This is the fourth article in a four part series that walks readers through how to rate and value a stock. Chemical manufacturer DuPont (DD) is our example. We began by calculating NOPAT, next calculating Invested Capital, and then determining economic earnings.

Our fourth and final step to gauge the value of a stock is to use our dynamic discounted cash flow model to quantify market expectations for future cash flows of a company. As Warren Buffet has stated many times, the value of any stock equals the discounted value of the future cash flows available to equity holders. Therefore, changes in the expected cash flows are the most important driver of changes in a stock price. Having made the necessary adjustments to derive accurate and complete NOPAT, Invested Capital, economic earnings and free cash flow (FCF), we have high conviction in our DCF model.

Ever hear the old adage: “buy low and sell high”?

Our research enables clients to execute the “buy low and sell high” strategy with high confidence. Our valuation models are the best in the business at identifying the stocks with the highest and lowest market expectations. We are the best implementation of “Expectations Investing” for over 3,000 stocks, 400 ETFs and 7,000 mutual funds.

For example, when we put Amazon (AMZN) in the Danger Zone back in May 2013, we highlighted that the current stock price of $267/share embedded the expectation that the company would grow profits by 25% compounded annually for 25 years. Those are clearly high expectations. On the other hand, when we recommended PetSmart Inc. (PETM) we highlighted that the current stock price of $57/share implied the company’s profits would never grow beyond current levels for the remainder of its life. Those are low expectations. Understanding expectations guides investors through the “noise” in the market. It helps them focus on what matters most, which in the medium and long term is cash flow.

Details On How We Quantify Market Expectations

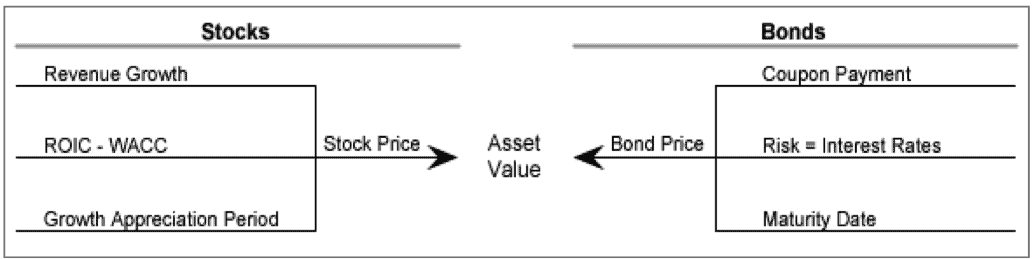

Figure 1 shows the variables that are required to derive the price of any asset. The key take away of Figure 1 is that one can value a stock in the same way one values a bond as long as one is flexible with the length of the forecast period in the DCF model.

Figure 1: Key Value Drivers Are The Same For All Securities

Sources: New Constructs, LLC and company filings.

Because our model focuses on quantifying the market’s expectations for the future financial performance of a company as embedded in the stock price, we need a more dynamic DCF model than the traditional models that force the valuation of every stock into a 5 or 10-year forecast horizon. We use a model that analyzes multiple forecast periods not just one. Accordingly, the key difference between our DCF model and others is that we calculate the value attributable to equity shareholders over multiple (100) different forecast periods or what we call Growth Appreciation Periods (GAP)[1]. Consequently, our model assumes no profit growth in the terminal or residual value calculations for each year of the forecast. If we think the company’s profits will grow more than five years, then we look at the implied values of a longer (up to 100 years) forecast horizon. Adding perpetual growth rates to terminal values is reckless and, too often, has a disproportionately large impact on the DCF valuation.

Scenario Analysis

Our models compare and contrast multiple forecast scenarios so clients can assess the valuation impact of different forecasts for revenue growth, margins and capital allocation strategies. Note that all of our models come with our default scenario so that there is at least one forecast loaded in every model. Our default scenarios are not meant to be interpreted as gospel. They are simply a good, reasonable starting point for quantifying expectations. We encourage clients to make their own forecasts.

Below is a quick review of the forecasting inputs in our models and how we derive our default estimates.

Forecast Driver #1: Revenue Growth

Revenue growth is the easiest of all the estimates. We like to rely on consensus values for the first few years. Then, we tend to converge back to historical averages. From EY51-100, most of the time we assume a growth rate of 6% for all companies. We converge most companies to 6% over the long term because that is roughly the long-term geometric GDP growth rate since1929.

These assumptions are only a baseline, and can be adjusted as needed. Forecasted revenue growth should not be 6% if a company has never generated 6% growth, and our analysts make this adjustment in our forecasts. Also, revenue growth is rarely below 3% since the historical average annual inflation rate in the US is 3%.

Forecast Driver #2: Net Operating Profit Before Tax (NOPBT) Margin

Margin forecasts tend to be based on historical averages. WE prefer not to forecast significant deviations from what the company has done in the past. Also, the NOPBT margin forecasts tend not to change across the entire forecast period. This consistency makes it easier for clients to assess what the market’s margin expectations truly are.

We cannot use consensus values for our margin forecasts because our margin calculations take into account a great deal more data than is used in most analysts’ models. See details on our income statement adjustments.

Forecast Driver #3: Cash Operating Taxes

Tax rate forecasts tend to be based on historical averages also. Like the margin forecast, tax rate forecasts tend not to change across the entire forecast period in our default scenarios.

Forecast Driver #4: Changes in Invested Capital

Lastly, to measure free cash flow, we must forecast how Invested Capital changes. We break out the invested Capital forecasts into changes for net working capital and fixed assets.

Adjustments to Shareholder Value

After we calculate the present value of future free cash flows for all forecast periods, we make several adjustments to shareholder value to account for non-operating assets and liabilities that impact the amount of cash available to shareholders. Assets such as excess cash, discontinued operations, and unconsolidated subsidiaries are added to our DCF value as they represent cash that can be returned to shareholders in the future. Liabilities such as debt, underfunded pensions, and outstanding employee stock options are deducted from the DCF value, as they are senior claims on cash flows that must be satisfied before existing shareholders can be paid.

Valuing DuPont

Our model show that the current valuation of ~$67/share implies the company will grow NOPAT at 6.5% compounded annually for 19 years. These results are based on our default DCF scenario, which can be seen here. The scenario makes the following assumptions.

- Revenue growth of 0.8% in year 1, 5.4% in year 2, and 6.5% thereafter.

- A pre-tax margin of 14.9%.

- Net working capital increases by 10% of revenue growth while fixed assets increase by 90%, so that an additional $1 of invested capital is added for every $1 of revenue growth.

These are fairly reasonable assumptions based on DD’s track record of profit growth.

However, a 19 year GAP is on the high end of our Neutral range, which runs from 10-20 years. If we shorten the GAP to 15 years, the stock is worth $62/share.

Is DuPont a Buy?

We currently have a Neutral rating on DuPont, which means we don’t see it as a stock to buy, but we also don’t consider it to be particularly dangerous. DuPont is a high quality company that is expensive based on its recent track record of growth and profitability.

Of course, not everyone will agree with that assessment. Activist investor Nelson Peltz holds a $1.6 billion stake in DD and believes a breakup of the company will unlock shareholder value. He could be right. If a breakup of the company delivers the cost savings that Peltz believes and improves pre-tax margins to 17% and spurs 8% revenue growth for 15 years, the stock is worth over $90/share.

If you believe in Nelson Peltz’s assessment, it would be reasonable to buy shares of DD. Investors can disagree on the future prospects of a company. What’s important is that investors have the tools that enable them to understand the company’s profitability and the expectations embedded in its valuation.

Kyle Guske II contributed to this report.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.

[1] The Growth Appreciation Period represents our implementation of the Competitive Advantage Period (CAP) concept, which Michael Mauboussin and Paul Johnson introduced to Wall Street in January of 1997.

Photo Credit: Lendingmemo.com (Flickr)