We closed this position on November 16, 2020. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and Marketwatch.com.

The Williams Companies, Inc. (WMB) is in the Danger Zone this week. This stock is a great example of another Wall Street trap to avoid: investing based on “sector” theme and following the crowd.

Don’t Believe the Hype

Wall Street loves to hype stocks that are part of a sector with exposure to growth potential. The focus is on larger economic trends while the idiosyncratic fundamentals of each stock are ignored. According to Thomson/First Call on Yahoo, the average analyst rating on this stock is between “Buy” and “Strong Buy”. There are no “underperform” or “sell” ratings. Beware whenever everyone on Wall Street is on the same page.

WMB is certainly in a good sector. There is great growth potential in most things related to natural gas as our economy continues to shift to using it as our chief source of energy. The catch is that WMB is not likely to translate the industry’s growth into returns for investors.

The nature of its business, its management failures, and the high expectations built into its stock price make it much riskier than most realize.

Management’s Failures

The primary responsibility of management is to create value with the capital given it by investors. My forensic analysis of WMB’s balance sheet shows that management has destroyed value instead of creating it.

Review of the financial footnotes reveals nearly $3.5 billion in asset write-downs over the last several years. If you do no think that is bad, then consider that $3.5 billion in write-offs equates to management destroying almost 20 cents of every dollar on the company’s 2012 balance sheet. That stat is a big red flag for investors.

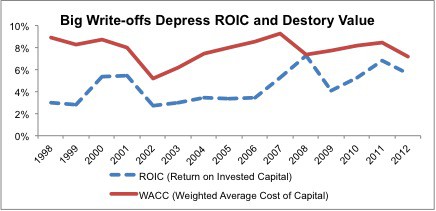

These write-downs lower the company’s returns on invested capital, the primary driver of stock valuation. Since 1998, the company’s return on invested capital (ROIC) has never matched its weighted average cost of capital (WACC). The company has earned negative economic earnings for the past decade and a half.

Figure 1: Consistent Value Destroyer as ROIC Never Exceeds WACC

Asset write-downs reflect management failure to allocate capital efficiently as they result from capital investments that are worth less than what they originally cost, even after depreciation.

Write-downs allow management to erase billions of dollars of capital and as if it never existed. In my calculation of invested capital, I add back the value of those write-downs (after-tax). This provides a truer measure of how much capital has been invested in a company, and the true level of returns that company generates. In the case of WMB, a lot of more capital has been invested in the company with fairly disappointing returns to show for it.

This stands in marked contrast to the company’s reported performance. WMB’s reported EPS of $859 million and growth of nearly 120% in 2012 is far greater than the -$396 million in economic earnings and -%5 growth in cash flows that I show over the same period. This misleading trend is another red flag.

Low Potential for Growth

Growth in the natural gas business does not necessarily translate into significant growth in profits for all companies involved. First, a significant amount of the value derived from this shift in energy use will transmit directly to consumers rather than corporations. Moreover, the consistently plentiful supply and growth in natural gas reserves helps to keep a ceiling on prices, and corporate profits.

Another ceiling on WMB’s profits is the nature of its business. Pipeline companies are not too dissimilar from electric power transmission utilities like Duke Energy (DUK) or American Electric Power (AEP). Utility companies’ profits are capped and governed by regulators focused on ensuring consumers get the cheapest power possible. WMB’s business may get similar scrutiny from regulators and may even become a utility, which puts a ceiling on the company’s profit potential.

High Valuation

It appears that few, if any, analysts have done their homework and prefer to ride the bandwagon as the expectations for future profit growth embedded in the stock price are simply too high.

Specifically, the current share price of ~$36.9 implies that the company will grow after-tax profits (NOPAT) by 13% compounded annually for the next 15 years. Those expectations dwarf the company’s past performance. Since 1998, WMB has grown NOPAT by an average of 7% compounded annually. Such high expectations mean lots of risk with little potential for reward.

Such impressive profit growth seems unlikely from a company that, as previously stated, performs similar services to a utility company. Especially discouraging for investors, WMB’s NOPAT has grown by a meager 2% compounded annually since 2007, much slower than its long-term average of 7%.

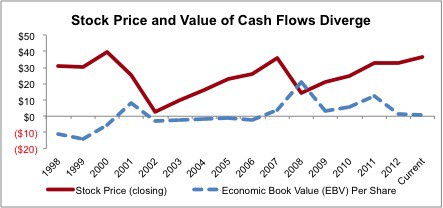

Figure 2: Stock Price Soars Far Above Economic Book Value (EBV)

Diligence Pays

WMB is a perfect example of the necessity for due diligence before buying a stock.

All the analyst buy ratings seem to be missing serious red flags on the company’s balance sheet and in the stock’s valuation. WMB’s stock price and the analyst community seem to be writing checks they just can’t cash. Investors should ignore the hype and avoid this stock.

Watch Out for the ETFs and Mutual Funds that Hold WMB

Investors should also avoid the following ETFs and mutual funds due to their Dangerous or worse rating and significant (3.6% or more) allocation to WMB:

- Hennessy Funds Trust: Hennessy Gas Utility Index Fund (GASFX)

- Touchstone Funds Group Trust: Touchstone Premium Yield Equity Fund (TPYAX, TPYCX, TPYYX)

- Meeder Funds: Meeder Utilities & Infrastructure Fund (FLRUX)

- Federated Equity Funds: Federated Clover Value Fund (VFCCX, VFCAX, VFCBX)

- Virtus Equity Trust: Virtus Mid-Cap Value Fund (FMICX, PIMVX, FMIVX)

Sam McBride contributed to this article

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.