Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

SolarCity Corp (SCTY: $50/share) wants to change the way Americans obtain electricity. So far, this goal has been extremely unprofitable, and the future profit outlook remains clouded. Nonetheless, SCTY is up over 300% since it IPO’d in 2012 and receives a 4-star rating from Morningstar. Widening losses in an uncertain industry and an expensive valuation lands SolarCity in the Danger Zone this week.

Another Profitless “Growing” Company

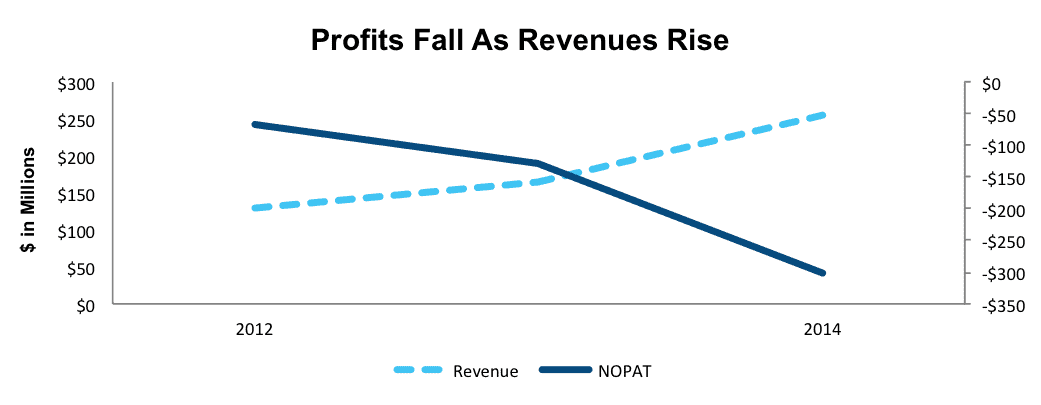

The perception of SolarCity benefits from the increased awareness and emphasis the United States is placing on alternative energy, including solar. However, this increased awareness has not led to increased profits. Since 2012, SolarCity’s after-tax profit (NOPAT) has fallen from -$66 million to -$300 million in 2014. When including quarterly results through 2015, NOPAT has fallen even further to -$404 million on a trailing twelve-month (TTM) basis.

Figure 1: Negative Profits Only Getting Worse

Sources: New Constructs, LLC and company filings.

SolarCity’s profitability issues manifest in the company’s declining NOPAT margins, which have fallen to an alarming -135% on a TTM basis. While revenues have grown 41% compounded annually since 2012, sales and marketing and general and administrative costs have grown 85% and 79% compounded annually, respectively. Essentially, the cost of attracting new customers and hiring more workers has far outpaced revenues.

Furthermore, SolarCity has a bottom quintile return on invested capital (ROIC) of -10%, which has fallen every year since the company went public in 2012.

SolarCity Faces Competition From Numerous Angles

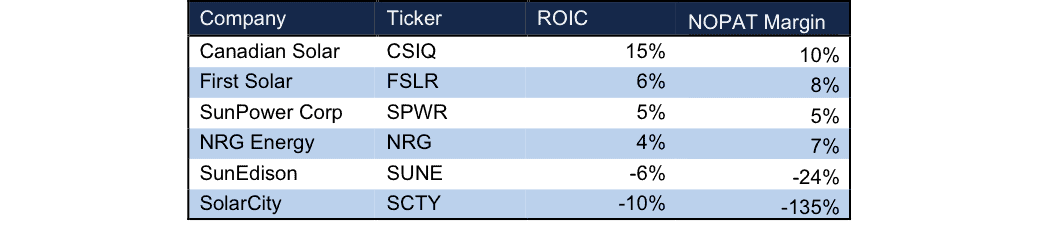

Incumbent energy providers, other alternative energy sources, and other solar panel providers and installers all pose significant competition to SolarCity. Per Figure 2, despite being one of the largest players in the solar industry, SolarCity earns a ROIC well below other solar companies and even below NRG Energy, a traditional utility that SolarCity identifies as a direct competitor.

Ultimately, the ability to compete in the energy industry will be predicated on cost control. With profit margins already well below the competition, becoming profitable looks to be a big struggle for SolarCity.

Figure 2: SolarCity is No Shining Light

Sources: New Constructs, LLC and company filings.

Capital Intensive Business Model Adds Risk

SolarCity operates in a market that is extremely capital intensive, and one in which positive returns on invested capital may not materialize for years to come, if at all. Making matters worse, the company fronts the initial cost of the solar panels, and then either leases them back to the customer over 20 years or provides the customer with a 30-year loan.

This business model leaves SolarCity with the task of servicing and maintaining these panels for the next three decades. Defaults on loans and changes in technology could greatly lower the value of SCTY because the company risks holding large uncollectable loan balances or potentially outdated or useless solar panels.

Changing Government Regulations and Investigations Add Risk

The Solar Investment Tax Credit (ITC) is a 30% tax credit for solar systems, which is set to fall to only 10% at the end of 2016. Industry analysis has shown that after the ITC steps down, only 3 out of 20 studied states will have solar power costs below that of traditional electricity rates. With a republican controlled congress, the likelihood of an extension of the ITC appears low. SolarCity has used this tax credit not only to generate revenue by selling it to investors, but also to lower the price it charges customers.

Apart from the possibility that SolarCity’s product may not be economically feasible if the ITC isn’t extended, the company faces many other legal issues. In 2012, the Inspector General of the U.S. Treasury and Department of Justice opened an investigation into whether SolarCity, among other solar companies, was inflating the market value of its installations to receive a higher tax credit and Treasury grant. No decision has been made but if the Inspector General determined that misrepresentations were made, SolarCity could face damages that would materially affect the liquidity and operations of the business. One study estimated that SolarCity was valuing installs around 28% higher than other companies from 2007-2011.

Bull Case Hopes Are Already Priced In

The bull case for SolarCity rests on many large assumptions. First, bulls tout the huge value of future revenues ($7 billion) SolarCity will receive from customer payments currently under contract. Management discounts the payments to arrive a their present value, called “retained value”, which is presented as a “better metric” to value the company. Not surprisingly, this “retained value” shows SolarCity to be in much better standing than the true cash flows of the business, which remain negative.

The first problem with this retained value is that it is based on a discount rate of 6% while we measure the firm’s weighted average cost of capital (WACC) at over 9%. With rising interests rates and the need for additional capital moving forward, a 6% discount rate seems generous. Second, 25% of the “retained value” is built upon the assumption that 90% of customers will renew their leases (which last 20 years) for an additional 10 years upon the initial expiration.

Another key to the bull case is SolarCity’s goal to achieve a cost per watt of $2.50 by 2017. This metric represents the installation, general and administrative, and sales cost to deploy 1 watt of power. Cost per watt conveniently excludes SG&A stock based compensation expenses. Achieving this cost per watt would allow SolarCity to provide competitive energy rates even without the ITC. However, this goal is no sure bet, despite what the valuation of SCTY implies. Since 3Q14, cost per watt has increased to 2.91 from $2.89. This increase can be attributed to installation cost declines being offset by SolarCity’s SG&A costs. As the company ramps up efforts to increase revenues, it’s unlikely these SG&A costs, and overall cost per watt, will reach the stated goal.

Lastly, bulls point to new forms of energy storage, such as Tesla’s home battery, as another reason to like the prospects of SolarCity. With a $3000 price tag in addition to the solar panels, there remains little evidence that energy storage will make solar panels any more attractive. However, as we’ll show below, achieving the best-case scenario for just about every element of the bull case is already baked into the stock price.

Stupid Money (Buyout) Risk

Because of their large market share (34% in 2014) of the solar industry, SolarCity could attract attention as a buyout candidate from traditional energy providers or even technology firms. SunEdison (SUNE) recently acquired Vivint Solar (VSLR), which was the second largest solar installer in 2014 for $2.2 billion. However, with no profits and over $2.1 billion in debt we find it hard to fathom a suitor for SolarCity would surface at its current price.

Impact of Footnotes Adjustments and Forensic Accounting

We made several adjustments to SolarCity’s 2014 reported financials:

Income Statement: we make $395 million of adjustments with a net effect of removing $245 million of unusual income (96% of revenue). We remove $75 million related to non-operating expenses and $320 million in non-operating income. The largest adjustment is the removal of $319 million of income related to losses attributable to non-controlling interests.

Balance Sheet: we make $1.1 billion worth of balance sheet adjustments to calculate invested capital with a net decrease of $716 million. The largest adjustment is the removal of $883 million due to midyear acquisitions. This adjustment represents 22% of reported net assets.

Valuation: we make four adjustments for a net decrease of $2.7 billion. There are no value increasing adjustments. The largest adjustment to shareholder value is the removal of $597 million related to the fair value of minority interests. These liabilities represent 12% of SolarCity’s current market cap.

Valuation Is Out of Reach, Even in Best Light

As it stands, SolarCity has a NOPAT margin of -135% on a TTM basis and gross margins around 42% in 2Q15. Assuming the ITC is extended and SolarCity is able to maintain gross margins, to earn a positive NOPAT margin the company must drastically lower its sales and marketing expenses, which undermines customer growth potential going forward.

Nevertheless, if we assume a best-case scenario and SolarCity achieves a NOPAT margin of 20% (higher than the 15% average of electric utility companies), the company would have to continue growing revenue by 40% compounded annually for the next 10 years to justify its current price of $50/share. This scenario implies SolarCity’s revenue growth would continue unabated by the cuts in SG&A and reach $7 billion within a decade.

However, in a more likely, and still optimistic scenario, one in which the ITC is not extended and SolarCity sees its gross margins take a hit; the valuation is even more alarming. If SolarCity can achieve a 15% NOPAT margin (equal to utility companies but still higher than competitors CSIQ, FSLR, SPWR) and grow revenues by 30% compounded annually for the next 10 years, the stock is only worth $9/share today – an 82% downside.

Any NOPAT margin below 15% returns a negative equity value in our DCF model. It’s hard to argue how SolarCity’s business operations justify its current share price.

Loss of Tax Credit and Cost Per Watt Miss Will Push Shares Downward

We see two particular events that could propel SCTY down in the near future. First, if the ITC is not extended, investors may question the feasibility and competitiveness of the SolarCity business model. In turn, expect SCTY to decline when the expected ITC step-down becomes reality. Second, if SolarCity’s cost per watt rises again, or even if it decreases but at a slower rate, we believe shares will move lower as the market realizes the assumptions baked into the current stock price are overly optimistic and not likely to be met.

Short Interest is Very High

Short interest stands at 23 million shares, or 24% of shares outstanding. The market has certainly recognized the potential for downside risk in SCTY.

Heavy Insider Selling, Not Much Buying

In the past 12 months, the stock is down 28% as insiders have sold 13 million shares and bought only 1.8 million shares, for a net of 11.2 million shares sold or 12% of all shares outstanding.

Executive Compensation Not Based On Profits

SolarCity executives, aside from their annual salaries, are paid largely in the form of stock options. These stock options are granted based upon a performance objective specific to each executive. These performance objectives relate to total megawatts deployed, cost per watt, customer growth, and even “financial operations efficiency”. These objectives are also used in the determination of annual cash bonuses. Rather than paying executives over $38 million (aggregate fair value of equity awards) last year, we suggest SolarCity pay executives based on more shareholder friendly criteria, like profits.

Dangerous Funds That Hold SCTY

The following ETF allocates significantly to SCTY and earns our Very Dangerous rating.

- First Trust NASDAQ Clean Edge U.S. Liquid Series Index ETF (QCLN) — 5.8% allocation to SCTY and Dangerous rating

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.

Photo Credit: Steve Jurvetson (Flickr)

3 replies to "SolarCity’s Light Is Fading Fast"

“Jim Chanos Calls SolarCity A ‘Financing Scheme,’ Says Oil Pain Not Over”

Read more: http://www.benzinga.com/analyst-ratings/analyst-color/15/10/5929351/jim-chanos-calls-solarcity-a-financing-scheme-says-oil-p#ixzz3q5CY7bSm

SolarCity down 22% today as earnings show that rising SG&A costs continue to offset any decline in installation cost and guidance for year-over-year installed megawatts significantly lower than current growth rates.

SCTY down 13% today and over 20% this week as Nevada votes to adopt regulations that raise fees and lower credits for solar-powered homes. Now down 27% since Danger Zone report publish date.