We published an update on this Danger Zone pick on June 3, 2024. A copy of the associated report is here.

We’re reiterating a Danger Zone pick that recently reported calendar 3Q21 earnings. After missing both top and bottom line estimates, this business has still not recovered from the COVID-19 pressures and looks increasingly unlikely to achieve the high revenue and profit growth implied by its stock price. Eventbrite (EB: $21/share) is in the Danger Zone.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1] and shown to provide a new source of alpha, with qualitative research to highlight this firm whose stock presents poor risk/reward.

Eventbrite Has 86%+ Downside

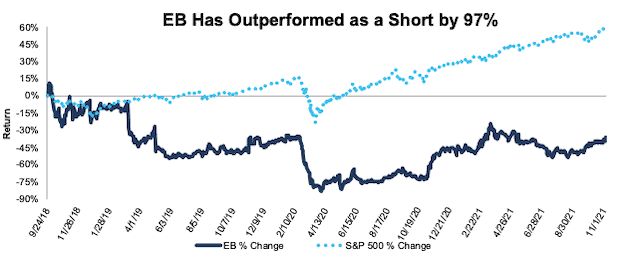

We put Eventbrite in the Danger Zone in September 2018 right after its IPO. Since our original report, the stock has outperformed as a short vs. the S&P 500 by 97%. After more than tripling from its March 2020 lows, and now trading at its pre-pandemic levels, the stock carries as much risk as ever. Add in the fact that the recent Astroworld tragedy will likely slow the return to pre-COVID “normalcy” for events, and the stock looks even more expensive.

Figure 1: Danger Zone Performance: From Original Report Through 11/5/21

Sources: New Constructs, LLC and company filings.

What’s Working for the Business: Given the unprecedented economic shutdowns that largely remained in place across the globe in 3Q20, it’s no surprise Eventbrite reported impressive year-over-year (YoY) revenue growth in 3Q21. Revenue jumped 144% YoY, which actually came in slightly below consensus estimates.

On a non-GAAP basis, Eventbrite’s adjusted EBITDA improved from $4 million in 3Q20 to $6 million in 3Q21. Investors should note Eventbrite’s adjusted EBITDA removes real costs of doing business, such as stock-based compensation and “other expense”, and is a poor representation of the firm’s true profits.

Going forward, Eventbrite expects fourth quarter paid ticket volume and revenue “will be higher than third quarter levels.” Consensus estimates for full year 2021 revenue growth is 75% YoY.

What’s Not Working for the Business

Below, we highlight some of the key challenges Eventbrite faces that make it unlikely to achieve the expectations baked into its stock price.

Stock Price Recovered Faster Than the Business. Investing in Eventbrite as a “reopening play” ignores that the company has yet to return pre-pandemic levels across key metrics despite many economies reopening around the globe. Furthermore, the event industry is likely forever changed by COVID-19, with so many events going permanently virtual for ease of access and cost savings. Meanwhile, Eventbrite’s stock price has tripled from its March 2020 lows and trades near its pre-pandemic levels.

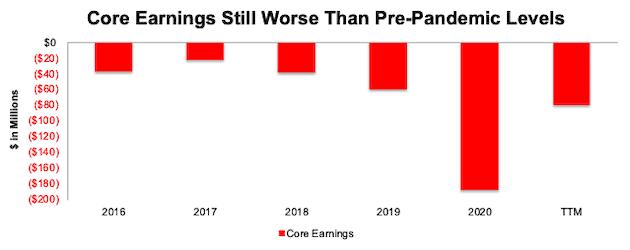

Despite impressive YoY growth, Eventbrite’s revenue over the trailing twelve months (TTM) remains 53% below 2019 revenue. Core Earnings, at -$79 million over the TTM, are worse now than in 2019, when they were a company best -$59 million.

In other words, Eventbrite was unprofitable, and losses were growing, before the pandemic. Now, a challenging post-pandemic event world (with differing local regulations and restrictions and lingering hesitancy from consumers) makes reversing its pre-pandemic downward trend in profits even more unlikely.

Figure 2: Eventbrite’s Core Earnings: 2016 – TTM

Sources: New Constructs, LLC and company filings.

Despite Personnel Cuts, Eventbrite Is Still Structurally Unprofitable. In April 2020, as countries began shutting down their economies, Eventbrite made the decision to lay off 45% of its employees. Such a large cut to personnel should create a more profitable business, but, it did not.

Through the first nine months of 2021, Eventbrite’s:

- general and administrative expenses were 48% of revenue, up from 30% of revenue in the same period in 2019

- product development costs were 38% of revenue, up from 19% of revenue in the same period in 2019.

- total operating expenses[2] were 143% of revenue, up from 119% of revenue in the same period in 2019.

Even with the rebound from the lows of 2Q20, Eventbrite’s TTM net operating profit after-tax (NOPAT) margin of -35% is lower than any year of our model, excluding 2020, which dates back to 2016.

Going forward, it will likely be more challenging to “re-scale” the business given that the company lost 45% of its people. A tough labor marker could also make it more difficult, and costly, to bring employees back.

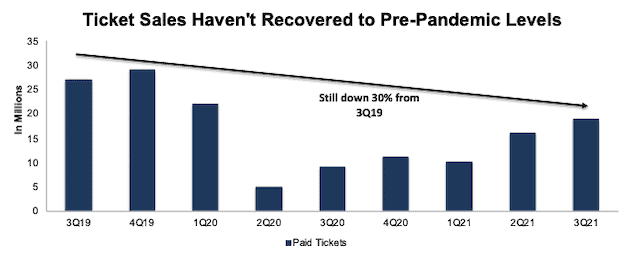

Ticket Sales Struggle to Recover to Pre-Pandemic Levels and Lag Competitors. Beyond the top and bottom line, Eventbrite’s 3Q21 paid ticket volume of 19 million is 30% below 3Q19.

For reference, Live Nation (LYV) sold 43.3 million paid tickets in 3Q21, or just 22% below 3Q19 levels. The recovery from COVID-19 is not complete, yet Eventbrite’s stock is priced as if the downturn never happened.

Figure 3: Eventbrite’s Paid Ticket Sales: 3Q19 – 3Q21

Sources: New Constructs, LLC and company filings.

Revenue per paid ticket has not recovered, either, and is trending down in the most recent quarter. Eventbrite collected $2.81 in revenue per paid ticket in 3Q21, which is less than $3.04 in 3Q19 and $2.89 in 2Q21.

Meanwhile, Eventbrite’s primary competitor, Live Nation, appears to be recovering from COVID-19 faster. In its 2Q21 earnings release, Live Nation noted that Ticketmaster North America recorded its 4th best month in history for transacted ticket volume and that its U.S. concerts division put the highest number of shows on sale ever during a single month, “50% more than the next highest month back in March 2019.”

Competition in the Smaller Ticket Market is Plentiful. While Live Nation caters to larger events, such as sports and concerts, Eventbrite’s focus on smaller, simpler events invites more competition. Below, we present just some of the many Eventbrite alternatives in the ticketing/event industry, and where disclosed, the number of tickets sold or users of each platform:

- Facebook Events (by Meta Platforms [FB]) – used by 700mm people each month

- Ticketmaster/Live Nation (LYV) – sold 76 million paid tickets in first nine months of 2021

- CTS Eventim – sold 7.5mm tickets in first half of 2021

- OnZoom (by Zoom Video Communications [ZM])

- Mobilize

- Ticketbud

- EventBee

- Eventzilla

- HeySummit

- Fonteva Events

- Soapbox Engage

- Gather

- ZapEvent

- SimpleTix

This crowded competitive landscape minimizes Eventbrite’s (or any provider’s) pricing power for smaller events. Note Eventbrite’s profit margins have been persistently negative. The bottom line is that anytime Eventbrite raises its prices, it risks losing business to multiple other low-cost platforms, such as EventBee, which charges a flat rate of $1 per ticket sold. This margin pressure presents a real problem to investors who want Eventbrite to turn a profit or have any chance of achieving the revenue and profit growth expectations baked into its stock price.

Eventbrite Is Priced to Grow 9x Faster than the Industry

At $21/share, Eventbrite is currently priced as if it will become as profitable as Live Nation and grow 9x the projected industry growth rate in the coming years.

Specifically, to justify its current price of $21/share, Eventbrite must:

- improve its NOPAT margin to 3% (equal to Live Nation’s best ever margin in 2014, compared to Eventbrite’s -35% in TTM and best-ever margin of -8% in 2017), and

- grow revenue at a 54% CAGR through 2030 (9x projected industry growth through 2025).

In this scenario, Eventbrite would generate $7.7 billion in revenue in 2030, which is 50x its TTM revenue and 24x its pre-pandemic 2019 revenue. At $7.7 billion, Eventbrite’s revenue would be 67% of Live Nation’s pre-pandemic 2019 revenue.

This scenario also implies Eventbrite sells 2.8 billion paid tickets in 2030 (based on $2.75 in revenue per paid ticket sold over the TTM), which is 25x more than Eventbrite’s paid tickets sold in 2019 and nearly 13x the paid tickets Live Nation sold in 2019.

We think it’s overly optimistic to assume Eventbrite will reverse years of margin deterioration (even before COVID-19) while also growing revenue 9x the industry. Such a scenario effectively requires a complete return to pre-COVID operating procedures, which is no sure bet at this point. In a more realistic scenario, detailed below, the stock has large downside risk.

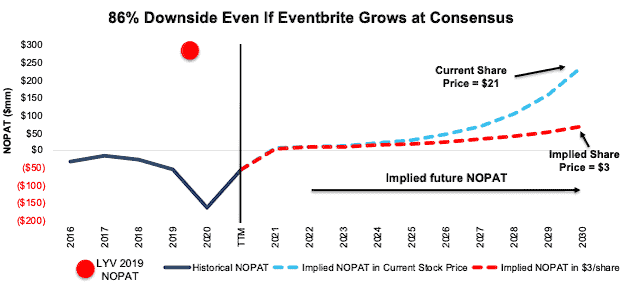

EB Has 86%+ Downside if Consensus Is Right: if we assume Eventbrite’s:

- NOPAT margin improves to 3% (Live Nation’s best ever margin) and

- revenue grows at consensus rates in 2021, 2022, and 2023 and

- revenue grows 30% a year in 2024-2030 (continuation of 2023 consensus estimates), then

the stock is worth $3/share today – an 86% downside to the current price. This scenario still implies Eventbrite’s revenue grows to 15x greater than TTM levels and 7x 2019 levels. If Eventbrite fails to grow revenue as quickly, or improve margins as much we assume for this scenario, the downside risk in the stock would be even higher.

Figure 4 compares Eventbrite’s historical NOPAT to the NOPAT implied by each of the above DCF scenarios. For reference, we include Live Nation’s’ pre-pandemic 2019 NOPAT.

Figure 4: Eventbrite’s Historical vs. Implied NOPAT

Sources: New Constructs, LLC and company filings.

Each of the above scenarios also assume Eventbrite grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely, but allows us to create best-case scenarios that demonstrate the extraordinarily high expectations embedded in the current valuation.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This article originally published on November 8, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, proven by professors at Harvard Business School & MIT Sloan and featured in The Journal of Financial Economics.

[2] Includes cost of revenue, product development, sales, marketing, and support, and general and administrative.