We closed this position on September 4, 2019. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

Investors chasing momentum stocks are playing a dangerous game. As a stock moves up, momentum increases, and investors pile in which drives the price higher. However, this momentum can change in the blink of an eye. After greatly outpacing the gains of the market over the past two years, we believe Expedia Inc. (EXPE: $116/share) could be the next momentum stock to see its run end. A mix of overvaluation and destruction of shareholder value lead Expedia into the Danger Zone this week.

Expedia’s Business Is Declining Despite EPS Growth

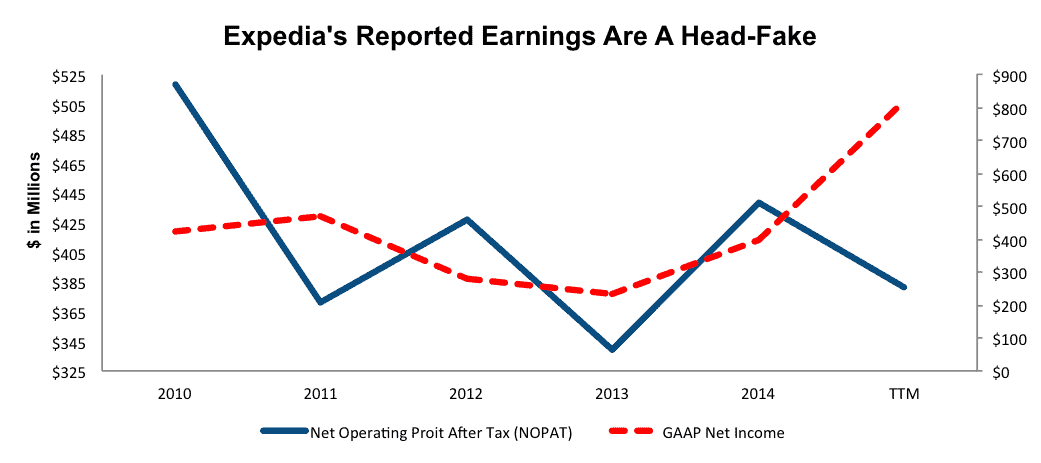

Expedia’s share price is up more than 133% since 2010, which is nearly double the return of the S&P 500. However, as demonstrated in Figure 1, Expedia’s after-tax profit (NOPAT) has declined 6% compounded annually over this same timeframe.

Figure 1: Expedia’s NOPAT Moving in the Wrong Direction

Sources: New Constructs, LLC and company filings

The divergence between share price and profits is due to investors not understanding the shareholder value destruction resulting from Expedia’s acquisition approach to growth. Since 2013, Expedia has acquired Trivago, Auto Escape, Wotif, and Travelocity for a total of $1.65 billion. Earlier this year, Expedia announced the purchase of Orbitz for $1.6 billion, which is still pending approval from the Department Of Justice.

These acquisitions have failed to create shareholder value as shown above, but EPS growth has masked this fact by growing at 18% compounded annually since 2010. The impact of an acquisition on a company’s accounting earnings is not indicative of its economic value to shareholders, a point illustrated by the high-low fallacy.

Since traditional analysts rarely discuss the cash flow impact of acquisitions, few investors are aware of their true costs. In the case of Expedia, acquisition-driven balance sheet expansion costs equaled approximately $4.43/share, an amount that should be deducted from 2014 earnings. In total, Expedia’s economic earnings per share were -$1.17 in 2014, which falls well below the reported GAAP EPS of $2.99. Longer-term, Expedia has failed to generate positive economic earnings in any year since going public in 2005.

Competitors are High Quality and High Quantity

Expedia faces competition from a host of travel and lodging booking sites, hotels/airlines/car rentals’ own websites, and large online travel agency Priceline (PCLN: $1,288/share). Priceline also has been on an acquisition spree, but, unlike Expedia, it has done so in a more shareholder-friendly manner. Priceline maintains a top quintile ROIC of 54% and generates positive economic earnings.

Just this year, Amazon launched its travel-booking site Amazon Destinations. While the service still focuses on a small client demographic, Amazon Destinations has access to a captive client base of 244 million consumers already using Amazon. Google also announced a new travel feature, Google Flights, earlier this year. Google Flights shows travel information immediately in Google search results, which allows consumers to compare airfares without ever leaving Google. One would be remiss to not point out non-traditional competition from the likes of Airbnb as well.

A Rising Tide Doesn’t Lift All Boats

Much of the bull case behind Expedia relies upon its position in the travel booking industry. In late July, UBS estimated that a combined Expedia and Orbitz would have a 73% share of the U.S. online travel agency market. Additionally, the travel agency market is estimated to be a $1.3 trillion growing industry. However, simply occupying the space does not ensure success for Expedia. As shown above, its past history of acquisitions has not been successful in growing true cash flows and with more competition entering the market, further consolidation and margin compression is likely. To reach the profit levels bulls believe are possible, Expedia must execute its acquisition of Orbitz without further deterioration of already negative cash earnings, which does not appear possible unless the terms of the deal change drastically. The bigger problem for bulls is how much the current share price already implies Expedia’s profits will grow. Put another way, the bigger problem for bulls is that the share price seems blinded by the EPS performance and oblivious to the negative economic performance of Expedia’s business.

Buyout Risk Seems Minimal

In the online travel agency market, the two largest players are Expedia and Priceline. As such, any merger action would likely come in the form of smaller acquisitions by these two. An acquisition of Expedia by Priceline, or vice versa, would certainly raise antitrust issues. Additionally, with over $2.9 billion in debt (17% of market cap) and an overvalued share price, we find it unlikely Expedia will be acquired.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Expedia’s 2014 10-K. The adjustments are:

Income Statement: we made $250 million of adjustments with a net effect of removing $42 million of unusual expenses (<1% of revenue). We removed $146 million related to non-operating expenses and $104 million in non-operating income.

Balance Sheet: we made $5.9 billion of balance sheet adjustments to calculated invested capital with a net increase of $1.3 billion. The largest adjustment was the inclusion of $2.9 billion due to asset write-downs. This adjustment represented 62% of reported net assets.

Valuation: we made $5.1 billion of adjustments with a net effect of decreasing shareholder value by $1.9 billion. The largest adjustment to shareholder value was the removal of $670 million in minority interests. This liability represents 4% of Expedia’s market cap.

Valuation Is Overly Optimistic

Despite the challenges noted above, Expedia has been one of the best performing stocks over the past few years. Price momentum has boosted the shares to dangerous levels when analyzed through the lens of a discounted cash flow model. To justify its current price of $116/share, Expedia must grow NOPAT by 16% compounded annually for the next 14 years. IBIS World estimates that the travel agency industry will grow by 2.3% compounded annually through 2020. Placing a bet on Expedia would mean that the company can grow its business significantly faster than the industry, which implies Expedia makes large market share gains while also improving margins. With no large competitors left to acquire, we find it hard to believe Expedia can organically take such significant market share.

Even if Expedia is able to grow NOPAT by 10% compounded annually for the next decade, the stock is worth $51/share today – a 56% downside.

No matter how you slice the high expectations already embedded in the stock, it is clear the valuation of EXPE has more room to fall than rise.

Merger Uncertainty Remains Large Catalyst

In the short term, the biggest catalyst to Expedia’s share price is the pending approval/disproval of the Orbitz merger. EXPE jumped 14% the day the merger was announced, and has risen in total 48% since the announcement. If the DOJ rules that a combined Expedia/Orbitz would create an illegal monopoly and subsequently rejects the merger, Expedia’s shares would fall. On the other hand, approval of the merger appears already baked into the price, as shown above.

Long-term, Expedia must fend off competition from every angle. Any signs of weakness or losing ground to incumbent Priceline, or newcomers, like Amazon, Google, or Airbnb could undermine the positive price momentum that has elevated the stock to such lofty heights.

Short Interest Implies Some Have Realized Expedia’s Overvaluation

Expedia short interest stands at 11.6 million shares, which represent 9% of shares outstanding. While not as large as some other companies we’ve seen, it is apparent that a portion of investors have realized the troubles at Expedia.

Executive Compensation Could Be More Shareholder Friendly

Executives at Expedia receive base salaries, cash bonuses, and equity awards. The compensation committee has a wide range of factors on which they base cash bonuses and equity awards. These factors include business and financial performance, executives’ individual performance, general economic conditions, and non-cash compensation as a percentage of adjusted EBITDA. We would much rather see Expedia have more specific goals for management, such as economic profits, rather than a general list of factors that determine executive compensation.

Dangerous Funds That Hold EXPE

The following ETFs allocate significantly to EXPE and earn a Dangerous-or-worse rating.

- PowerShares Nasdaq Internet Portfolio (PNQI) – 2.3% allocation and Dangerous rating

- First Trust DJ Internet Index Fund (FDN) – 2.2% allocation and Very Dangerous rating

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Jonathan Caves (Flickr)

1 Response to "Expedia’s Acquisitions Are Destroying Shareholder Value"

EXPE falls over 18% after 3Q earnings miss. EXPE has underperformed the S&P by ~29% since our Danger Zone report