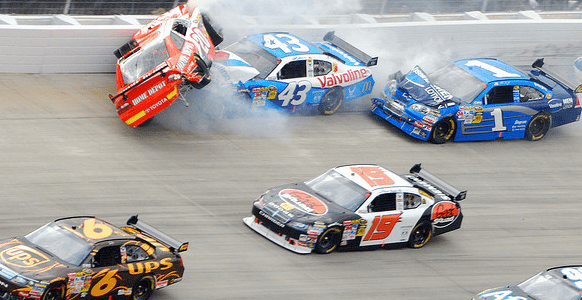

SolarCity’s Light Is Fading Fast

SolarCity Corp (SCTY: $50/share) wants to change the way Americans obtain electricity. So far, this goal has been extremely unprofitable, and the future profit outlook remains clouded.

Kyle Guske II, Senior Investment Analyst, MBA