The COVID-19 pandemic, and ensuing economic damage dropped Core Earnings[1] for the NC 2000, our proxy for an All Cap index, to the lowest level since September 2017. This report analyzes Core Earnings for the NC 2000 and each sector since 1998. It also compliments our large cap research on the S&P 500 and its sectors.

The NC 2000 consists of the largest 2000 U.S. companies by market cap in our coverage. Constituents are updated on a quarterly basis (March 31, June 30, September 30, and December 31). We exclude companies that report under IFRS and non-U.S. ADR companies.

Our measure of Core Earnings leverages cutting-edge technology to provide clients with a cleaner and more comprehensive view of earnings[2]. Investors armed with our measure of Core Earnings have a differentiated and more informed view of the fundamentals of companies and sectors.

Within the NC 2000, only the Technology, Consumer Non-cyclicals, and Healthcare sectors saw a rise in Core Earnings since the end of 2019, same for the S&P 500. The Core Earnings improvement in these sectors makes sense, as the shift to work-from-home, pantry loading, and a V-shaped recovery in healthcare spending drove a stronger rebound in these sectors than others.

Rankings the Sectors by Core Earnings Growth

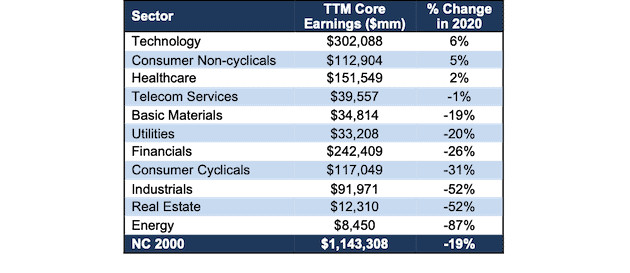

Figure 1 ranks all 11 NC 2000 sectors by the change in Core Earnings from the end of 2019 through 11/17/20.

Figure 1: TTM Core Earnings Through 11/17/20 vs. Last year by NC 2000 Sector

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents.

The Technology sector generates the most Core Earnings by far (nearly 25% more than the next closest sector) and grew Core Earnings by 6% thus far in 2020. On the flip side, the Energy sector has the lowest Core Earnings and the largest drop since the end of 2019. Plummeting oil prices in early March followed by the COVID-19 shutdowns across the globe hit the energy sector hardest.

Details on the NC 2000 & 11 Sectors

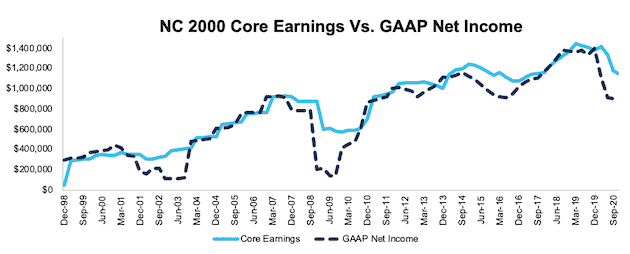

Figures 2-13 compare the Core Earnings and GAAP net income trends for the NC 2000 and every NC 2000 sector since December 1998.

NC 2000

Figure 2 shows the Core Earnings for the NC 2000 have fallen 19% since the end of 2019, which is less than the 36% drop in GAAP net income over the same time. Figure 2 also highlights the severe impacts brought on by the COVID-19 pandemic as Core Earnings for the NC 2000 sit at the lowest level since September 2017.

Figure 2: NC 2000 Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

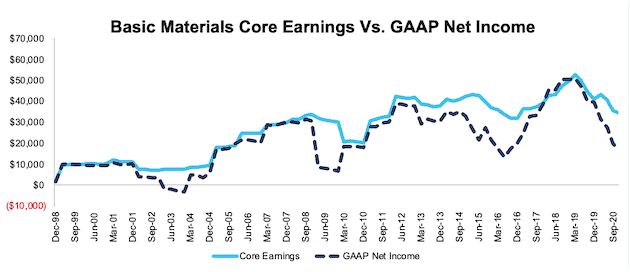

Basic Materials

Figure 3 shows Core Earnings for the Basic Materials sector peaked in mid 2019 and have fallen 19% since then. Asset write-downs, which occurred at record levels through the first half of 2020, help explain the disconnect between Core Earnings and GAAP net income.

Dupont De Nemours (DD), LyondellBasell Industries (LYB), and Dow Inc. (DOW) combined for write-downs of over $4 billion TTM, which equals 11% of the Basic Materials sector’s TTM Core Earnings.

Figure 3: Basic Materials Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

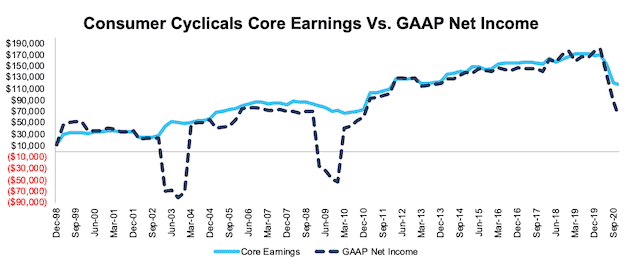

Consumer Cyclicals

Figure 4 shows that the COVID-19 pandemic impacted the Consumer Cyclicals sector differently than during the early 2000’s and Financial Crisis, when Core Earnings were largely unchanged. Global shutdowns and depressed leisure spending caused Core Earnings to fall 31% since the end of 2019. Despite the bad look for the sector, we highlight many Consumer Cyclicals stocks in the NC 2000 that present excellent fundamental risk/reward in our “See Through the Dip” Long Ideas.

Figure 4: Consumer Cyclicals Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

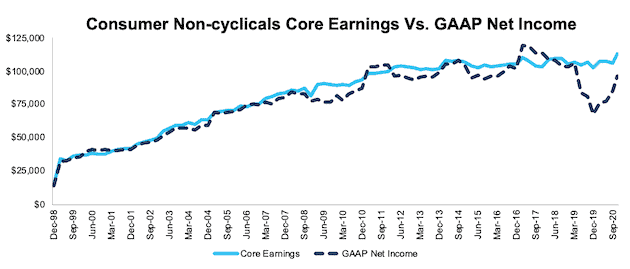

Consumer Non-Cyclicals

Figure 5 shows Core Earnings for the Consumer Non-Cyclicals sector have been relatively stable over time and rose 5% since 2019. However, investors looking at GAAP net income would have seen a much different picture. The drastic drop in GAAP net income in early 2019 is a result of Kraft Heinz’s (KHC) ~$16 billion write-down. Our Core Earnings remove such unusual charges, so investors get more accurate, and less volatile, views of profits.

Figure 5: Consumer Non-Cyclicals Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

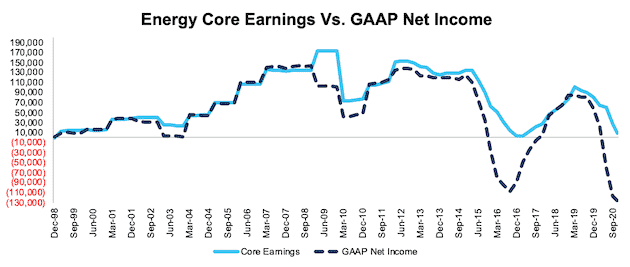

Energy

Figure 6 shows Core Earnings for the Energy sector have fallen 87% since the end of 2019 to levels last seen at the end of 2016. Five companies, Schlumberger (SLB), Occidental Petroleum (OXY), Marathon Petroleum (MPC), Concho Resources (CXO), and Baker Hughes (BKR) have the five largest write-downs. Combined, these firms reported over $47 billion in asset write-downs over the TTM, which explains the even larger drop in GAAP net income relative to Core Earnings.

Figure 6: Energy Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

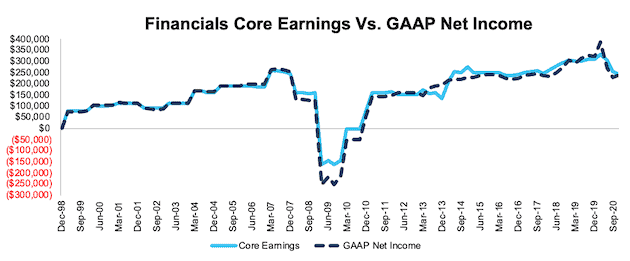

Financials

Figure 7 shows Core Earnings for the Financials sector, while down 26% since the end of 2019, have held up much better than during the Financial Crisis. The key difference between the two periods, as we pointed out in our Long Idea on JPMorgan Chase (JPM), is that many banks were the source of the problems that caused the Financial Crisis. On the other hand, today, Financial firms are playing a key role in the recovery.

Figure 7: Financials Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

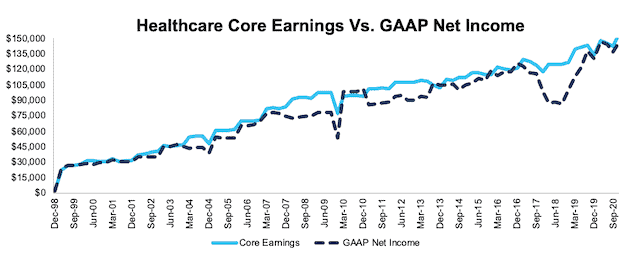

Healthcare

Figure 8 shows Core Earnings for the Healthcare sector have consistently increased since 1998 and are currently up 2% thus far in 2020. The consistent rise in demand for healthcare, after the initial drop in elective procedures during the onset of the COVID-19 pandemic, helps drive continued Core Earnings growth.

Figure 8: Healthcare Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

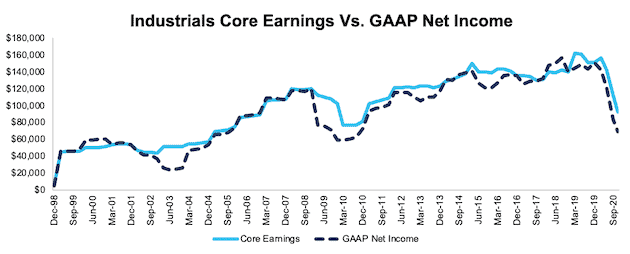

Industrials

Figure 9 shows the Industrials sector is particularly impacted by COVID-19, as Core Earnings have fallen 41% since the end of 2019. Not surprisingly, the Industrials sector, which is most exposed to the drastic drop in airline travel and reduced capex across the globe, bore much of the brunt of the global shut downs.

Figure 9: Industrials Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

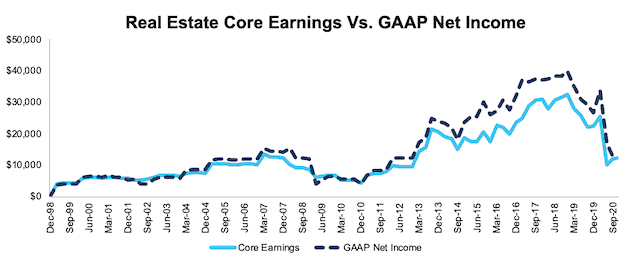

Real Estate

Figure 10 shows that after many years of consistent growth, Core Earnings for the Real Estate sector have fallen 52% since the end of 2019. This analysis also reveals the weakness in Real Estate firms outside of the S&P 500. The S&P 500 Real Estate sector’s Core Earnings have fallen just 14% since the end of 2019.

Figure 10: Real Estate Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

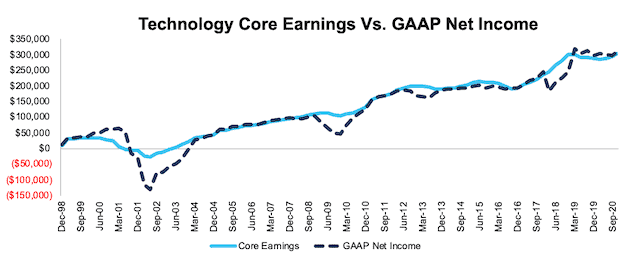

Technology

Figure 11 shows that not only have the Technology sector’s Core Earnings risen 6% thus far in 2020, they have consistently risen since bottoming in early 2002. Our analysis of the NC 2000 and S&P 500 Technology sector further illustrates the “Fool’s Gold” nature of the sector. For example, the 74 stocks in the S&P 500 Technology sector generated $304 billion in TTM Core Earnings while the 314 stocks in the NC 2000 Technology sector generated $302 billion in Core Earnings.

Figure 11: Technology Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

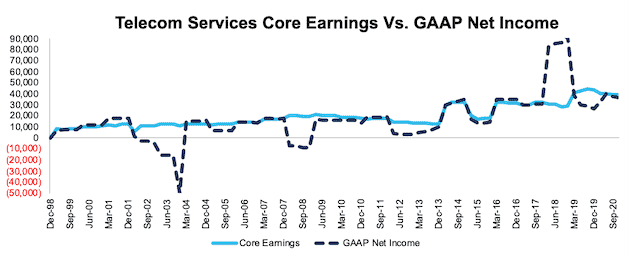

Telecom Services

Figure 12 shows Core Earnings for the Telecom Services sector, despite falling 1% since the end of 2019, have consistently improved since 1998. The significant jump in GAAP net income in 2018 come from the Tax Cuts and Jobs Act. At the time, we identified Verizon (VZ) and AT&T (T) as the biggest winners of tax reform, and in 2017, they recorded nearly $25 billion in combined income tax benefits. Note how our Core Earnings adjusts for the anomalous, one-time tax effects.

Figure 12: Telecom Services Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

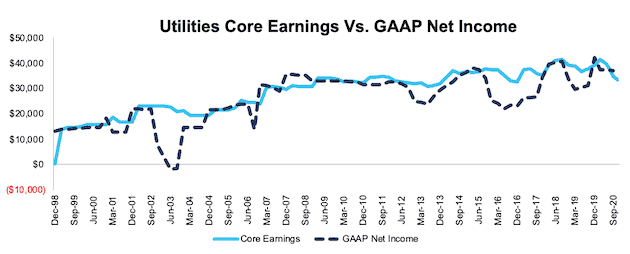

Utilities

Figure 13 shows the Utilities sector has consistently grown Core Earnings since 1998, but the sector’s Core Earnings have fallen 20% since the end of 2019.

Figure 13: Utilities Core Earnings Vs. GAAP: 1998 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

This article originally published on December 9, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our Core Earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. Recently accepted by the Journal of Financial Economics, the paper proves that our data is superior to all the metrics offered by S&P Global (SPGI).

[2] For 3rd-party reviews, including The Journal of Financial Economics, on the benefits of adjusted Core Earnings, historically and prospectively, across all stocks, click here and here.