Though most investors take for granted that corporate managers fudge their earnings, there’s never been any empirical data and evidence to prove it – until now. In a recent paper, “Core Earnings: New Data & Evidence, professors at Harvard Business School (HBS) & MIT Sloan show:

- corporate managers exploit footnotes to manipulate earnings (Section 4.1) and

- new technology enables investors to generate alpha (10%) from these manipulations (Section 4.3).

The Problem

Identifying unusual items has become increasingly difficult. Companies bury this information in the footnotes in a myriad of ways. It’s gotten so difficult, that most analysts and data providers (including Compustat and IBES) don’t do it. As a result, markets inefficiently measure earnings – as shown in the aforementioned paper.

The Answer

The paper shows that our “novel dataset of footnotes adjustments” provides a measure of core earnings that is “incremental to alternative measures of operating performance in predicting an array of future income measures.” The alternative measures used in the paper are “Street Earnings” from Refinitiv’s IBES, owned by Blackstone (BX) and Thomson Reuters (TRI), and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI). See section 3.4 of the paper for more details.

The professors empirically conclude that our adjusted core earnings are meaningfully superior to those from Compustat and IBES, and increasingly so over time.

How to Make Money with This New Research

We provide two strategies to exploit our “novel dataset” of earnings adjustments:

- Short-term – use our Earnings Distortion Scores to trade stocks most likely to beat or miss earnings estimates. Get started now with our Earnings Distortion Scorecards for the 1Q20 earnings season.

- Long-term strategy – use our Stock Ratings to own more stocks with understated earnings and avoid/sell stocks with overstated earnings. Get our Stock, ETF & Mutual Fund Ratings here.

Most Under/Overstated “Unadjusted” Earnings

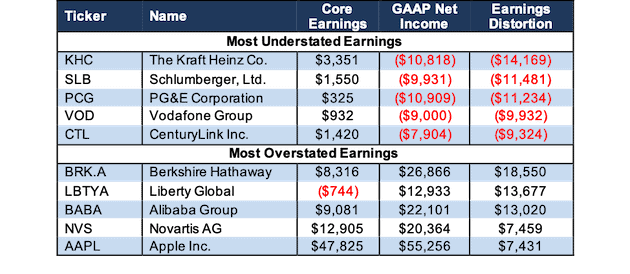

To get a jump on using this new proprietary research, see Figure 1 for a list of companies with the most under/overstated earnings as compared to our adjusted core earnings.

Figure 1: Companies with Most Understated/Overstated TTM Earnings as of January 8, 2020

Sources: New Constructs, LLC and company filings.

Per Figure 1, Berkshire Hathaway’s (BRK.A) core earnings are $18.6 billion less than its reported GAAP earnings over the TTM period. The large disconnect between reported earnings and core earnings stems from over $27 billion in gains from reported other non-operating income. These non-operating items include $10.5 billion, $9.8 billion, and $19.4 billion in unrealized investment gains on securities in 3Q19, 2Q19, and 1Q19 respectively.

This income is a direct result of Accounting Standards Update 2016-01, which changed the way companies account for changes in the fair value of securities. When discussing this accounting rule change in his 2017 letter to BRK.A shareholders, Warren Buffett noted “for analytical purposes…Berkshire’s bottom-line will be useless.” You can see how we handle this accounting rule change, and its impact on our models, here.

Liberty Global (LBTYA), Alibaba Group (BABA), Novartis AG (NVS), and Apple Inc. (AAPL) also have significantly overstated GAAP net income after adjusting for earnings distortion.

On the other hand, Kraft Heinz’s (KHC) net income greatly understates its core earnings. Kraft Heinz (KHC) famously took a $16 billion write-down when it filed its 2018 10-K. When combined with other non-core expenses, such as $598 million in goodwill and intangible asset impairment losses in 2Q19, we see that KHC’s core earnings of $3.4 billion are much higher than its -$10.8 billion reported GAAP net income.

Schlumberger, Ltd. (SLB), PG&E Corporation (PCG), Vodafone Group (VOD), and CenturyLink Inc. (CTL) each reported GAAP net income that understated the core earnings of their business operations in the TTM period. However, understated earnings alone don’t mean a stock is worthy of investment. All five stocks with the most understated earnings in Figure 1 receive a Neutral-or-worse rating.

Figure 2 shows how we calculate core earnings.

Figure 2: How to Calculate Core Earnings

Total Revenue

+ Total Operating Income

– Total Reported Operating Expenses, Net

+ Total Hidden Non-Operating Expense, Net

– Reported Interest Expense/(Income), Net

– Reported Losses/(Income) from Unconsolidated Subsidiaries, Net

+ Goodwill Amortization Expense, Net

– Unreported Employee Stock Option (ESO) Expense

– Cash Taxes on Core Earnings

– Reported Minority Interest Expense, Net

– Reported Preferred Dividends, Net

– Reported Dividends on Redeemable Preferred Stock, Net

= Core Earnings

Sources: New Constructs, LLC and company filings

For a more details on our calculation of core earnings, including details on the hidden and reported items we collect, click here. For details on the difference between the “Reported” and “Hidden” items, click here.

Earnings Distortion = Net Income Minus Core Earnings

Earnings distortion is the non-core, non-operating, and unusual gains/losses that must be stripped out when calculating core earnings. It equals core earnings minus reported earnings. Figure 3 shows the key components of core earnings distortion. The higher the earnings distortion, the more overstated reported earnings are. The lower the earnings distortion, the more understated reported earnings are.

Figure 3: Components of Earnings Distortion

+ Earnings Distortion from 13 Categories of Hidden Items, Net

+ Earnings Distortion from 13 Categories of Reported Items Pre-Tax, Net

+ Income Tax Distortion

+ Earnings Distortion from 2 Categories of Reported Items After-Tax, Net

= Total Core Earnings Distortion, Net

Sources: New Constructs, LLC and company filings

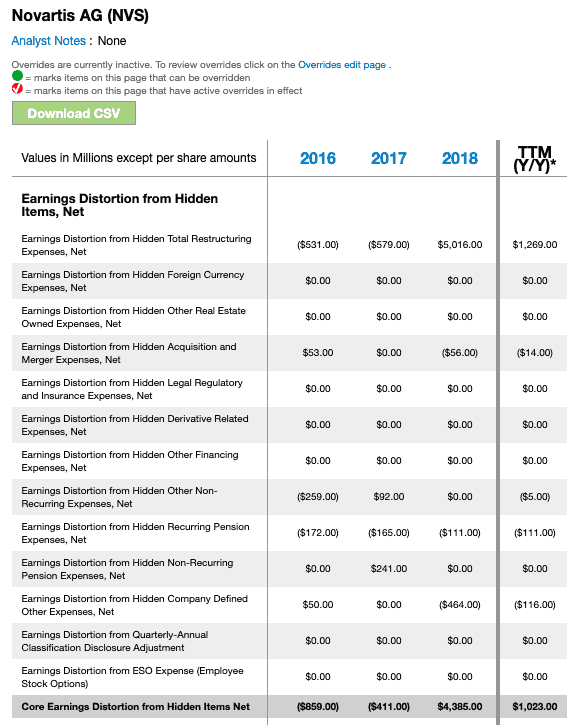

Figure 4 shows the 13 categories of “Hidden” items that we present on the Core Earnings pages in our company valuation models on over 5,000 stocks.

Figure 4: “Hidden” Items Details from our Models

Sources: New Constructs, LLC and company filings

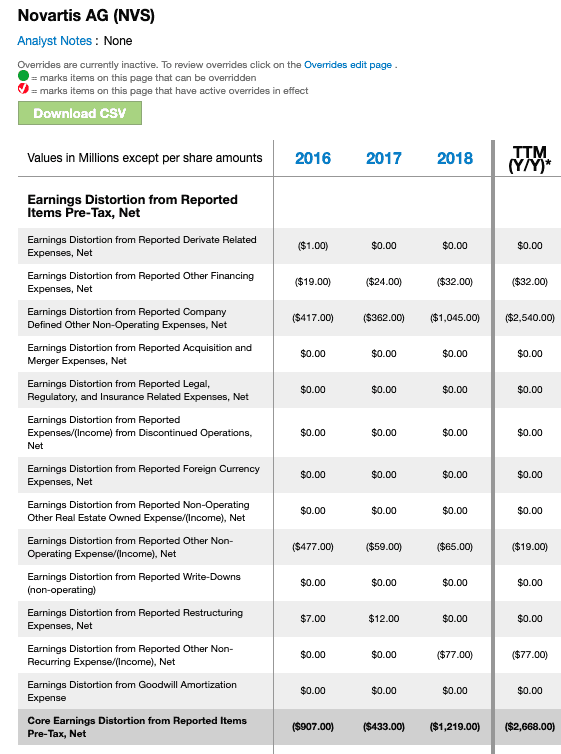

Figure 5 shows the 13 categories of “Reported” items we display on the Core Earnings pages in our company valuation models on over 5,000 stocks.

Figure 5: “Reported” Items Details from our Models

Sources: New Constructs, LLC and company filings

Clients who subscribe to our valuation models get access to all the data behind our calculations. Our models also provide audit-ability of all data back to the original 10-Ks and 10-Qs upon which our models are built.

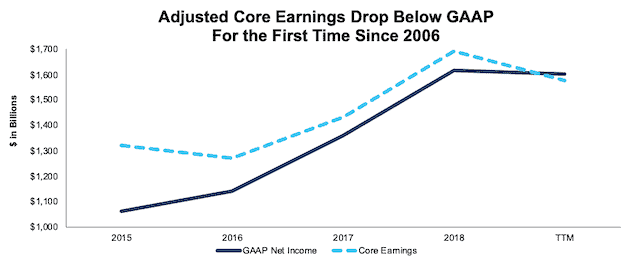

Applying Core Earnings & Earnings Distortion: Analyzing Market Trends

We leverage our database of footnotes adjustments and calculation of core earnings to spot trends across the market. Core earnings, over the trailing twelve months (TTM) period through November 18, 2019, fell below GAAP net income for the first time since 2006. Figure 6 shows that investors only looking at reported earnings would get a misleading picture of profitability across the market. Over the TTM period through November 18, 2019, GAAP earnings fell 1% while core earnings fell 6%. More details are in our report on this topic.

Figure 6: GAAP Net Income vs. Adjusted Core Earnings: 2015-TTM (through November 18, 2019)

Sources: New Constructs, LLC and company filings.

This analysis is based on the top 1,000 companies by market cap in each measurement period.

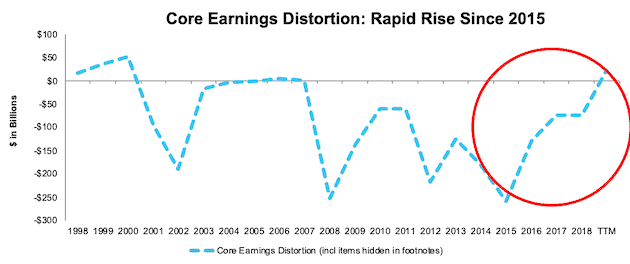

Furthermore, earnings distortion from hidden gains is on a rapid rise, and core earnings have not been this overstated since 2000. Figure 7 shows the level of earnings distortion from the unusual gains and losses since 2000. Note the rapid rise in the distortion from gains buried in footnotes over the last few years.

Figure 7: Core Earnings Distortion: Worst Since 2000 – Data Through November 18, 2019

Sources: New Constructs, LLC and company filings.

Notably, earnings distortion is positive for the first time since 2007, and the highest it’s been since 2000. Soon after earnings distortion broke into positive territory, in 2006-07 and 1998-2000, the market crashed.

This article originally published on January 16, 2020.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.