Is the down market getting on your nerves?

There’s a better way to invest. A way that leverages superior data and analytics to drive proven-superior stock ratings.

Want proof?

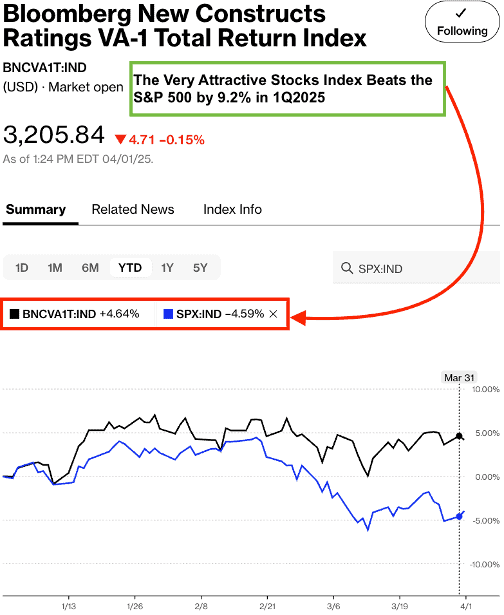

See Figure 1. It compares the performance of the Very Attractive Stocks Index, managed by Bloomberg, to the S&P 500. In 1Q25, the Bloomberg New Constructs Ratings VA-1Index (ticker: BNCVAT1T:IND) was up 4.6% while the S&P 500 was down 4.6%. As explained in more detail here, this index only holds the stocks that get our Very Attractive Rating.

I would say this performance is a very strong endorsement of the value of our Stock Ratings.

Figure 1: Very Attractive-Rated Stocks Strongly Beats the S&P 500 by over 9% in 1Q25

Sources: Bloomberg as of March 31, 2025.

Note: Past performance is no guarantee of future results.

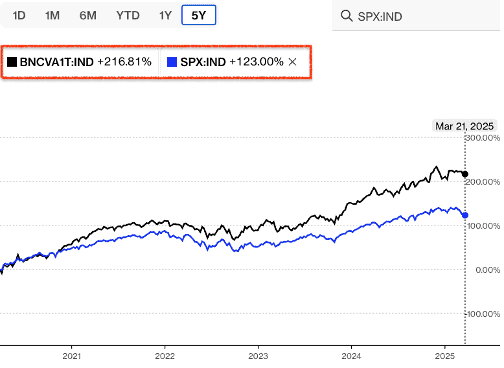

Performance is not just super strong in the short term either. Figure 2 shows that the Very Attractive Stocks index (up 217%) outperforms the S&P 500 (up 123%) by 94% over the last 5 years.

Good Stocks Are Hard to Find

My father-in-law likes to say “it takes a lot of hammering to make good steel” anytime his grandchildren complain. We value hard work in our family, and hard work is a big part of how New Constructs finds good stocks.

Wall Street wants you to believe picking stocks is easy, but it’s clear by the performance of their stock picks that they are faking it. As my regular readers know, Fake News Is Cheap for A Reason, and so are Wall Street stock ratings.

Unlike Wall Street, where 95% of the stocks get a Buy or Hold Rating, less than 5% of our coverage universe of stocks get a Very Attractive Rating. In other words, stocks that get a Very Attractive Rating are hard to find.

Good stocks are not supposed to be as easy to find as CNBC and Wall Street would have you believe.

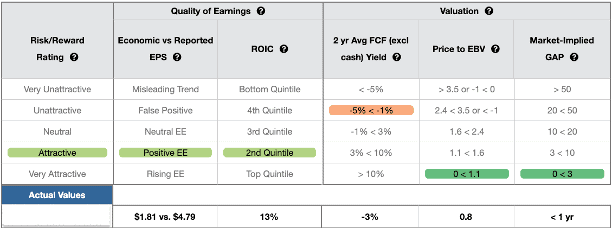

Why do Very Attractive Stocks outperform the market? They outperform because they offer outstanding risk/reward by having cheap valuations on businesses that have excellent quality of earnings.

Figure 2: Very Attractive-Rated Stocks Strongly Outperform the S&P 500 Over the Last 5 Years

Sources: Bloomberg as of 5:00pmCT on March 26, 2025.

Note: Past performance is no guarantee of future results.

Where to Find Good Stocks

We work hard to provide the best fundamental research in the world. No other research firm can match our proven-superior fundamental data, analytics and stock ratings.

We’re constantly providing free training and stock picks to help investors make more money and invest with peace of mind.

We also offer a variety of Model Portfolios for clients, such as the Most Attractive Stocks, Safest Dividend Yield Stocks, and more. We offer memberships like Stock Tracker 50 that empowers individual investors with access to our proven-superior ratings on 3,300 U.S. stocks and over 7,000 ETFs and mutual funds.

Our Professional Membership offers more in-depth detail, access to all Model Portfolios, access to our API, and the most powerful stock and fund screeners in the business.

See Figure 3 for a peek at what our Stock Ratings look like. We blocked out the ticker here, but trust that we have plenty of Attractive and Very Attractive stocks, ETFs and mutual funds in our coverage universe of 10,000+ securities.

Figure 3: How To Find The Right Stocks: The Robo-Analyst Rating System

Sources: New Constructs, LLC and company filings.

Given how poor the rest of the market has performed this year, don’t you think it is time to up your game and invest smarter based on research with a proven advantage.

The days of making easy money by jumping into crowded trades are over. Put MOMO and YOLO behind you and invest in truly attractive stocks BEFORE the rest of the market catches on. That’s how the top investors make the big bucks.

Bloomberg Special Event To Learn More About our Indices

Register here for “Footnote Season: Uncovering Hidden Value In Company Financials” on April 11 at 11amEDT.

Join Bloomberg and New Constructs for an exclusive webinar exploring how AI-driven financial analysis enhances accounting transparency to reveal underestimated earnings. Discover how Bloomberg Indices integrates New Constructs’ proprietary data to develop systematic strategies that identify companies whose true financial strength is often overlooked—creating a unique opportunity for accounting alpha.

We work hard to provide the best fundamental research in the world. No other research firm can match our proven-superior fundamental data, analytics, stock ratings and indices.

This article was originally published on April 2, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.