We closed this position on February 8, 2019. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

As we wrote in our recent report, “Bursting the Micro-Bubble – Part 1”, a bubble exists in certain stocks whose valuations are disconnected from their fundamentals. Despite the 48% drop from its IPO, Snap’s valuation still puts it in a micro-bubble.

As we’ll show below, many of the issues that plagued Snap at IPO have only gotten worse and as a result, Snap Inc. (SNAP: $12/share), and its micro-bubble, is already in our Focus List – Short Model Portfolio, and once again back in the Danger Zone.

Decelerating User Base Exacerbates Competitive Disadvantage

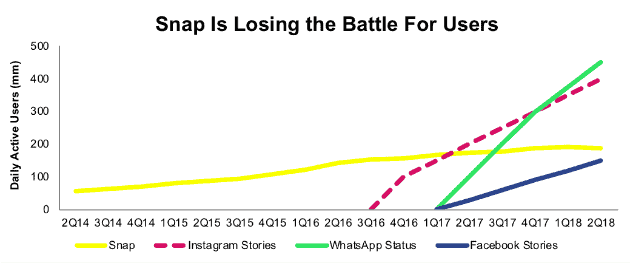

It’s hard to buy any of the Snap story when its daily active users (DAU) are falling further behind its competition.

Snap’s daily active users reached 188 million in 2Q18 (+8% year-over-year (YoY). For comparison, Facebook’s daily active users reached 1.47 billion (+11% YoY). More alarming is the speed at which Facebook’s copycat competition is growing, and surpassing, Snap in DAU’s. Per Figure 1, Instagram Stories, launched in August 2016, reached 400 million DAUs in 2Q18 (+60 YoY). WhatsApp Status, a Snapchat lookalike launched in February 2017, reached 450 million DAUs in May 2018 (+157% YoY). Lastly, Facebook Stories, another Snapchat clone that exists directly within the Facebook app launched in March 2017 and already has 150 million DAUs (no YoY comparison available).

Figure 1: Snap’s DAUs Dwarfed by Competition from Facebook

Sources: New Constructs, LLC, company filings, and company announcements

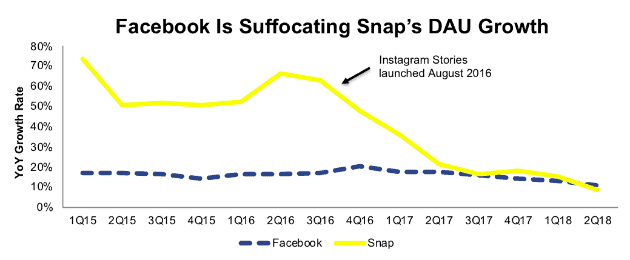

Per Figure 2, it’s clear that Snap’s growth has been negatively impacted since the launch of Instagram Stories, in August 2016.

At the end of 2016, Snap’s DAUs grew 48% year-over-year. This growth slowed to 18% YoY at the end of 2017, and has fallen further, to just 8% YoY through 2Q18.

Figure 2: Snap’s DAU Growth Is Decelerating Since Facebook Stepped into The Ring

Sources: New Constructs, LLC and company filings

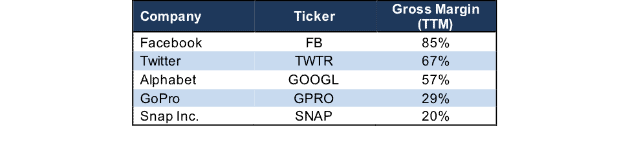

Advertising Giants Increase Competitive Pressure on Snap’s Margins

User base aside, Snap’s heavy reliance on advertising dollars (97% of 2017 revenue, up from 96% of 2016 revenue) pits it against some of the largest media/internet firms in the market. Specifically, Snap faces direct competition from Facebook (FB), Alphabet (GOOGL), Twitter (TWTR), and more. For comparison sake, we included GoPro (GPRO), as Snap claims to be a camera company (despite its failed attempt to make a camera). Per Figure 3, Snap’s trailing twelve months (TTM) gross margin ranks well below its main competitors and is closer to a hardware company like GoPro rather than a social media company.

Figure 3: Snap’s Margin Lags All Competition

Sources: New Constructs, LLC and company filings

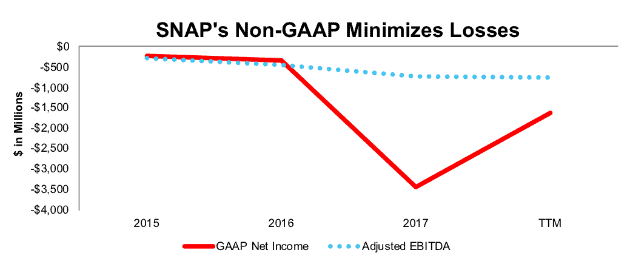

Non-GAAP Metrics Can’t Hide Losses

Snap remains highly unprofitable. Non-GAAP metrics are a red flag for investors because they often mask the true economics of the business as is the case with Snap. Snap’s adjusted EBITDA can only minimize, not eliminate (on paper) the true extent of its losses. Over the last twelve months, adjusted EBITDA is -$750 million, even as GAAP losses improved to -$1.6 billion (from $-3.4 billion), per Figure 4. GAAP losses only improved due to the outsized stock compensation expense in 2017 resulting from Snap’s IPO.

Figure 4: After Adjustments, Adjusted EBITDA is Still Negative

Sources: New Constructs, LLC and company filings

Snap’s adjusted EBITDA was -$720 million in 2017, compared to -$3.4 billion GAAP net income, and -$3.7 billion economic earnings. The largest item removed from adjusted EBITDA was stock-based compensation expense. Snap removed $2.6 billion (320% of 2017 revenue) in stock-based compensation expense last year.

Management Feels No Accountability to Investors

Snap’s co-founders hold all voting power in the company.

Snap’s latest “shareholder meeting” lasted only three minutes and consisted only of a recorded message from the company’s lawyer. The lawyer reminded investors that executives hold 96% of the voting rights and a more traditional meeting was unnecessary. A new board member was also announced via this recording.

Perhaps, if management cared more about creating shareholder value, it would spend time informing shareholders of their plans to make money at some point.

SNAP Still Priced as if It’s the Next Facebook, Despite Evidence to the Contrary

Despite trading 48% below the price its IPO opened at ($24/share), SNAP is still vastly overvalued. SNAP’s valuation indicates that a significant amount of noise traders[1] are still propping the stock up, as the expectations baked into its current stock price imply that SNAP will grow into a platform that rivals Facebook’s margins and market share.

Comparisons to Facebook make sense on the surface, since both compete for user engagement and must find ways to monetize users. Furthermore, the firms compete directly in the “photo-capture” aspects (with Facebook’s many Snapchat clones) of mobile applications and social media. However, these firms have vastly different economics, even when going back to Facebook in its infancy.

First, when Facebook went public in 2012, it’s NOPAT was $1.1 billion and the company achieved a 21% NOPAT margin whereas Snap’s NOPAT in 2016 was -$498 million with a -123% margin. Facebook has continued to grow its revenue, user base, and improve margins.

Second, when Facebook first entered the market, it did not have to unseat a large, firmly established and highly profitable incumbent. To become the next Facebook, Snap would need to take huge chunks of market share from Facebook, a feat it has proven unable to accomplish to date, while also drastically improving its margins. So, what does it all mean? How much lower could Snap fall as the noise turns negative and the fundamentals are exposed? Below, we model multiple scenarios for future cash flow performance baked into Snap’s current valuation.

How Much Risk? See Exactly What Snap’s Valuation Implies

- The Next Facebook: SNAP’s current valuation implies that Snap is the “next Facebook” and achieves the same economic success. Specifically, $12/share embeds expectations for Snap to achieve the same NOPAT margins as Facebook over its first five years as a public company (starting at 22% and rising to 32%) and grow revenue by the same 53% compounded annual rate. See the math behind this dynamic DCF scenario.

- A Better Twitter: This scenario implies that Snap can reach the same profitability as Twitter and still grow revenue at a much faster pace. To justify its current price in this scenario, Snap must immediately achieve an 11% NOPAT margin and grow revenue by 46% compounded annually for nine years. See the math behind this dynamic DCF scenario. In this scenario, Snap would be generating $25 billion in revenue (nine years from now), which is just over half of Facebook’s TTM revenue.

- A Lesser Twitter: this scenario implies that Snap is unable to reach Twitter’s profitability, as it struggles to provide a unique service (whereas Twitter is unique compared to Snap and Instagram) in the shadow of Instagram Stories. In this scenario, were Snap to achieve a 5.5% NOPAT margin and grow revenue by 40% compounded annually for the next decade, the stock is worth just $5/share today – a 61% downside. See the math behind this dynamic DCF scenario.

Do Investors Even Care About Fundamentals?

Just as it was at the time of its IPO, it remains hard to make a straight-faced argument for Snap at this valuation…if you care about fundamentals. For those that do care about fundamentals, it is wise to stay away from Snap.

The disconnect between fundamentals and valuation is a perfect sign of the rising influence of noise traders in the market. These traders make investment decisions based on narratives, momentum, or stories and have no regard for fundamentals. Noise trading can be successful over the short term, but it usually ends very poorly over the long term.

While Snap was once buoyed by positive user growth, soaring revenue, and “promise” of future results, those trends have diminished. When the noise shifts toward the negative, the drop in this stock could be precipitous.

This article originally published on August 13, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Shiller, Robert J., et al. “Stock Prices and Social Dynamics.” Brookings Papers on Economic Activity, vol. 1984, no. 2, 1984, pp. 457–510. JSTOR, JSTOR, www.jstor.org/stable/2534436.