Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

Although the overall stock market looks reasonably valued, there are pockets of extraordinary risk where stocks with 2000-bubble-like valuations lurk.

Specifically, there are “micro-bubbles” in certain stocks, where valuations reflect expectations for future cash flows that would require unrealistically higher margins, faster growth, and larger market share. These expectations might not be so “bubbly” if not for the fact that the current margins, growth rates, and market share of these companies have trended at very low or negative levels for years. We highlighted five other micro-bubble stocks in “Bursting the Micro-Bubble – Part 1.” The stocks featured in that 8/6/18 report are down an average of 3% while the S&P 500 is up 1%.

Stocks in Micro-Bubble #2

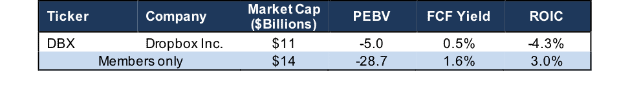

Figure 1 lists one of the stocks we’re putting in our next micro-bubble. New Constructs members can access a version of this report with a second stock in this micro-bubble. They share a few key characteristics:

- Low or negative return on invested capital (ROIC) and free cash flow

- Unrealistically high valuations: both companies have negative economic book values

- Expectations that they achieve heretofore unseen dominant market shares and significant user growth

Figure 1: Micro-Bubble Stocks Part 2

Sources: New Constructs, LLC and company filings

Briefly, here’s what makes this company part of the micro-bubble.

Dropbox (DBX: $27/share) – up 26% vs. S&P 500 up 6% since IPO on 3/23/2018.

Dropbox’s IPO filing tried to hide the company’s poor financials by using colorful charts that were impossible to glean any information from. Look past the flash, and the financial statements tell a story of slowing revenue growth and accelerating expense growth.

Dropbox has built a large base of individual users, who generate no profits for the company. The profits in cloud storage are on the enterprise side. To succeed there, Dropbox needs to compete against smaller firms like Box (BOX) as well as giants like Microsoft (MSFT) and Google (GOOGL) that have substantially more resources and deeply embedded software and services.

Competitive issues aside, our dynamic DCF model, which we use to quantify the future cash flow expectations baked into DBX’s price, reveals just how expensive this stock is. To justify its current price of $27/share, DBX must immediately achieve a 9% NOPAT margin (average of competitors in our IPO report, vs. DBX’s -5% TTM NOPAT margin) and grow revenue by 22% compounded annually for the next 12 years. See the math behind this dynamic DCF scenario.

In this scenario, Dropbox would be generating $12 billion in revenue, which, at current per user averages, implies the firm would have over 103 million paying users. For reference, DBX had just 11.9 million paying users as of June 30, 2018. Microsoft’s Office 365, which provides access to Microsoft’s OneDrive, had 135 million commercial users as of June 30, 2018. Essentially, this scenario implies DBX will grow its user base to near Microsoft levels, all while drastically improving margins and fighting off competition from Microsoft itself, along with many others. Good luck with that.

How to Bet Against the Micro-Bubble

Investors that want to bet against these micro-bubble stocks can short them directly, but that strategy can be expensive (as shown by each stock’s outperformance) and risky for these noise-driven companies. As the saying goes, the market can stay irrational longer than you can stay solvent.

Another way to profit from the bursting of this micro-bubble is to invest in the incumbents from which these companies must take major chunks of market share just to meet the market’s current expectations. When these micro bubble stocks fall back to earth, a great deal of capital should be reallocated to the incumbents.

Macro Bubbles vs. Micro Bubbles

A few new features are shaping the market now and explain why today’s micro bubbles are unlikely to spread to the entire market and create a macro bubble, at least for the foreseeable future:

- Politicians and Policymakers Focused on Preventing Macro Market Crashes: Today’s politicians and policymakers are heavily shaped by both the housing bubble of the mid-2000s and the tech bubble of the late 1990’s. They will likely do everything in their power to prevent recurrence of such cataclysmic events on their watch.

- Rising Influence of Noise[1] Traders: Noise traders, who make investment decisions based on noise and have no regard for fundamentals, are an increasingly influential force in today’s market. Roughly a quarter of all U.S. adults with internet access are retail online traders. That’s around 50 million investors who don’t have professional trading (much less investing) experience and might be more susceptible to buying into “story” stocks without understanding the fundamentals. There’s power in those numbers.

- Overhyping of “Transformative” Technology: The splintering of online media has led journalists to overhype nearly every new technology and trend in a relentless competition for clicks. For example, despite the “Retail Apocalypse” narrative, brick and mortar sales still account for 90% of retail sales, and Walmart earned nearly three times more revenue than Amazon (AMZN) last year. In reality, very few new technologies are as transformative as we like to imagine.

- Value Transfer vs. Value Creation: Too many investors overestimate the value creation opportunities for new technologies. Even when technologies are transformative, predicting who will reap the benefits of these technologies is difficult. Often, most of the value accrues to end users/consumers and not corporations. When it does accrue to a company, it’s usually at the expense of another company. During the tech bubble, bulls believed that the internet would make our economy radically more productive and allow the ~5% GDP growth rate of the late 90’s to persist for many years. When this utopian future failed to materialize, the market collapsed. By contrast, today’s micro-bubble companies compete against firmly established incumbents from which they must take large chunks of market share to survive. Instead of adding value, these companies aim to take value from existing players. Even if they succeed, we think much of that value will eventually pass to consumers.

This last point is key. In 1999, investors gave Microsoft its absurdly high valuation because they believed its software would create enormous amounts of value and growth for thousands of other companies. On the other hand, Tesla’s (TSLA) sky-high valuation implies that it will take market share away from General Motors (GM) and Ford (F), which decreases the valuation of those companies.

These modern-day, micro bubbles reflect the zero-sum nature of today’s crowded and more mature competitive landscapes.

Why We’re Not in a Macro Bubble

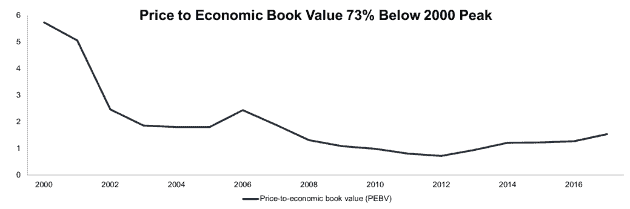

Figure 2 sums up the difference between the tech bubble and today’s market pretty clearly. It shows the price to economic book value (PEBV) of the largest 1,000 U.S. stocks by market cap going back to 2000. PEBV compares the current valuation of a company compared to the zero-growth value of its cash flows, i.e. NOPAT, so a higher PEBV means the market expects more future cash flow growth.

Figure 2: Price to Economic Book Value Since 2000

Sources: New Constructs, LLC and company filings

While the market’s PEBV has more than doubled since 2012, from 0.7 to 1.5, it’s nowhere close to its tech bubble level of 5.7.

There are definitely some outrageously valued companies out there, but those high valuations haven’t spread to the rest of the market. People forget that high valuations weren’t confined to tech stocks in the late 90’s. At the height of the tech bubble, Walmart (WMT) had a P/E ratio of 46 and a PEBV of 5.1. Currently it has a P/E of 32 (artificially inflated by a $3 billion loss on debt refinancing) and a PEBV of 1.0.

Bubble alarmists are hyping up the valuations of a subset of stocks while ignoring the rest of the market.

This article originally published on September 10, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Shiller, Robert J., et al. “Stock Prices and Social Dynamics.” Brookings Papers on Economic Activity, vol. 1984, no. 2, 1984, pp. 457–510. JSTOR, JSTOR, www.jstor.org/stable/2534436.

Click here to download a PDF of this report.