Ten new stocks made October’s Safest Dividend Yields Model Portfolio, which was made available to members on October 20, 2023.

Recap from September’s Picks

On a price return basis, our Safest Dividend Yields Model Portfolio (-0.8%) underperformed the S&P 500 (-0.3%) by 0.5% from September 21, 2023 through October 18, 2023. On a total return basis, the Model Portfolio (-0.6%) underperformed the S&P 500 (-0.3%) by 0.3% over the same time. The best performing large-cap stock was up 7%, and the best performing small-cap stock was up 9%. Overall, 9 out of the 20 Safest Dividend Yield stocks outperformed their respective benchmarks (S&P 500 and Russell 2000) from September 21, 2023 through October 18, 2023.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

This Model Portfolio only includes stocks that earn an Attractive or Very Attractive rating, have positive free cash flow (FCF) and economic earnings, and offer a dividend yield greater than 3%. Companies with strong free cash flow provide higher quality and safer dividend yields because strong FCF supports the dividend. We think this portfolio provides a uniquely well-screened group of stocks that can help clients outperform.

Featured Stock for October: Ethan Allen Interiors, Inc. (ETD: $28/share)

Ethan Allen Interiors, Inc. (ETD) is the featured stock in October’s Safest Dividend Yields Model Portfolio.

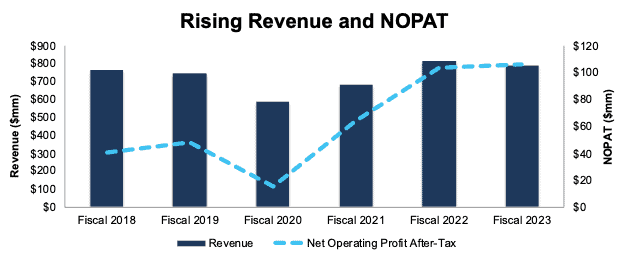

Since fiscal 2018, Ethan Allen Interiors has grown revenue by 1% compounded annually and net operating profit after tax (NOPAT) by 21% compounded annually. Longer term, Ethan Allen has grown NOPAT by 9% compounded annually over the past decade. Ethan Allen Interiors’ NOPAT margin improved from 5% in fiscal 2018 to 13% in fiscal 2023 (year ends June 30, 2023), while invested capital turns increased from 1.2 to 1.3 over the same time. Rising NOPAT margin and invested capital turns drive the company’s return on invested capital (ROIC) from 6% in fiscal 2018 to 17% in fiscal 2023.

Figure 1: Ethan Allen Interiors’ Revenue & NOPAT Since Fiscal 2018

Sources: New Constructs, LLC and company filings

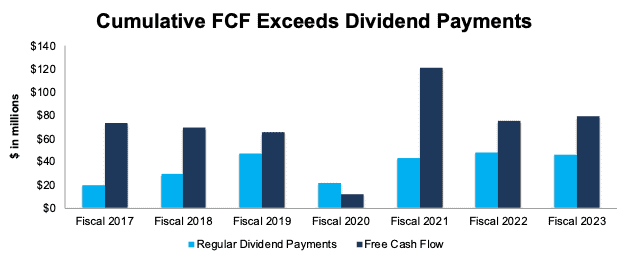

Free Cash Flow Exceeds Regular Dividend Payments

Ethan Allen Interiors has increased its regular dividend from $0.19/share in 1Q17 to $0.36/share in 4Q23. The current quarterly dividend, when annualized, equals $1.44/share and provides an 5.1% dividend yield.

More importantly, Ethan Allen Interiors’ free cash flow (FCF) easily exceeds its regular dividend payments. From fiscal 2017 to fiscal 2023, Ethan Allen generated $496 million (66% of current enterprise value) in FCF while paying $256 million in dividends. See Figure 2.

Figure 2: Ethan Allen Interiors’ FCF Vs. Regular Dividends Since Fiscal 2017

Sources: New Constructs, LLC and company filings

As Figure 2 shows, Ethan Allen Interiors’ regular dividends are backed by a history of reliable cash flows. Dividends from companies with low or negative FCF are less dependable since the company may not be able to sustain paying dividends.

ETD Is Undervalued

At its current price of $28/share, Ethan Allen Interiors has a price-to-economic book value (PEBV) ratio of 0.5. This ratio means the market expects Ethan Allen Interiors’ NOPAT to permanently fall 50% from TTM levels. This expectation seems overly pessimistic given that Ethan Allen Interiors has grown NOPAT by 21% compounded annually since fiscal 2018 and 9% compounded annually since fiscal 2013.

If Ethan Allen Interiors’ NOPAT margin falls to 9% (equal to five-year average vs. 14% in fiscal 2023) and the company’s revenue grows by just 1% compounded annually for the next decade, the stock would be worth $40/share today – a 43% upside. See the math behind this reverse DCF scenario. In this scenario, Ethan Allen Interiors’ NOPAT would fall 3% compounded annually through fiscal 2033. Should the company’s NOPAT grow more in line with historical growth rates, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we make based on Robo-Analyst findings in Ethan Allen Interiors’ 10-K:

Income Statement: we made $18 million in adjustments with a net effect of removing $1 million in non-operating expenses (<1% of revenue). Clients can see all adjustments made to Ethan Allen Interiors’ income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made $289 million in adjustments to calculate invested capital with a net decrease of $6 million. The most notable adjustment was $90 million (15% of reported net assets) in asset write downs. See all adjustments made to Ethan Allen Interiors’ balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made $308 million in adjustments, with a net decrease of $42 million in shareholder value. The most notable adjustment to shareholder value was $41 million in operating leases. This adjustment represents 6% of Ethan Allen Interiors’ market value. See all adjustments to Ethan Allen Interiors’ valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on October 25, 2023.

Disclosure: David Trainer, Kyle Guske II, Italo Mendonça, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.