Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

The S&P 500 Technology sector generates the most Core Earnings[1] and has the highest return on invested capital (ROIC) of all 11 sectors, as we noted in Only Three S&P 500 Sector’s Core Earnings Improved in 2020 and Only Two S&P 500 Sectors Have a Rising ROIC Through 3Q20.

While most investors might assume the entire sector is a good investment, deeper analysis reveals it is not because only a few large companies are highly profitable.

Investors must discern, at the individual stock level, which investments are good and bad because the macro view of the sector does not apply to all stocks.

Technology Sector Looks Highly Profitable From the Surface

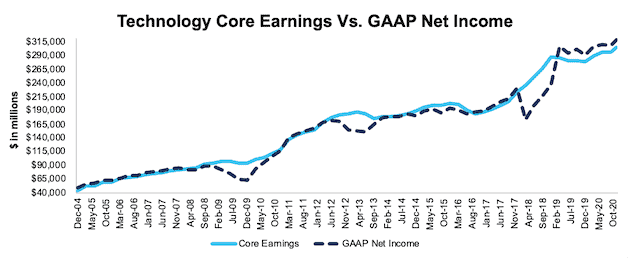

Figure 1 shows that not only did the Technology sector’s Core Earnings rise 6% thus far in 2020, they have consistently risen since December 2004. In fact, the Technology sector’s Core Earnings of $304 billion over the TTM are nearly three times that of the next closest sector, the Consumer Non-cyclicals sector at $103 billion.

Figure 1: Technology Core Earnings Vs. GAAP: 2004 – 11/17/20

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

Digging Deeper Reveals Fools Gold

When we look below the surface, we see that the Technology sector’s Core Earnings are unevenly distributed.

From the end of 2019 through 11/17/20, the Technology sector’s Core Earnings net a $16.4 billion increase. 44 firms (59% of the sector) grew Core Earnings over this time, for a total increase of $25 billion. 30 firm’s saw Core Earnings decline a total of $8.6 billion.

Of the 44 firms with improved Core Earnings since the end of 2019:

- Microsoft (MSFT), Apple (AAPL), Intel (INTC) and Facebook (FB) grew Core Earnings by $14 billion

- The remaining 40 firms grew Core Earnings by $11 billion combined.

In other words, since the end of 2019, four S&P 500 Technology firms grew Core Earnings by a greater amount than the other 40 firms with positive Core Earnings growth.

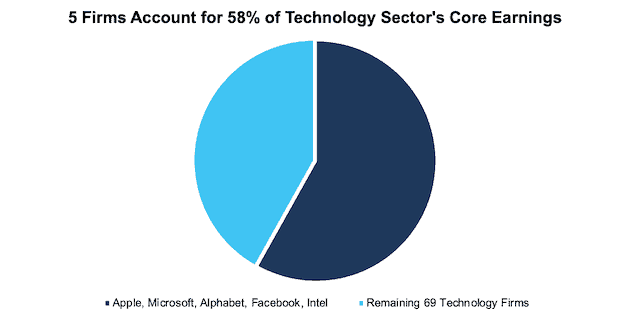

This dominance by just a few firms continues when we look at the overall Core Earnings of the entire sector and not just the change since the end of 2019. Per Figure 2, the four firms from above plus Alphabet (GOOGL) account for 58% of the Technology sector’s overall Core Earnings, which leaves 69 other firms generating the remaining 42%.

Put another way, 7% of the firms in the S&P 500 Technology sector generate 58% of the sector’s TTM Core Earnings.

Figure 2: Only a Few Firms Dominate Technology Sector Profitability

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in the measurement period.

Diligence Matters – Fundamental Analysis Provides Insights

The Core Earnings dominance from just a few firms illustrates why investors need to perform proper due diligence before investing, whether it be an individual stock and especially a basket of stocks through an ETF or mutual fund.

Those rushing to invest in the Technology sector and doing so blindly through passive funds are allocating to a significant amount of firms with declining Core Earnings. Worst of all, investors may be unaware of this deterioration because it is often overshadowed by a few standout performers.

Our measure of Core Earnings leverages cutting-edge technology to provide clients with a cleaner and more comprehensive view of earnings[2]. Investors armed with our measure of Core Earnings have a differentiated and more informed view of the fundamentals of companies and sectors, which allows them insights to find high-quality and low-quality stocks.

Where Not to Put Your Money

Leveraging our more comprehensive view of earnings, we identified 13 stocks in our Most Dangerous Stocks for Fiduciaries series of reports that we think present abnormally high risk. Of the 13 stocks, eight are in the Technology sector, including Spotify (SPOT), Dropbox (DBX), Box (BOX), Shopify (SHOP), Snowflake (SNOW), Uber (UBER), Pinterest (PINS), and Snap (SNAP). We also recently featured DoorDash (DASH), another tech stock, that is aiming to go public at an extremely unrealistic valuation.

The stocks in Figure 4 show companies whose Core Earnings declined so far during 2020.

Selling these stocks would provide most investors with more than healthy gains to reallocate to stocks with much better long-term prospects. Nevertheless, this strategy is directed more to fiduciaries than traders, who may see the recent price performance as reason for holding these positions. Fiduciaries need more than price momentum to justify investing in a given stock.

Figure 3: Most Dangerous Stocks for Fiduciaries With TTM Core Earnings Less Than 2019

| Company | Ticker |

| Spotify Technology | SPOT |

| Snap Inc. | SNAP |

| Beyond Meat | BYND |

| Carvana Co. | CVNA |

Sources: New Constructs, LLC and company filings.

This article originally published on December 7, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our Core Earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. Recently accepted by the Journal of Financial Economics, the paper proves that our data is superior to all the metrics offered by S&P Global (SPGI).

[2] For 3rd-party reviews, including The Journal of Financial Economics, on the benefits of adjusted Core Earnings, historically and prospectively, across all stocks, click here and here.