Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

Technology has a long history of making old habits, services, or products obsolete. As we have shown in prior reports, technology now exists for consultants to link their offerings directly to shareholder value creation. Those consultants who adopt cutting-edge tools will experience more success than those that remain wedded to older, more manual techniques. It’s time we place Traditional Corporate Consulting in the Danger Zone.

Why Do Companies Make Poor Decisions

In our Danger Zone reports, we focus on what is wrong with companies while spending less time on how management teams make the poor decisions that land their stock in the Danger Zone. The actions and decisions we’ve criticized, such as serial acquisitions or use of non-GAAP metrics, are wrong because they focus on the wrong outcomes. Too often, an outdated understanding of the capital markets leads managers to focus on maximizing earnings or EPS growth, when both have a poor correlation with stock valuation.

These misguided strategies and others like them can be blamed, at least partially, on a lack of awareness of better corporate performance metrics, e.g. return on invested capital (ROIC). ROIC (aka economic value added (EVA) or cash flow return on investment (CFROI)) is a superior paradigm for linking corporate performance to valuation and aligning the interests of management with those of shareholders.

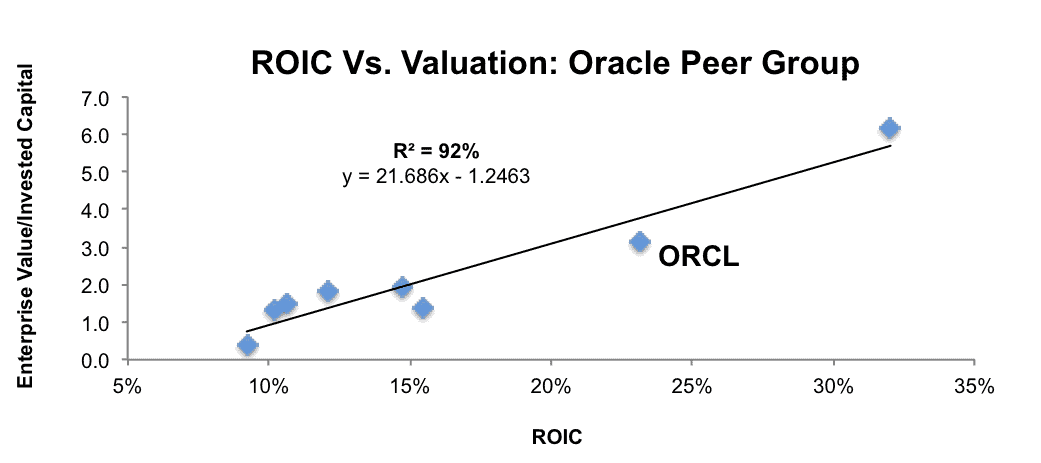

Figure 1: ROIC Is the Primary Driver of Stock Market Valuation

Sources: New Constructs, LLC and company filings

Traditional Corporate Consulting Drawbacks

If ROIC based models are superior, why do investors, executives, and the financial media focus on reported earnings and other metrics such as EBITDA? Why aren’t executives around the world adopting ROIC in order to boost shareholder returns?

Anyone asking those questions should read the 1996 CFO Magazine article “Metric Wars.” Back in the mid-90’s, ROIC-based models such as EVA and CFROI were all the rage, with corporate giants such as Coca-Cola (KO), AT&T (T), and Procter & Gamble (PG) linking them to executive compensation and highlighting them in communications with shareholders.

The short answer is that they tried but could not pull it off because high-quality ROIC models were too hard to build with any kind of scale. The costs were prohibitive for the consultants. A more in depth explanation can be found in our report If ROIC is So Great, They Why Doesn’t Everyone Use.

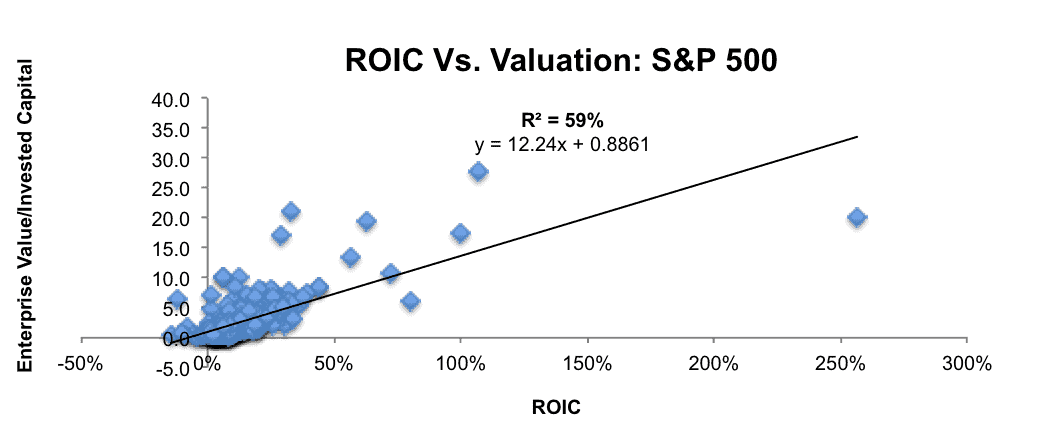

Figure 2: ROIC Best Explains Changes In Market Value

Sources: New Constructs, LLC and company filings

The Proper Technology Has Arrived

Figure 1 shows that ROIC explains 92% of the changes in valuation for Oracle and its peers.

Figure 2 shows that ROIC explains 59% of the changes in valuation of S&P 500 companies. The ability to measure ROIC (and all its components) across so many companies provides consultants with easy-to-use tools to frame, measure and value the impact of their offerings.

We also show in ROIC: The Paradigm For Linking Corporate Performance To Valuation that ROIC has, by far the largest impact on the valuation of stocks. This strength of this relationship is intuitive. If the purpose of capital markets is to promote the most efficient use of capital, it makes sense that the market would reward companies that earn the most profit per dollar of capital invested with the highest valuations.

Our recent case study on Oracle (ORCL) provides a real-world example of the potential value creation opportunities that come with aligning corporate decision making with the best interests of shareholders.

The Oracle case study also serves as a template for illustrating how almost any consulting service or software offering could be pitched within a framework like the one we created for Oracle.

Figures 1 and 2 and the case study on Oracle along with many other reports shows that the technology for scaling high-quality ROIC and valuation models has arrived. With our patented research system, we are able to analyze 10-K’s and Q’s much more thoroughly and with great speed and accuracy. In fact, this rigorous analysis can be applied across a virtually unlimited number of public and private companies.

Consultants can use this technology to create better benchmarks for:

- Designing compensation plans

- Measuring the efficacy of their proposals

- Quantifying the potential benefits of implementing their proposals

These benchmarks are not only more accurate and more aligned with stock valuation, they are currently live and applicable across 3,000+ of the most actively traded stocks in the world.

The Paradigm Shift Is Underway

We believe a return to focus on ROIC is underway and the time to adopt these models could not be better. For the past several years, markets largely ignored fundamentals and cared more about momentum and technical trading. As the frothy market slows down, we believe a focus on fundamentals will return, which will make ROIC models all the more valuable. As more companies adopt ROIC as the primary benchmark for measuring corporate performance, more companies will be pressed to do the same, or they risk losing credibility with investors.

Traditional corporate consulting exists in its current form due an inability to execute a concept (i.e. ROIC) with scale, not the failings of the concept. Now that we can execute on that concept, there is no reason to limit the application of the concept. We are providing a new level of transparency for the link between corporate performance and stock market valuation, and we see no reason for the market to resist it.

ROIC Models In Action

Executive management teams focusing on ROIC as a performance metric is not just a theory or model. There are large corporations where management is currently using ROIC to measure the effectiveness of their capital allocation and the results, particularly in regards to shareholder value, speak for themselves.

AutoZone Inc. (AZO) executives must be aware that ROIC and valuation are highly correlated. As the company says in its 10-K:

“We use ROIC to evaluate whether we are effectively using our capital resources and believe it is an important indicator of our overall operating performance.”

The company consistently highlights its ROIC throughout its filings and provides details into its calculation. Best of all, AutoZone’s executive compensation lists ROIC as one of the factors that determine executive bonuses each year. The results of this focus speak for themselves. We first showcased AutoZone in February 2014 as the best bet in automotive retail. Since then, AZO is up 43% compared to an 8% rise in the S&P 500. Over the past decade, AZO is up an astonishing 725% compared to 51% for the S&P 500.

The downside to not using an ROIC model surfaces in our analysis of Oracle from above. For years, Oracle was following an EPS growth strategy, possibly unaware of a better option due to consultant constraints. This strategy has led Oracle’s once market leading ROIC, invested capital turns, NOPAT margins, and revenue growth all to revert to levels on par, or even below, its peer group.

Luckily for investors, there are other companies currently focusing on ROIC. These companies are the types of businesses we will focus on when finding Long Ideas to bring to our clients. On the flip side, those companies that ignore ROIC and focus on a flawed metric are likely to land in the Danger Zone.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Tom Chapman (Flickr)