We closed this position on September 4, 2019. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

MarineMax (HZO: $18/share) is the United States’ largest retailer of luxury recreational boats. While the stock suffered along with the company’s earnings during the financial crisis, it rebounded far too high on the back of overstated earnings. The only thing growing as fast as the artificially inflated earnings is the company’s debt. With revenues coming in below expectations for three of the last four quarters, it is only a matter of time before we see another major earnings miss. The company cannot artificially boost EPS for much longer while cash flows are negative. Given the awfully high expectations embedded in the current valuation of the stock, we think HZO could fall well over 50% on the earnings miss.

Misleading Profitability

MarineMax posted a huge increase in net income last year, from $1 million in 2012 to $15 million in 2013. However, this jump in net income tells a misleading story about the profitability of MarineMax because two unusual items inflate the company’s 2013 results:

- $12 million settlement recovery from the Deepwater Horizon Oil Spill

- $1 million decrease in inventory reserves

While the Deepwater Horizon settlement was well publicized, the inventory reserve decrease is buried in a paragraph on page 47. Even without the Deepwater settlement, the company’s net income jumped 50% to over $2 million. In reality, MarineMax’s recovery has been much more muted, with free cash flow (FCF) only briefly reaching a positive $1.5 million in 2012 before falling to -$13 million in 2013.

It is true that MarineMax has finally returned to accounting profitability the past two years after several years of losses, but it is not nearly as profitable as the headlines suggest. Its return on invested capital (ROIC) has been super low at 1% in both 2012 and 2013.

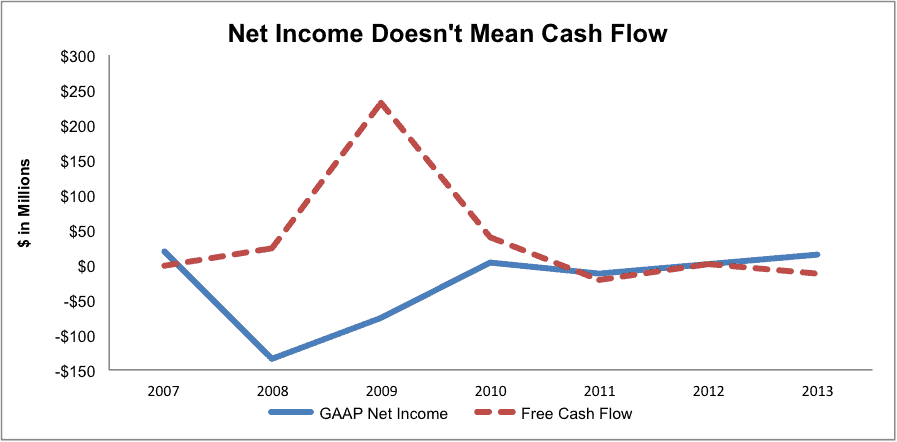

In reality, MarineMax’s poor ROIC and free cash flow is not new news. Since 1998, the company’s FCF has been cumulative negative $143 million, despite a huge $232 million inflow in 2009 from the company’s inventory liquidation. Cash flow has remained below zero even after the recession: Since 2011, FCF is a cumulative negative $34 million, with FCF at negative $13 million in 2013. Figure 1 contrasts the increase in net income with the decline in free cash flow.

Figure 1: No Cash as Net Income Improves

Sources: New Constructs, LLC and company filings.

Even in the best of times before 2007, MarineMax’s earnings overstated cash flows. And now that we are far removed from the best of times and not likely to see them again soon, earnings are increasingly overstating the company’s cash flows.

Cash Flow Faces Serious Pressure Going Forward

It seems that only the company’s debt is growing as quickly as its reported EPS, which is a big red flag and could lead to a major earnings miss in the near future. The company has over $137 million in total debt, or 31% of its market value. This includes over $15 million in off-balance sheet debt, or 7% of net assets.

For the last twelve months, free cash flow has improved to $11 million. However, history tells us that positive cash flow is not sustainable for MarineMax. During peak revenue years 2005-2008, the company carried around $450 million in inventory. To pay down debt in 2009, it reduced its inventory by over $200 million. Currently, the company has $228 million of inventory on its balance sheet, which it must increase to support peak-like revenues.

MarineMax needs inventory — it must be able to show its customers boats to make sales. This business does not support a build-to-order model. This company has to spend a lot of money to make money. The only problem is that it does not make money in the first place.

My thesis on the need for big spending is supported by the company’s recent expansion of its financing facility to provide for short-term borrowings of up to $235 million. Investors should not count that $11 million in free cash flow as money in the bank when the company has positioned itself to spend over $200 million.

My warning here also applies to debt investors if the company’s sales growth fails to keep its current pace.

Macro Factors Not Pointing to Growth

MarineMax operates in the fairly niche market of high-end boat sales. Its average boat sells for nearly $150 thousand, four times the industry average. The most expensive boats MarineMax sells are Azimut yachts, which sell from $600,000 to over $12 million. Azimut yachts alone account for 13% of MarineMax’s revenue.

Clearly, MarineMax’s primary customers are among this country’s wealthiest consumers, which explains why the company was so hard-hit after the financial crisis. Given that the wealthy recovered more quickly than the middle-class over the past few years, one would expect MarineMax to rebound quickly, but this simply hasn’t been the case. MarineMax earned just $600 million in revenue in 2013, less than half the $1.3 billion it earned in 2007.

It’s not just MarineMax that is struggling either. The luxury boat industry as a whole is 11% smaller than it was eight years ago. It appears that ostentatious displays of wealth like yachts may be going out of fashion much like Humvees did, and smaller-ticket luxury retailers such as Michael Kors (KORS) or Tiffany (TIF) are getting a bigger share of the rich’s disposable income.

Weak Bull Case

The biggest reason for bullishness on this stock is the continued economic recovery and increasing amount of disposable income. However, as shown above, MarineMax is struggling to make the most of the recovery. The point is that while there may be a recovery in the top line — albeit a muted one — there has been no recovery in cash flows.

Investors may also believe that the stock is reasonably valued due to its artificially inflated accounting earnings. As we will see below, the stock is in fact significantly overvalued.

Sky-High Valuation

HZO’s current valuation of ~$18/share implies that the company will grow after-tax profit (NOPAT) by 26% compounded annually over the next 13 years. This forecast assumes that MarineMax can regain the peak 7% pre-tax margins it achieved in the mid-2000’s (much higher than 2013’s 1.2% margin) and also grow revenue to over $5 billion, or five times the sales the company earned in 2007, its best year.

Even if we give MarineMax credit for 22% compounded annual NOPAT growth for 10 years, the stock is only worth $7/share. It’s hard to see how this stock can command a significant premium to its accounting book value of $9/share.

Stupid Money Risk

I don’t see the risk of a buyout here, as the stock is overvalued by most metrics and is the leader in its industry. On the other hand, I do see the risk of MarineMax buying up smaller boat retailers. While this strategy could boost accounting results in the near term (see the High/Low Fallacy), it will result in even more shareholder value destruction.

Buybacks are in vogue on Wall Street these days, and MarineMax could jump on the bandwagon to keep its EPS afloat. This strategy would result in value destruction as well given the stock’s nosebleed valuation.

In addition, a buyback or a dividend would likely require the company to take on even more debt due to its already weak cash flow.

Catalyst For Stock Price Drop: Can’t Sustain EPS and Sales Growth With Weak Cash Flows

MarineMax has missed on earnings in each of the past two quarters, and in the first quarter of this year the company missed on revenue by a whopping 22%. Due to MarineMax’s artificially inflated earnings from last year and the continuing struggles in its industry we expect it to experience more disappointing earnings.

In addition, the stock’s lofty valuation has made it extra-risky during periods of volatility. MarineMax has dropped 17% since September 12, while the Russell 2000 is down just 9%. It is only matter of time before MarineMax fails to meet the market’s lofty expectations once again.

MarineMax’s miniscule cash flows are limiting its options to keep EPS growing. Limited cash flows limit opportunities for reinvestment and for financial engineering such as buybacks — the only other option is for the company to add to its substantial debt load.

Although boat sales this year are up from the absolute bottom of the recession, demand for yachts has hardly skyrocketed as evidenced by MarineMax’s razor-thin margins and ROIC. The only question is: How much longer can the company prop up EPS while cash flows suffer?

The Crew is Abandoning Ship — Follow Their Lead

Over the past year, there have been 175,428 shares sold and 35,729 shares bought by insiders for a net of 139,699 shares sold. This represents over 27% of total insider shares held. If insiders are bailing, maybe you should too.

Short Interest

Short interest stands at just over 1 million shares, or over 6% of float.

Funds that Allocate to HZO

Professionally Managed Portfolios Hodges Small Intrinsic Value Fund (HDSVX) allocates 3% of its assets to HZO and earns my Very Dangerous rating.

Sam McBride and André Rouillard contributed to this report.

Disclosure: David Trainer is short HZO. David Trainer, Sam McBride, and André Rouillard receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.

Photo credit: Little Larry (Flickr)

[/opmIf]Not a Member Yet? You need a Professional Membership or higher to view the content on this page.

Start Your Professional Membership Today | New Constructs Member Login