Forget all the “earnings season” analysis you read last month. The real earnings season—annual 10-K filing season—is happening right now.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with a 12/31 fiscal year end. Our analysts work tirelessly to uncover red flags hidden in the footnotes and make our models the best in the business.

There’s no way we could analyze so many filings in such a short time without our engineering team’s help. Using machine learning and natural language processing, we automate much of the rote work of data gathering and modeling. Our technology frees our analysts up to spend more time on the complicated and unusual data points that other firms miss.

Investors understand that analyzing all financial statements and footnotes is an essential part of the diligence needed to fulfill the fiduciary duty of care. How else can one make the necessary adjustments to assess a company’s true earnings and return on invested capital (ROIC)? Our innovation is to scale this diligence and make it easily accessible to our subscribers.

What We Accomplished Yesterday

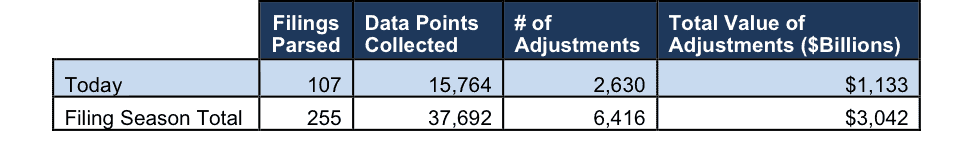

Figure 1 shows the work our analysts did yesterday and over the entirety of this filing season so far.

Figure 1: Filing Season Diligence

Yesterday, our analysts parsed 107 filings and collected 15,764 data points. In total, they made 2,630 adjustments with a dollar value of $1.1 trillion. That breaks down into:

- 1,129 income statement adjustments with a total value of $74 billion

- 1,070 balance sheet adjustments with a total value of $424 billion

- 431 valuation adjustments with a total value of $635 billion

In particular, analyst Allen L. Jackson found an unusual item in Town Sports International Holdings (CLUB) 10-K.

We highlighted the small fitness club operator back in 2015 as a company that could be negatively impacted by the updated accounting standard that will force companies to include operating leases on their balance sheet starting in 2018.

Operating leases are a form of off-balance sheet debt. Companies utilize off-balance sheet debt avoid being held accountable for all of the capital employed in their business, and CLUB is one of the worst offenders. Page 51 of CLUB’s 10-K reveals $565 million in operating lease obligations with a present value of $463 million. That off-balance sheet debt represents 536% of CLUB’s market cap and 68% of its invested capital.

Without holding management accountable for their use of operating leases, CLUB would appear to have an ROIC of 6.2%. Accounting for the off-balance sheet debt, we see that CLUB actually has an ROIC of just 1.9%, putting it in the bottom 20% of all the companies we cover.

This article originally published here on February 24, 2017.

Disclosure: David Trainer, Allen L. Jackson, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.