Uncertainty defined 2016. Analysts tried in vain to predict the Fed’s actions on interest rates. Changing commodity prices defied investor expectations. And of course, the presidential election provided ample drama for the markets.

In the midst of all that uncertainty, investors grew more and more aware of the need for real diligence. The market is increasingly aware that the accounting constructs reported by companies (especially those non-GAAP results) don’t always represent the underlying economics of the business. In 2016:

- Big institutional investors began pushing companies to tie executive compensation to return on invested capital (ROIC) instead of GAAP EPS.

- The SEC began cracking down on the non-GAAP numbers companies invent to make themselves appear more profitable.

- The influence of sell-side research declined as investors gained understanding of the conflicts inherent in the business model.

- Fights over the Department of Labor’s Fiduciary Rule raised investor awareness of the need for diligent investment advice that serves their best interests.

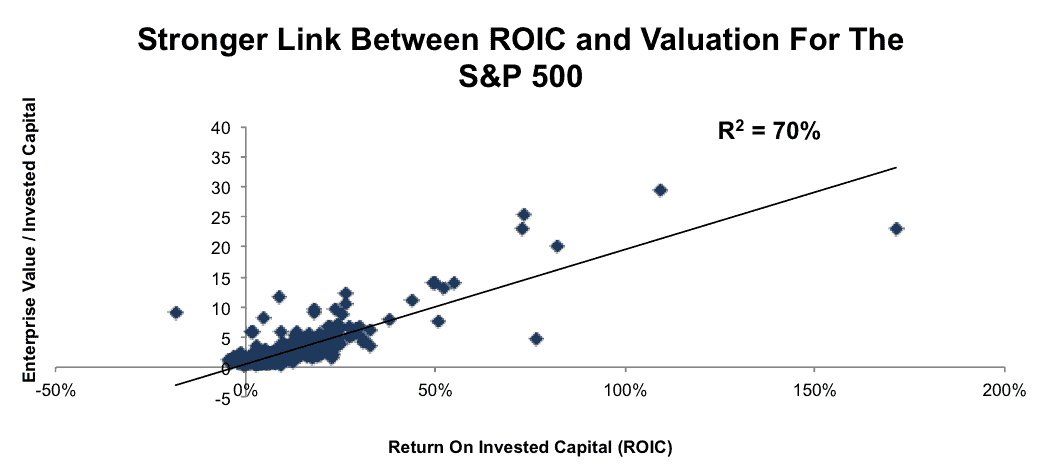

Companies that tie executive compensation to ROIC outperformed in 2016. Figure 1 shows just how strong a driver of valuation ROIC is.

Figure 1: ROIC Vs. Enterprise Value/Invested Capital For The S&P 500

Sources: New Constructs, LLC and company filings.

When we ran this same regression at the beginning of 2016, ROIC explained 56% of the difference in valuation for companies in the S&P 500. Today, it explains 70% of the difference.

This trend should only grow more prevalent and powerful in 2017. Market conditions, changing investor behavior, and new technologies all come together to make diligent research matter more than ever.

This Market Requires Diligence

For many years after the Great Recession, the combination of falling interest rates and general economic recovery was a rising tide that lifted all stocks. Low rates spurred borrowing and activity, and as savings in the economy began to grow, the stock market was the only place to earn a decent return.

Now, it’s fiscal policy, rather than monetary policy, that’s driving the bus. The prospect of corporate tax reform, deregulation, and infrastructure spending has been driving the market up over the past several months. While low interest rates have a broad impact on the entire economy, fiscal policy impacts different companies in very different ways, which is why individual stock correlations are lower than at any point since the recession.

Lower correlation makes fundamental diligence more important. Investors need to truly understand a company’s cash flows and business model to succeed in this environment. Superficial research just doesn’t cut it.

As an example, look at the iShares Global Infrastructure ETF (IGF). Investors initially piled into the fund after the election in the hopes of an infrastructure boom, only to quickly exit after realizing it was filled with utilities that would suffer from rising interest rates. Meanwhile, the four stocks we highlighted to benefit from the election have an average return of 16% since Election Day versus 11% for the S&P 500.

Passive Investing Removes the “Easy Games”

Gone are the days when professional investors could exploit information asymmetries to trade against novices and earn outsized returns. Increasing data availability and rules such as Reg FD have leveled the playing field to some extent. More importantly, many uninformed and unsophisticated investors have decided to stop playing the game entirely.

Passive funds have seen $1.2 trillion in inflows over the past decade. Less skilled investors are growing content with an average market return, which leaves the professional money managers competing with each other for a limited share of alpha.

In his white paper “Looking for Easy Games,” Michael Mauboussin has three suggestions for active managers looking to retain their edge:

- Be Active: Passive funds have mostly taken market share from “closet indexers,” high fee mutual funds that hold portfolios virtually identical to their benchmark. We’ve called out closet index funds in the past as these funds essentially guarantee their investors will underperform. Active managers are not going to be cheaper than index funds, so they need to actually differentiate themselves in a meaningful way.

- Be Long-Term Oriented: We’ve all read the stories about the high frequency trading firms that only lose money one day out of five years. Humans cannot compete with computers at reading price signals and reacting to news events. The best way for active managers to outperform is to have a low-turnover portfolio. Investing for the long-term requires rich financial data going back years to get a complete picture of a company’s business.

- Use Quantitative Methods: This one should be obvious. Managers may have been able to “go with their gut” in the past, but it’s impossible in this day and age to justify making investment decisions without a quantitative basis. Most investors now know that the majority of active funds underperform after fees and that past performance is not a good indicator of future results. Attracting investor capital requires a clear process with proven links to investment returns.

Asset managers that want to take an active, long-term, quantitative approach need diligent research that goes deeper than the financial statements. Low cost ETFs can cover simple investment strategies such as buying stocks with low P/E ratios or rapid earnings growth. The only way for active managers to differentiate themselves is by cutting through the accounting constructs to get at the real drivers of shareholder value.

Defining Diligence

Depending on what happens with the Department of Labor’s fiduciary rule, diligence could become required by law for advisors making investment recommendations. Even if the fiduciary rule does not go into effect, the debate over the standard has raised investor awareness and made investors more likely to demand a fiduciary level of diligence.

It’s difficult to come up with a precise definition of diligence. Still, I don’t think anyone could argue with the fact that truly diligent research should be:

- Comprehensive: All relevant publicly available (e.g. 10-Ks and 10-Qs) information has been diligently reviewed, including the footnotes and the Management’s Discussion & Analysis (MD&A).

- Un-conflicted: Clients deserve unbiased research.

- Transparent: Users should be able to see how the analysis was performed and the data behind it.

- Relevant: There must empirical analysis with a tangible, quantifiable connection to stock, ETF or mutual fund performance.

Technology Makes Diligence Accessible

Research that met the four criteria above used to be virtually impossible to produce at scale. People have understood for decades that ROIC is the key driver of shareholder value. However, the complexity of calculating ROIC led to an expensive consulting model with competing calculations, restricted access, and a lack of comparability.

As a result, most investment research continued to rely on metrics such as price-to-earnings ratios despite its obvious flaws. Bad research thrived because so few investors had access to worthwhile alternatives.

Fortunately, technological innovation is opening up new opportunities for diligence at scale. The increased sophistication of our robo-analyst technology allows us to continually increase both the number of companies we cover and the amount of information we provide to investors.

Now, the biggest names in the financial industry are embracing technology and automation. BlackRock, the largest fund company in the world, just announced that it will be moving roughly $30 billion in assets to funds that rely on algorithms and artificial intelligence to pick stocks.

“The democratization of information has made it much harder for active management,” BlackRock CEO Larry Fink told the New York Times. “We have to change the ecosystem — that means relying more on big data, artificial intelligence, factors and models within quant and traditional investment strategies.”

Technology is rapidly disrupting the investing process. The raw processing power of machines, combined with the staggering amount of financial data now available, creates a competitive advantage that human investors can’t replicate. Active managers that don’t fully utilize these tools will increasingly find themselves on the wrong sides of trades with those that do.

This is not to say that there’s no role for humans in the modern investment process. Skilled investors can still bring a level of industry knowledge and experience that machines can’t replicate. Instead, machines can now automate much of the process of gathering data, building models, and identifying patterns. Leveraging technology gives investors a better baseline for analyzing industry trends and assessing a company’s long-term competitive advantage.

Now that this technology for proper diligence exists, there is no reason for investors not to use it or advisors not to provide it.

This article originally published on April 3, 2017.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.

Click here to download a PDF of this report.

Photo Credit: Irene Lee (Flickr)