Last month, we highlighted the common bond between the stocks that delivered big returns in the market crash of 2008. We saw that companies that earned a consistently high return on invested capital (ROIC) were the only ones to survive unscathed.

While it’s unlikely we’re in for a repeat of 2008, recent volatility will certainly have investors wondering how to protect their portfolio in the event that our 7-year bull market has ended, and we’re in for a significant downturn.

With that in mind,

- They have high ROIC’s, 10% or higher in every year for the past decade

- They have consistent ROIC’s, among the lowest variance year-by-year of all S&P 500 stocks

- They earn our Attractive or better rating

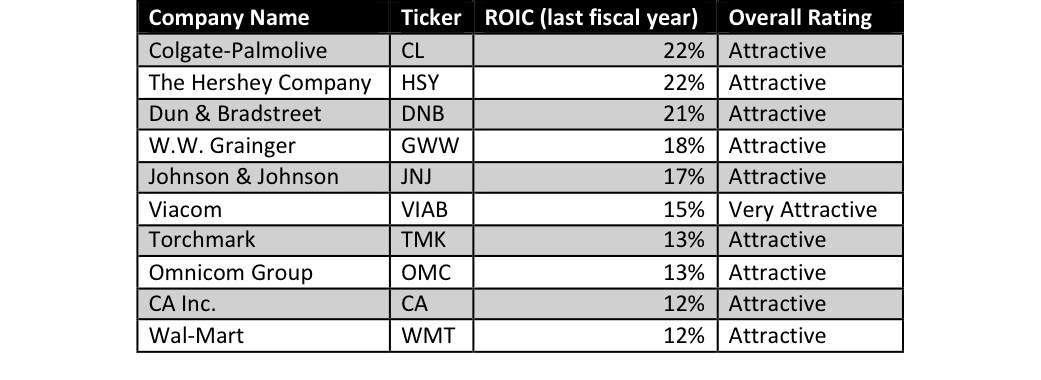

Figure 1: Best Stocks For A Bear Market

Sources: New Constructs, LLC and company filings.

Viacom (VIAB) is our top-ranked stock on this list, and the only one to earn our Very Attractive rating. We’ve liked VIAB for a long time, recommending it to investors back in 2012. Since then, the stock has been on a roller coaster ride, gaining almost 75% between our first article and its peak in early 2014 before crashing back down by 50%.

The recent decline is due in part to concerns over cord-cutting and increasing competition for ad dollars, as well as questions over the health of executive chairman Sumner Redstone, who owns 80% of the company’s shares.

These fears mask the fact that Viacom’s business continues to thrive. When we remove the impact of one-time write-downs and restructuring charges, we see that VIAB actually grew net operating profit after tax (NOPAT) by 7% in 2015 and increased its ROIC for the fifth straight year.

Make no mistake, this remains a very strong business. The continual improvement in ROIC shows that cord cutters are not hurting it as much as investors believe, and while Redstone’s health is a concern, he has not been heavily involved in running the business for several years now.

Not only is VIAB a strong business, the 50% drop over the past couple years means the market has already more than priced in any decline in profits that might occur. At its current price of $41/share, VIAB has a price to economic book value ratio (PEBV) of 0.5, which implies that the market believes its NOPAT will permanently decline by 50%.

At such a cheap valuation, VIAB can use its $3 billion in annual free cash flow to buyback stock, retiring shares at a undervalued price, thereby increasing the overall value for remaining shareholders. Last year, VIAB returned $2.1 billion (13% of market cap) to shareholders through dividends and buybacks, and that’s with the buyback program having been halted for roughly half the year. We can expect an even bigger return of capital to shareholders this year with the resumption of buybacks in October.

Buy This Blue Chip Retailer

Wal-Mart (WMT) is another stock we’ve been following for a long time that has been unfairly punished by the market over the past year. The market overreacted to some poor earnings reports to send shares of WMT down 27% in the last twelve months, even though the company still earns a 10.8% ROIC and has taken steps to reduce its debt load in the past year.

WMT is also the only stock on this list that also made it onto the list of stocks that gained 10+% in 2008, so it has proved its ability to thrive in a down market. Its 3% gain so far in 2016 as the rest of the market falls suggests that investors know this history and are already to flocking to one of the biggest blue chips around.

At its current price of $63/share, WMT has a PEBV of 0.8, which suggests that the market expects a permanent 20% decline in NOPAT. Even with the threat of Amazon (AMZN) and other online retailers, it’s hard to imagine a company with WMT’s track record of growth and profitability experiencing such a drastic decline.

Boring Can Be Beautiful

W.W. Grainger (GWW) is not the kind of company that tends to get investors excited. It’s an industrial supply company that sells motors, lighting, fasteners, plumbing, and other necessities to customers in a wide variety of industries.

Not the kind of business you expect to deliver massive returns, yet over the past decade GWW has nearly tripled the performance of the S&P 500. That’s due in no small part to the fact that, when the market crashed in 2008, GWW fell by less than 10%.

GWW’s products are the kinds that most business cannot do without. They do experience slight declines in revenues and profit during a recession, but nothing too significant. At its worst point in 2009, GWW still earned an ROIC of 13%.

GWW is not quite as cheap as some of the other stocks on this list, with a PEBV of 1.2, which means the market expects profits to grow by no more than 20% from current levels for the remainder of its corporate life. Those are still low expectations for a company with 12% compounded annual NOPAT growth over the past 10 years.

Finding Stability In A Volatile Market

The stocks in Figure 1 come from a number of different industries: media, consumer staples, advertising, tech, healthcare, etc. Their primary link is that they have proven their ability to thrive regardless of economic and market conditions.

Even in the troubled recession years, all these stocks continued to earn a top-tier ROIC. Over the past five years, they’ve had extremely low variance in ROIC, delivering consistently year over year rather than going from boom to bust.

These are the stocks you want to own when the market turns bearish. At that point, the high-flying momentum stocks that sell investors on their future potential sink like rocks. Only companies that consistently deliver strong cash flow can weather the market storm.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Magnus Johansson (Flickr)