“While we’ve been competing with many people in the last decade, it’s a whole new world starting in November…between Apple launching and Disney launching, and of course Amazon’s ramping up.”

-Netflix CEO Reed Hastings

Reality is closing in on Netflix (NFLX: $272/share). Unquestionably, Hastings is stating the obvious when he cops to competition from other streaming services hurting growth.

With the stock down 30% over the past three months, poor Q2 results and signs that Q3 growth might be below expectations, the market is no longer buying Hasting’s ridiculous claims like that Fortnite and YouTube are Netflix’s primary competitors.

Sentiment has shifted, not just from Hastings but also the market. There are currently 22 million shares sold short (5% of the float), a 60% increase since the beginning of 2019.

Without positive sentiment to prop it up, NFLX remains highly overvalued and a serious risk to shareholders.

Competitors Are Cheaper and Offer More Content Than Netflix

When Netflix first pushed into original content in 2013, it had a significant first-mover advantage. Traditional networks and studios either lacked the expertise to build their own streaming platforms, or they were unwilling to sacrifice the money they earned from licensing their content to Netflix.

That’s all changed now. Disney (DIS), Warner Media (T), and NBC Universal (CMSCA) are all pulling their content from Netflix in order to launch their own streaming services, Amazon (AMZN) is increasing its content budget, and Apple (AAPL) just announced the launch of its Apple TV+ service, which will be free for the first year for customers who buy an Apple device.

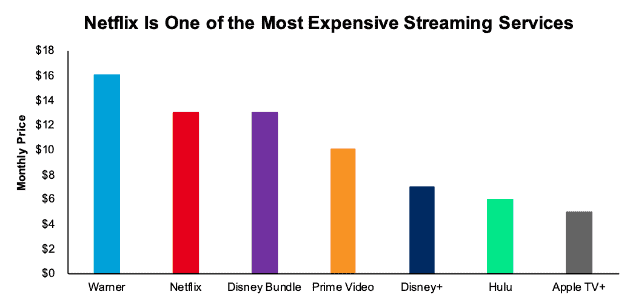

Figure 1: Monthly Price for Streaming Services in the US

Sources: New Constructs, LLC and company filings

Now, Netflix operates in a crowded space where it is one of the most expensive options. For the same $12.99 monthly price as Netflix, consumers can get a bundle of Hulu, Disney+, and ESPN+. For $10/month, they can get Prime Video – along with all the other perks of Prime membership.

The steady loss of licensed content means Netflix no longer has a larger content library than its peers. Amazon has the largest content library, and the Disney bundle’s collection of classic movies, family friendly entertainment, prestige TV, and live sports gives it a breadth of options Netflix can’t match.

Subscriber Growth Is Already Slowing

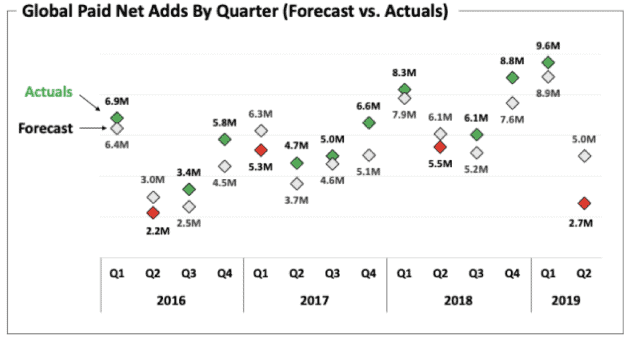

Netflix is already struggling to maintain its growth before these new competitors launch. The company added just 2.7 million subscribers in Q2 2019, its slowest growth rate in 3 years, as shown in Figure 2.

Figure 2: Quarterly Subscriber Growth: 2016-2019

Sources: Netflix Investor Relations

For the first time since the company began its original content push, net subscriber additions through the first half of 2019 (12.3 million) were less than the first half of the prior year (13.8 million in 2018). In the higher margin U.S. business, the number of subscribers actually declined by 130 thousand in Q2. This represents a <1% decline, but the fact that the company’s domestic subscriber base appears to have peaked is bad news for Netflix.

The pressure on the company’s domestic subscriber base will only increase going forward with the launch of new competitors. Disney+, which launches in November, received so much pre-order interest that it crashed the website.

A recent report from Evercore ISI suggests the company’s international growth has continued to struggle in Q3, with international downloads of its app up only 5% year-over-year in September. The company faces less competition internationally, so this slowing growth suggests its total addressable market may be lower than bulls believe. With competitors (like Hulu) preparing their own international rollouts, we expect Netflix’s international business to start to plateau soon as well.

Cost Increases Will Only Get Worse

Increased competition doesn’t just hurt subscriber growth, it also raises the costs for the company to produce, license, and market its content.

Netflix has increased the amount of money it pays to content creators in order to secure them to long-term contracts. The company recently paid a reported $300 million to secure the services of Game of Thrones creators David Benioff and D.B. Weiss. It also recently lost out to Amazon in its bid to sign recent Emmy winner Phoebe Waller-Bridge.

Netflix also continues to invest a significant amount of money in its licensed content library, contrary to executives’ claims that the company’s original content is enough to satisfy its subscribers. It recently paid $500 million to license Seinfeld. This price is more than the amount paid for The Office and Friends, two shows with a broader appeal.

Finally, the increased competition from rival media companies will make it harder for Netflix to advertise to consumers. The Wall Street Journal reported that Disney will ban advertising from Netflix across all of its TV networks. If NBC Universal and Warner Media follow suit, Netflix will be locked out of almost all TV advertising.

The company’s marketing costs have already been increasing, from $824 million (12% of revenue) in 2015 to $2.4 billion (15% of revenue) in 2018. As other media companies restrict the potential supply of advertising space for Netflix, its marketing costs should grow even higher.

Valuation Remains Irrational

Despite the stock’s 30% decline over the past three months, Netflix remains significantly overvalued. Our reverse DCF model quantifies the growth expectations implied by its stock price.

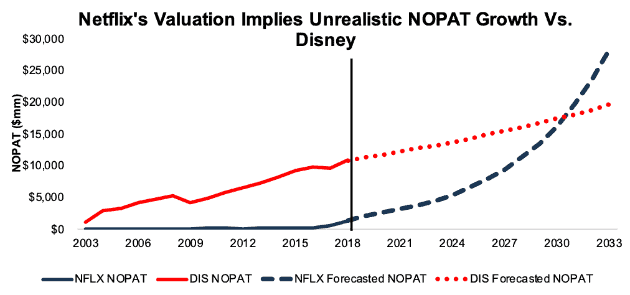

In order to justify its stock price of $273/share, Netflix must achieve a 12% after-tax operating profit (NOPAT) margin (up from 8% TTM) and grow NOPAT by 23% compounded annually for 15 years. See the math behind this dynamic DCF scenario.

By comparison, Disney’s $130/share valuation implies that it will grow NOPAT by just 4% compounded annually for the next 15 years. See the math behind this dynamic DCF scenario.

As Figure 3 shows, their respective valuations imply that Netflix, which currently earns ~$1.5 billion in NOPAT compared to ~$10 billion for Disney, will earn ~$9 billion more than Disney 15 years from now.

Figure 3: Historical vs. Implied NOPAT Growth: NFLX vs. DIS

Sources: New Constructs, LLC and company filings

The stock price still implies that Netflix can grow at an exponential rate over the long-term, even though subscriber growth is already plateauing. This slowing growth, along with mounting competition, makes it even harder for the company to justify its overblown valuation.

This article originally published on October 7, 2019.

Disclosure: David Trainer, Sam McBride and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.