We’ve long held the insurance industry in high regards due to its inclination toward consistent profit growth. Nonetheless, it is still up to the merits of individual companies to carve out their own place within the insurance realm. This week’s stock pick has done just that. Shareholder friendly management, strong profit growth, and a cheap valuation led us to make Universal Insurance Holdings (UVE: $26/share) our Stock Pick of the Week.

Revenue Growth That Translates to Profit Growth

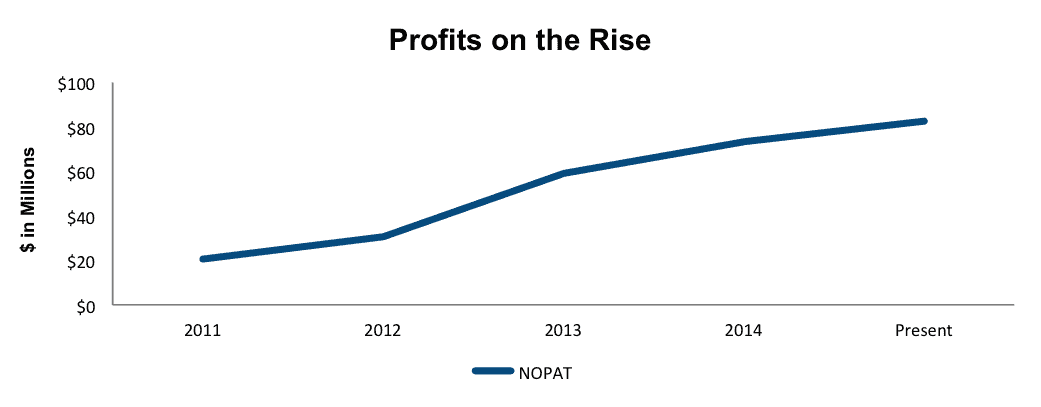

Universal Insurance has an impressive long-term track record. Since going public in 2007, the company has grown revenues by 10% compounded annually. More importantly, this revenue growth has translated into after-tax profit (NOPAT) growth of 5% compounded annually over the same time frame.

Profit growth has only accelerated in more recent years, as NOPAT has grown by 53% compounded annually since 2011. When taking into account 1Q15, NOPAT is up to $82 million on a trailing-twelve month (TTM) basis, which represents the highest profits Universal Insurance has ever achieved.

Figure 1: Consistently Increasing Profits

Sources: New Constructs, LLC and company filings

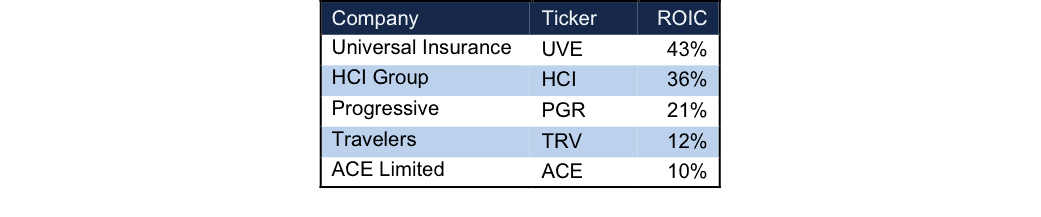

Profit growth isn’t the only positive in regards to Universal’s business. The company earns a top quintile return on invested capital (ROIC) of 43%, which is up from 16% in 2011. In addition, Universal has improved its NOPAT margin to 21% from 9% in 2011.

Management Has Superior Discipline

The insurance industry has numerous entrants looking to level the playing field. Universal excels in this industry by effectively managing the capital deployed into the business and exercising careful discretion in regards to risk. In 1Q15, management noted,

“Our focus on long term capital strength and growth leads us to be selective in the risks we are willing to accept, which may limit the number of policies written. In contrast, from time to time, some of our competitors lower their premiums to a level that is below what we believe to be adequate in order to generate and maintain capital and surplus for the protection of our Insurance Entities and our policyholders.”

This prudent decision to maintain premiums at a profitable and risk adverse level is something we wish we saw from more executive teams. Effective management like this often manifests in other tangible aspects, such as ROIC. Universal Insurance earns the highest ROIC of all 48 property & casualty insurers currently under coverage.

Figure 2: Competitive Position is Strong

Sources: New Constructs, LLC and company filings

The Bear Case is Not Specific to Universal

Much of the bear case surrounding Universal Insurance is the same for nearly all other insurance providers. With a large portion of their policies in Florida, Universal’s profitability would be severely hampered in the event of a natural disaster in the area. This kind of risk is not specific to Universal, however, and regardless of weather events, insurance products will always remain in demand. When all insurance companies share the same inherent liability, it does not make sense to avoid investing in one of the best companies in the industry, especially one that the market has undervalued.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we have made several adjustments to Universal Insurance’s 2014 10-K. The adjustments are:

Income Statement: we removed $1 million in non-operating expenses. The largest adjustment made was the removal of less than $1 million (<1% of revenue) related to the write down of assets hidden in operating line items. There were no non-operating income adjustments meaning the net effect of adjustments was $1 million.

Balance Sheet: we made $36 million worth of balance sheet adjustments to calculate invested capital. The largest adjustment made was the removal of $22 million due to midyear acquisitions. This adjustment represented 10% of reported net assets.

Valuation: we made $15 million worth of adjustments. The largest adjustment to shareholder value was the removal of $15 million related to outstanding employee stock options. These liabilities represent 2% of Universal Insurance’s market cap.

Valuation Is Compelling

Considering the strength exhibited across Universal Insurance’s business, it is surprising that the market has not realized how undervalued shares are. At its current price of $27/share, Universal Insurance has a price to economic book value (PEBV) ratio of 1.1. This ratio implies that the market expects Universal’s NOPAT to increase by no more than 10% over its corporate life. Given that Universal has grown NOPAT by five times that over the past four years, this expectation is rather pessimistic.

If we give Universal Insurance credit for 16% compounded annual NOPAT growth over the next five years, the stock is worth $45/share today – a 66% upside.

Propelling Shares Higher

After 1Q15 results were announced, UVE quickly jumped 4%. The stock has since traded lower and is only up 1% from its quarterly release. With the positive developments in 1Q15, such as net premiums written growing 50% year over year and lower cession rate creating future growth in premiums, 2Q15 could present a great opportunity to propel UVE higher. In addition, Universal further expanded its geographical reach, as it has started writing housing policies in Indiana and received licensing in Pennsylvania. Geographical expansion will allow for more outlets to grow the business.

Executive Compensation Plans

The majority of the compensation received by Universal executives is determined by their individual employee agreements. Base salaries are set and cash bonuses are paid on an annual basis, with the amount received tied to either pre-tax income or after-tax profit, depending upon the executive. Stock based awards were given per each executive’s employment agreement as well. At the end of 2014, the compensation committee made the decision to end an automatic increase in salaries for certain executives. In addition, the committee chose not to grant any further stock options as they develop a new compensation program that will rely on more efficient metrics (haven’t been decided upon yet) than pre-tax income and after-tax profit.

Share Buybacks

Universal Insurance repurchased 1.1 million shares in 2014, or 3% of shares outstanding

Attractive Funds That Hold UVE

- Arrow QVM Equity Factor ETF (QVM) – 2.2% allocation and Very Attractive rating

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: CheapFullCoverageAutoInsurance.com (Flickr Creative Commons)

2 replies to "A Quality Business in a Profitable Industry"

As of 4/4/16, this stock is down about one-third from the price in this article. The article states that the “bear case” is not specific to UVE. But since the original article was published, Anthony Bozza of Lakewood Capital argued that UVE is a great short. His claims include: (1) UVE has grown most by gaining market share in the most hurricane prone areas of Palm, Broward and Dade counties, (2) UVE has underestimated hurricane risk and does not have sufficient reserves, saying that competing insurance companies have much more equity per dollar of risk, and also arguing that under-reserving artificially inflates profits (3) the auditor, Plante & Moran, is a small firm that suspect for a large public company, (4) UVE is not rated by AM Best, and gets a D- from Weiss, and (5) CEO compensation since 2003 has been 23% of earnings, and (6) the CEO was arrested 5 times from 1990-2013, and perhaps is not trustworthy.

If the value was solid when the article was written, it is even better now. If you have changed your view, that would be great to know as well. I think value investors know that they often must be patient to see results. But sometimes fundamentals change. Your updated insights would be appreciated.

We continue to see UVE as a strong business and a great value. The company’s growth in areas outside Florida, along with the fact that a number of other Florida-based insurers are not covered by AM Best, leads us to believe the risks discussed by short-sellers are overstated. The CEO compensation is a negative, but the company’s high ROIC and cheap valuation outweigh that concern for us. UVE continues to earn our Very Attractive rating due to its 42% ROIC and 0.6 PEBV