It’s no secret that non-GAAP earnings allow management to directly manipulate their performance metrics. Investors must look past non-GAAP metrics to protect their portfolios. While non-GAAP tricks may provide some short-term boosts to stock prices, eventually reality sets in and the true economics of the business rule the day.

Why Non-GAAP Can’t Be Trusted

We spend lots of time explaining how GAAP earnings are not reliable measures of corporate profits, and non-GAAP earnings are worse. Most of the time non-GAAP earnings are blatant misrepresentations of profits for the benefit of corporate insiders at the expense of regular shareholders. Case in point is one of Bill Ackman’s favorites: Valeant Pharmaceuticals (VRX). That stock has cratered recently on the heels of long overdue coverage of its questionable accounting practices, about which we warned investors back in June 2014.

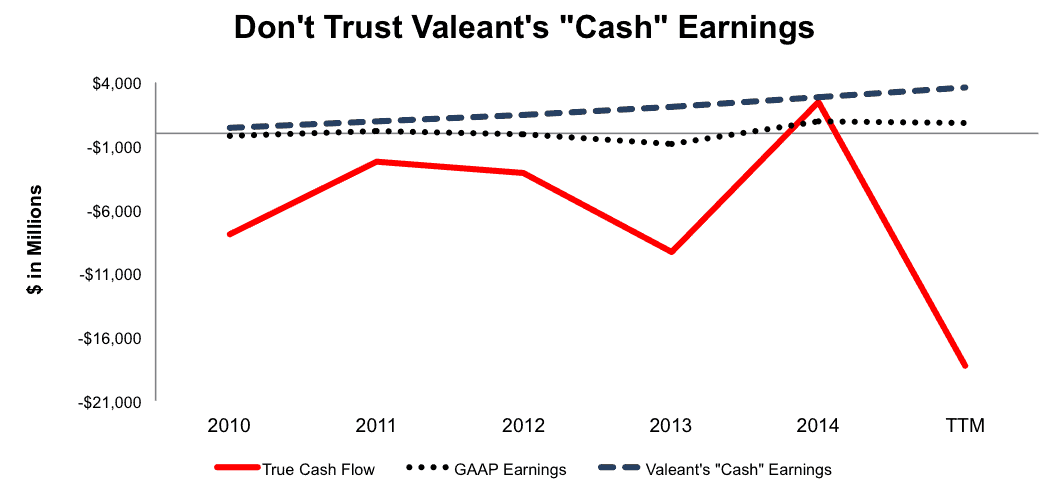

While arguments may persist over the future of Valeant, one thing is clear: the company’s use of non-GAAP earnings, or as they call it, “cash earnings”, has only misled investors while serving executives in four distinct ways. Since management wants investors to focus on cash, not earnings, we find the discrepancy between Valeant’s “cash earnings” and the company’s true cash flows alarming. Figure 1 shows: while the company’s “cash earnings” have been highly positive and grown from $421 million to $3.55 billion from 2010 thru the latest trailing-twelve-months (TTM), free cash flow has been highly negative with a cumulative -$38.4 billion in losses over the same time frame. Cumulate non-GAAP earnings, during the same time, are $11.2 billion.

Figure 1: Valeant’s Non-GAAP Tricks Have Tells For Those Who Look Closely

Sources: New Constructs, LLC and company filings

Non-GAAP Leads Investors Farther Away From The Truth About Profits

The key point for investors to remember about non-GAAP earnings is they are like lipstick on a pig. They only cover up the ugly, and they cannot change it. The more managers have to adjust GAAP, the worse the situation is likely to end for investors. Non-GAAP tricks may work for a while, but they cannot disguise a bad business forever. Another example is Demandware. After rising 160% from January 2013 to June 2015, DWRE is down 36% since we placed it in the Danger Zone on June 23, 2015.

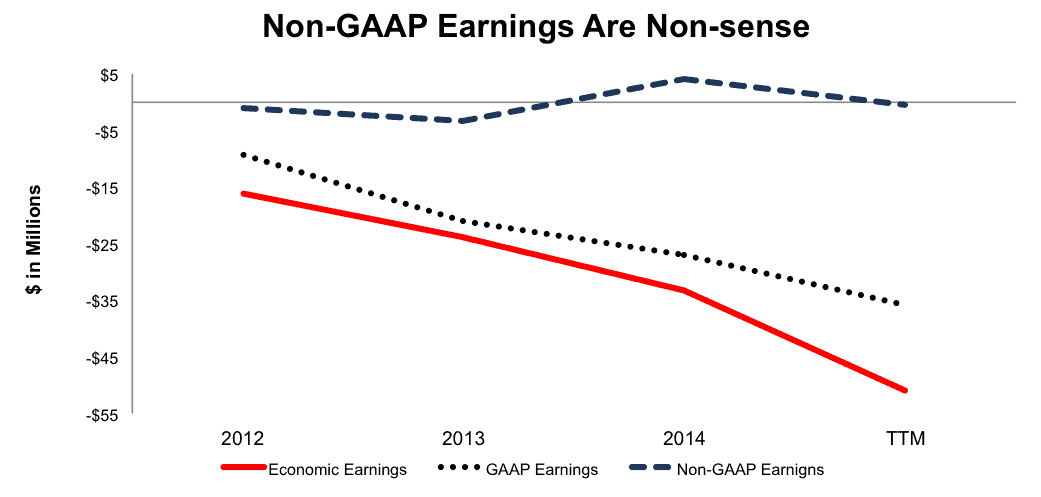

Figure 2 shows how much Demandware tried to fool investors by pedaling non-GAAP earnings while GAAP and economic earnings were headed in the opposite direction. Only after the stock has cratered do we see non-GAAP earnings decline. Note that the current decline in non-GAAP sets management up for an easier comparison in subsequent reporting periods as well.

Figure 2: Demandware’s Non-GAAP Creates Illusion of Profits

Sources: New Constructs, LLC and company filings

Expenses Management Excludes To Create Non-GAAP Earnings

Because non-GAAP earnings are entirely at the discretion of management, any number of items can be removed from traditional GAAP earnings. The following are just some of the items we have come across that companies remove from GAAP earnings to calculate non-GAAP or “adjusted earnings”:

- Stock based compensation

- Payroll tax expense related to stock based compensation

- Compensation expense related to contingent retention bonuses

- Acquisition related expense

- Depreciation and amortization

- Foreign exchange effect on revenue

- Purchases of property and equipment/ property and equipment purchased under capital lease

- Unrealized gain/loss on fuel price derivatives

- Deferred loan costs associated with extinguishment of debt

- Gains on divestiture

- Preopening expenses

- Management recruiting expenses

- Management and consulting fees

- General and administrative expenses

- Litigation expenses

- Integration costs

- Restructuring costs

- Gross profit deferred due to lease accounting

As should be clear, companies are removing not only a large amount of items, but also items that should most certainly be included when determining a business’s profitability. We find it hard to accept any argument for the removal of certain, natural costs of doing business like consulting fees, recruiting costs and compensation costs.

Details On How Companies Exploit Non-GAAP Earnings

The following examples are just a sampling of how management is creating the illusion of higher profitability.

- Wex, Inc. (WEX) – Click here to see the non-GAAP reconciliation

- Wex adds back certain acquisition expenses, non-cash tax adjustments, stock based compensation, and amortization of intangible assets to calculate adjusted net income. The company also removes certain income items such as the unrealized gain on derivatives and gain on divestitures. When totaled in 2014, the adjustments actually caused adjusted net income to be lower than GAAP net income. While this may seem counter intuitive, this is not a problem because the magnitude of beating targets is not nearly as important as just beating targets when using non-GAAP earnings to boost executive pay. In addition, this lowered adjusted earnings number will set up an easy comp in 2015.

- Marketo, Inc. (MKTO) – Click here to see the non-GAAP reconciliation

- Marketo is very transparent about all the items it removes from GAAP earnings and actually breaks down how each item is removed from cost of revenues, gross profits, operating expenses, and net income. However, this doesn’t detract from the fact that Marketo removes these items to appear less unprofitable than they truly are. Marketo removed $25 million in stock based compensation in 2014, or nearly 17% of revenue to derive non-GAAP net income.

- Tesla Motors (TSLA) – Click here to see the non-GAAP reconciliation

- In addition to some of the other items mentioned above, such as removing $156 million in stock based compensation in 2014, Tesla treats its non-GAAP calculation in a unique manner. Rather than just removing expenses to derive a non-GAAP net income, Tesla adds back deferred profits due to lease accounting. By adding this profit to net income, Tesla was able to report a non-GAAP net income of $20 million in 2014, compared to a GAAP net loss of $294 million.

- Demandware (DWRE) – Click here to see the non-GAAP reconciliation

- As shown above, Demandware uses non-GAAP net income to appear profitable when GAAP income and economic earnings both would prove otherwise. In 2014, Demandware removed $26 million in stock based compensation (16% of revenue) and $3 million in compensation expense related to contingent retention bonuses. Overall, Demandware reported a GAAP loss of $27 million in 2014, despite a non-GAAP profit of $4 million.

How Non-GAAP Could Harm Your Portfolio

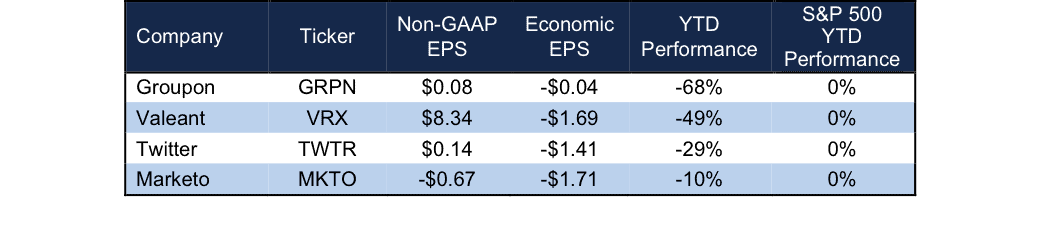

Look at the stocks in Figure 3 for a few more examples of how bad your portfolio can be burned if you trust companies using misleading non-GAAP results.

Figure 3: Non-GAAP Only Delayed The Inevitable

Sources: New Constructs, LLC

The stock market can be a dangerous place if you do not do your homework. Wall Street and corporate insiders are not afraid to trick you, and I think we have shown they have the lawful right-of-way to trick you. Investors need to do their homework in order to make the right investments consistently. To learn even more about the Dangers of Non-GAAP Earnings, watch our recent webinar and ensure you don’t get burned by non-GAAP earnings.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Al_HikesAZ (Flickr)

1 Response to "The Dangers of Non-GAAP Earnings"

Excellent explanation of VRX’s trickery.

Many Thx