Since we put DreamWorks Animation (DWA: $32/share) in the Danger Zone in May 2014, the company has been seeking a buyer, and held talks with Hasbro (HAS), Softbank, and more recently buyers in China. All of these talks have not resulted in DreamWorks being acquired, and for good reason. DWA at its current price is overvalued given the long-term deterioration of the business.

The Wall St. Journal is reporting that Comcast (CMCSA) is in talks to buy DWA for “more than $3 billion.” Comcast would represent DWA’s saving grace, a company with ample cash for DreamWorks to burn through. We would caution Comcast though, as acquiring DWA at current prices not only destroys shareholder value, but implies significant synergies, which are often not realized upon completion of acquisitions.

Comcast Would Be Buying A Business In Decline

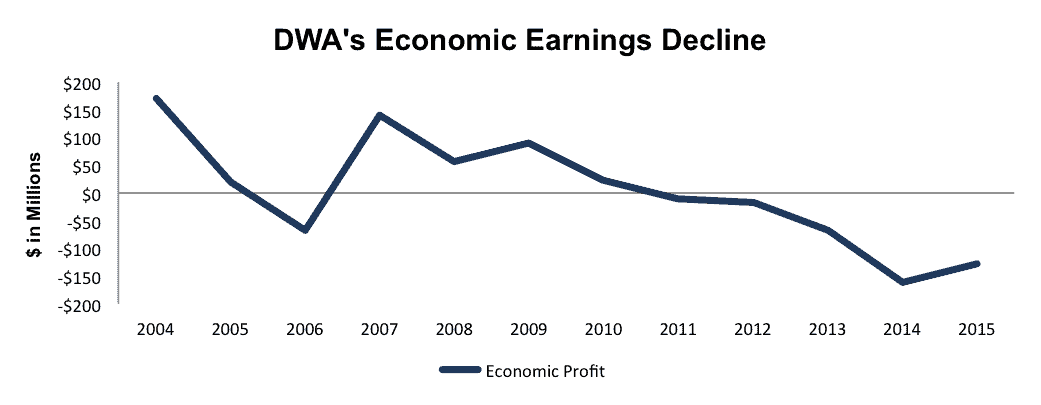

As we noted in our Danger Zone, since 2004 DreamWorks’ operations have been in a long-term downward spiral. Since 2004, the company’s economic earnings have declined from $169 million to -$127 million in 2015, per Figure 1. DWA’s return on invested capital (ROIC) has fallen from 21% in 2004 to a bottom-quintile 2% in 2015.

Figure 1: DreamWorks Destroying Shareholder Value

Sources: New Constructs, LLC and company filings

How Much Would Comcast Be Overpaying

It’s clear that DWA needs a suitor to keep this shareholder destructive business running. As we’ve noted in our reports highlighting the issues at Netflix, making original content is not cheap, and it’s no different at DWA.

Over the past four years, Comcast has generated over $29 billion in free cash flow, which means it could certainly provide the resources DWA requires. However, unless Comcast can acquire DWA at a price that earns a quality ROIC, the deal is a destruction of shareholder value. To begin analyzing this acquisition, we need to look at the large hidden liabilities that make DWA more expensive than the accounting numbers would suggest.

- $249 million in off-balance sheet debt (9% of market cap)

- $55 million in minority interests (2% of market cap)

- $22 million in outstanding employee stock options (1% of market cap)

- $18 million in deferred tax liabilities (1% of market cap)

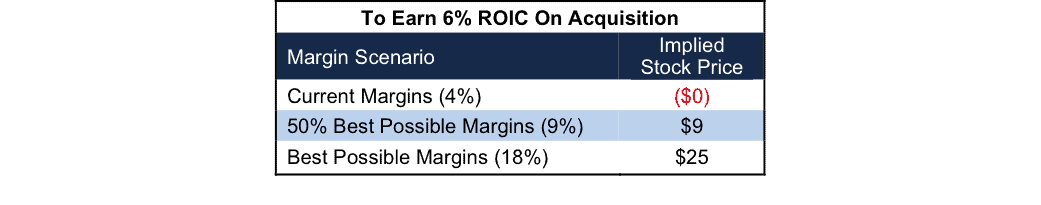

After adjusting for these hidden liabilities, we can model scenarios for the proper price for Comcast to purchase DreamWorks. Modeling different scenarios allows us to show you how overvalued DWA remains, and how much Comcast would be overpaying.

Figures 2 and 3 show the implied stock prices that Comcast should pay for DWA to achieve different “Goal ROICs” assuming different levels of profit margins. There are limits on how much CMCSA should pay to earn a proper return, given the NOPAT or cash flows being acquired. For each scenario, we show the max price CMCSA can pay and still achieve the “goal ROICs”.

Figure 2: Implied Acquisition Prices For CMCSA To Achieve 6% ROIC

The first “goal ROIC” is CMCSA’s weighted average cost of capital (WACC) or 6%. Figure 2 shows the prices CMCSA should pay for DWA assuming different levels of profit margin achieved post acquisition. In the “best case scenario”, the most CMCSA should pay is $25/share (22% downside at time of writing). This scenario assumes DWA could leverage Comcast’s distribution platform, scale, and resources to earn a NOPAT margin equal to Disney (DIS), one of the most successful content creators in the world.

Not only does this scenario seem optimistic given DWA’s current margin of 4%, it also highlights the unrealistic assumptions Comcast’s management has to make to justify this acquisition. Even with 18% NOPAT margins, the implied valuation of $25/share represents a market value of $2.1 billion. In order for Comcast to pay the reported price of “over $3 billion”, management must believe the deal contains additional synergies of at least $900 million.

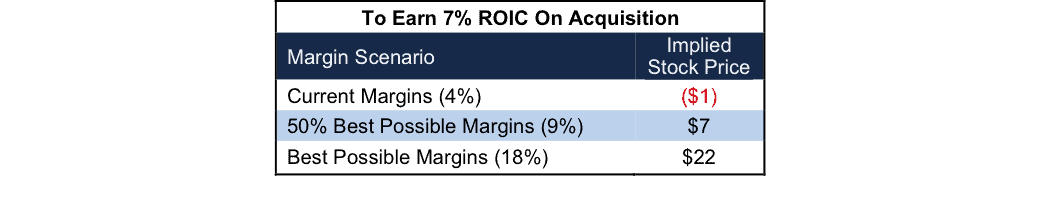

Figure 3: Implied Acquisition Prices For CMCSA To Achieve 7% ROIC

Figure 3 shows the next “goal ROIC” of 7%, which is CMCSA’s current ROIC. Any deal that doesn’t earn a return of 7% or above is bad for shareholders as it signals to the market that CMCSA’s ROIC will decline. Assuming management doesn’t want to drive down its ROIC, the most CMCSA should pay for DWA is $22/share (31% downside at time of writing).

No matter which way you analyze it, purchasing DWA at current prices, much less paying above the current market price is a bad deal for Comcast shareholders. If Comcast is set on acquiring DreamWorks, it must achieve significant synergies else CMCSA would be better suited to wait until DWA falls to a level where CMCSA can, at a minimum, earn a return equal to its WACC.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Jason Garber (Flickr)