustrate the lofty expectations for future cash flows implied by Squarespace’s current valuation.

To justify its current price of $25/share, Squarespace must:

- improve NOPAT margin to 8.4% (midpoint of Shopify and GoDaddy’s [GDDY] 2021 NOPAT margin, compared to -0.3% for Squarespace in 2021) and

- grow revenue by 28% compounded annually for the next eight years (nearly 3x the projected global ecommerce growth through 2025 and 2x the projected web content management market growth through 2026)

In this scenario, Squarespace would generate $5.7 billion in revenue (in 2029), which is 7x its 2021 revenue, 1.5x GoDaddy’s 2021 revenue, and 1.2x Shopify’s 2021 revenue.

Squarespace would also generate $481 million in NOPAT in 2029 in this scenario (compared to -$3 million in 2021), which is 1.6x Shopify’s 2021 NOPAT, 1.3x GoDaddy’s 2021 NOPAT, and just 3% below Etsy’s (ETSY) 2021 NOPAT.

Note that companies that grow revenue by 20%+ compounded annually for such a long period are unbelievably rare. Accordingly, we see the cash flows expectations in Squarespace’s share price as unrealistically high, which indicates downside risk is much larger than upside potential.

68%+ Downside if Consensus is Right

If we assume Squarespace’s:

- NOPAT margin improves to 8.4%,

- revenue row at consensus rates in 2022 and 2023, and

- revenue grows at 16% a year (continuation of 2023 consensus) from 2024-2029, then

SQSP is worth just $8/share today – a 68% downside. In this scenario, Squarespace would still generate $2.4 billion in revenue (in 2029), which is 3x its 2021 revenue and 103% of Etsy’s 2021 revenue. The company would also generate $201 million in NOPAT, up from -$3 million in 2021.

Such a scenario could prove too optimistic if Squarespace’s marketing spend as a percent of revenue continues to increase, thereby limiting margin improvement, or it raises prices to improve profitability, thereby limiting user and revenue growth potential. In either case, the downside risk in owning shares would be even greater.

Figure 3 compares Squarespace’s implied future NOPAT in this scenario to its historical NOPAT as well as Etsy, Shopify, and GoDaddy’s 2021 NOPAT.

Figure 3: Squarespace’s Historical and Implied Revenue: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Each of these scenarios also assumes Squarespace can grow revenue, NOPAT, and free cash flow (FCF) without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, Squarespace’s invested capital has grown 118% compounded annually since 2019.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This article originally published on March 14, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] Includes cost of revenue, research and product development, marketing and sales, and general and administrative.